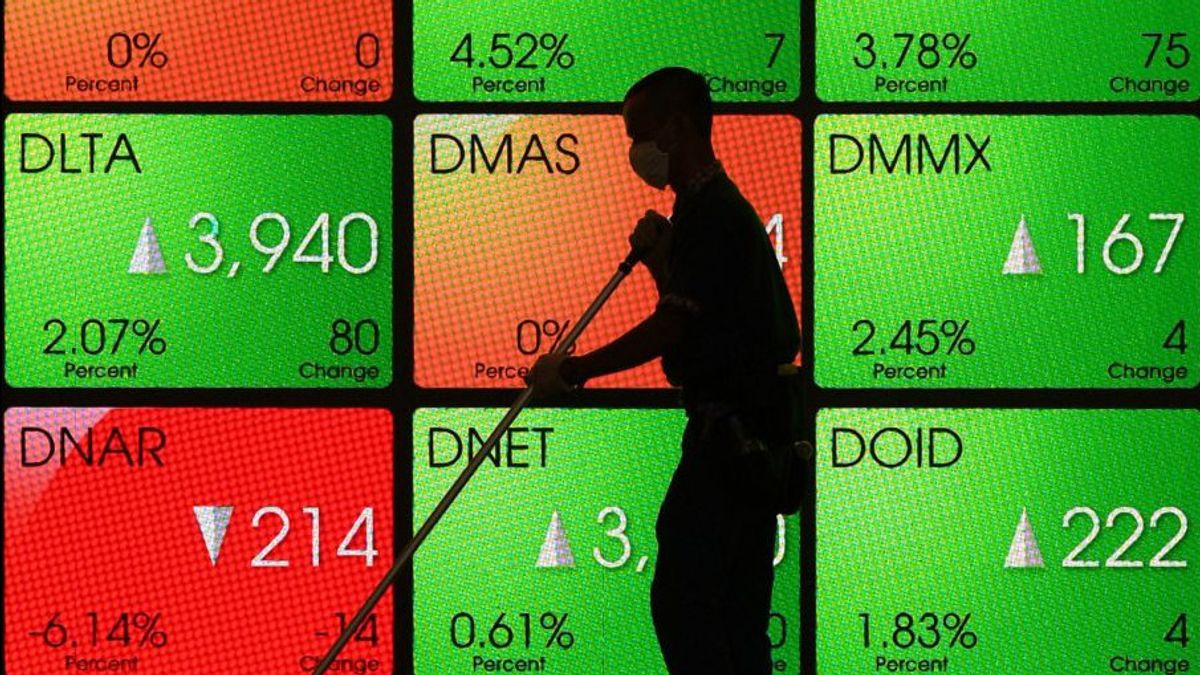

JAKARTA - The Composite Stock Price Index (IHSG) this week was enveloped in positive sentiment. However, investors must remain wary of profit-taking in the coming week.

"IHSG technically tested the flag pattern target level at 7,700 before reversing on Friday (30/8). IHSG is expected to move in the range of 7,600-7,730," wrote Phintraco Sekuritas in its research.

According to the broker, the 7,730 level is the highest level (resistance) of IHSG, while 7,600 is the lowest level (support), with the pivot at 7,650.

In terms of sentiment, from abroad, Wall Street indexes closed August with positive results. Wall Street recorded its fourth consecutive monthly gain in August 2024.

The main sentiment is still similar to previous weeks, namely the anticipation of a cut in the Fed's benchmark interest rate at the FOMC in September 2024. The realization of the PCE Price Index at 2.5 percent yoy in July 2024, which was lower than expected (2.6 percent yoy), opens up the opportunity for a more aggressive interest rate cut in September 2024.

From Europe, eurozone (flash) inflation fell to 2.2 percent yoy in August 2024 from 2.6 percent yoy in July 2024. From the Asian region, China experienced a decline in the manufacturing index (NBS) to 49.1 in August 2024 from 49.4 in July 2024. With this data, China's manufacturing conditions have been in a contraction phase for 4 consecutive months since May 2024.

Baca juga:

Domestically, the market hopes that Indonesia's manufacturing index in August 2024, which will be released on September 2, will return to an expansionary condition. Meanwhile, inflation is estimated to be stable at 2.12 percent yoy in August 2024.

"In general, domestic economic conditions are still relatively solid until August 2024," said Phintraco Sekuritas.

Phintraco Sekuritas recommends several stocks as choices for this week, namely BBRI, BBNI, BMRI, BBCA, ISAT, BRPT, SMGR, and INCO.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)