JAKARTA – Police in the Bahamas, where FTX is headquartered, have arrested Sam Bankman – Fried (SBF) on Monday night December 12. This FTX founder was arrested in a luxurious gated neighborhood called Albany in the capital city, Nassau.

Damian Williams, US Attorney for the Southern District of New York, said in a statement late Monday that the arrests were made at the request of the US government.

The Bahamas attorney general's office said it hoped he would be extradited to the United States. Bahamas Police said he was arrested for "multiple Financial Violations against United States laws, which are also offenses" in the Bahamas.

Furthermore, US federal prosecutors on Tuesday December 13 charged Sam Bankman-Fried (SBF) with fraud and violating campaign finance laws. Even the founder and former CEO of FTX is also facing additional charges from regulators in the US.

The 30-year-old Bankman-Fried arrived in a heavily guarded Bahamian court last Tuesday for his first public appearance since the cryptocurrency exchange collapse. He could be extradited to the United States.

"Mr. Bankman-Fried is reviewing the charges with his legal team and considering all of his legal options," his attorney, Mark S. Cohen, said in a statement quoted by Reuters.

In the indictment, prosecutors said Bankman-Fried had engaged in a scheme to defraud FTX customers by misusing their savings to pay expenses and debts and make investments on behalf of his crypto hedge fund, Alameda Research LLC.

According to prosecutors, SBF also defrauded lenders to Alameda by providing them with false and misleading information about the condition of the hedge fund, and attempted to disguise money he had obtained from wire fraud.

It's unclear what will happen at trial or whether Bankman-Fried will decide to fight extradition, which is a potentially high-stakes fight.

Both the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) accused SBF of fraud in lawsuits filed on Tuesday.

"While he was spending lavishly on office space and condos in the Bahamas, and sinking billions of dollars of customer funds into speculative venture investments, the Bankman-Fried house of cards was starting to crumble," said an SEC source.

The CFTC sued SBF, Alameda and FTX last Tuesday, alleging fraud involving digital commodity assets.

The SEC also alleges, since May 2019, that FTX collected more than $1.8 billion from equity investors in years of "rash multi-year schemes" in which Bankman-Fried concealed that FTX was diverting customer funds into hedge funds. its crypto affiliate, Alameda Research LLC.

"While the public believed the Bankman-Fried "lie" and sent billions of dollars to FTX, he improperly transferred customer funds to hedge funds," the SEC said in its filing. "He continued to divert FTX customer funds even though it became increasingly clear that Alameda and FTX could not make the customer whole."

SBF has apologized to customers and acknowledged oversight failures at FTX, but said he doesn't personally think he has any criminal responsibility.

SBF founded FTX in 2019 and leveraged the cryptocurrency boom to build it into one of the largest digital token exchanges in the world. Forbes pegged his net worth a year ago at $26.5 billion, and he's been a significant donor to US political campaigns, such as the Democratic Party.

Crypto exchanges are platforms where investors can trade digital tokens such as bitcoins.

Brad Simon, a criminal lawyer in New York, said he doubted the SBF would fight extradition attempts from the Bahamas, given his interviews about the case. Simon said he could be in the United States in a few weeks.

VOIR éGALEMENT:

Simon also said US authorities likely moved to prevent SBF from testifying in Congress, which his attorneys can use to claim certain immunity and often "throws a spanner in prosecutions."

FTX filed for bankruptcy on November 11, leaving about 1 million customers and other investors facing billions of dollars in losses. The FTX collapse was felt across the crypto world and sent bitcoin and other digital assets plummeting in value. However a spokesman for Debtors FTX declined to comment on the current state of the SBF.

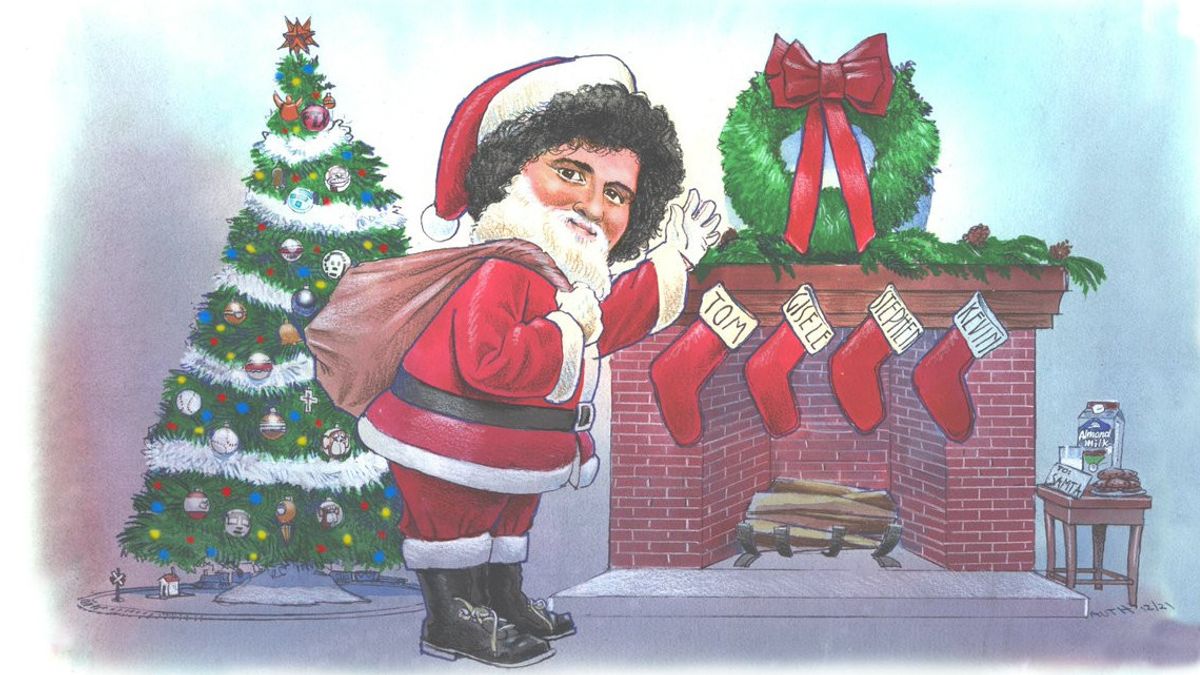

SBF, known as a prominent and unconventional figure. He wore wild hair, a t-shirt and shorts to panel appearances with statesmen such as former US President Bill Clinton and former British Prime Minister Tony Blair.

The SBF is also one of the largest Democratic donors in the United States, contributing $5.2 million to President Joe Biden's 2020 campaign.

FTX's liquidity crunch came after SBF secretly used $10 billion in customer funds to support its trading firm Alameda Research, Reuters reported. At least 1 billion US dollars of customer funds have disappeared.

Bankman-Fried stepped down as chief executive officer of FTX the same day the bankruptcy filing was filed.

Unlike other customers, Alameda is allowed to have negative accounts on the FTX platform, the SEC said. Bankman-Fried directed code to be written that would make this possible, the agency said.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)