JAKARTA - The debt restructuring of PT Garuda Indonesia (Persero) Tbk is worth 9.8 billion US dollars or Rp139 trillion is an alternative option for saving the government chosen. However, restructuring Garuda Indonesia's debt is not as easy as other SOEs such as PTPN to Waskita Karya.

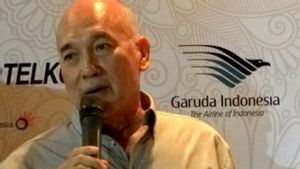

Deputy Minister of SOEs II Kartika Wirjoatmodjo admitted that the debt restructuring of the issuer codenamed GIAA was complex when compared to the debts of other SOEs. For example, the debt restructuring of PT Perkebunan Nusantara III (Persero), PT Krakatau Steel (Persero) Tbk, to PT Waskita Karya (Persero).

Furthermore, Tiko as he is familiarly known, said that debt restructuring to the three state-owned companies was quite easy when compared to Garuda Indonesia. This is because the creditors of the three SOEs are local creditors who can still be negotiated.

"This is very different compared to the restructuring of PTPN, which we can relatively do nationally and all of the creditors are locally so that they are controlled domestically," he said in a meeting with Commission VI of the DPR, quoted on Wednesday, November 10.

Meanwhile for Garuda, said Tiko, 70 percent of its creditors are foreign creditors. Therefore, in the process of restructuring Garuda's debt, it does not use an out-of-court system or one-on-one negotiation.

As is known, Garuda Indonesia is currently restructuring its debt worth US$9.8 billion with creditors and lessors. PTPN, Waskita Karya and Krakatau Steel are different from Garuda. This is because Garuda's lessors, which number up to 32 entities, are spread across several countries.

According to Tiko, if using the one-by-one negotiation route, Garuda will take a long time to issue its debts. Meanwhile, Garuda needs fast time.

SEE ALSO:

"Actually, Garuda needs to be fast. If it's not fast, in 3-6 months the plane can be grounded. Now some planes are being restructured to PT Garuda Indonesia (Persero) Tbk's debt worth 9.8 billion US dollars or Rp. 139 trillion as an alternative option for rescue chosen by the government. However, restructuring Garuda Indonesia's debt is not as easy as other SOEs such as PTPN to Waskita Karya because of the inability to pay," he explained.

Furthermore, Tiko said that the in-court restructuring had various positive impacts, one of which was that the in-court effort was able to bind all of Garuda's creditors. According to Tiko, this step will also give the company the ability to terminate or renegotiate the burdensome lease agreement. Then, the peace plan does not need to be approved by all creditors.

Even so, said Tiko, this meaning has an effect such as the need for large costs. Garuda also faces a huge potential risk, if the Garuda peace plan is not approved by creditors, there is a possibility of bankruptcy.

"So the government doesn't want to play Garuda. The government wants to find an in-court solution for homologation," he said.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)