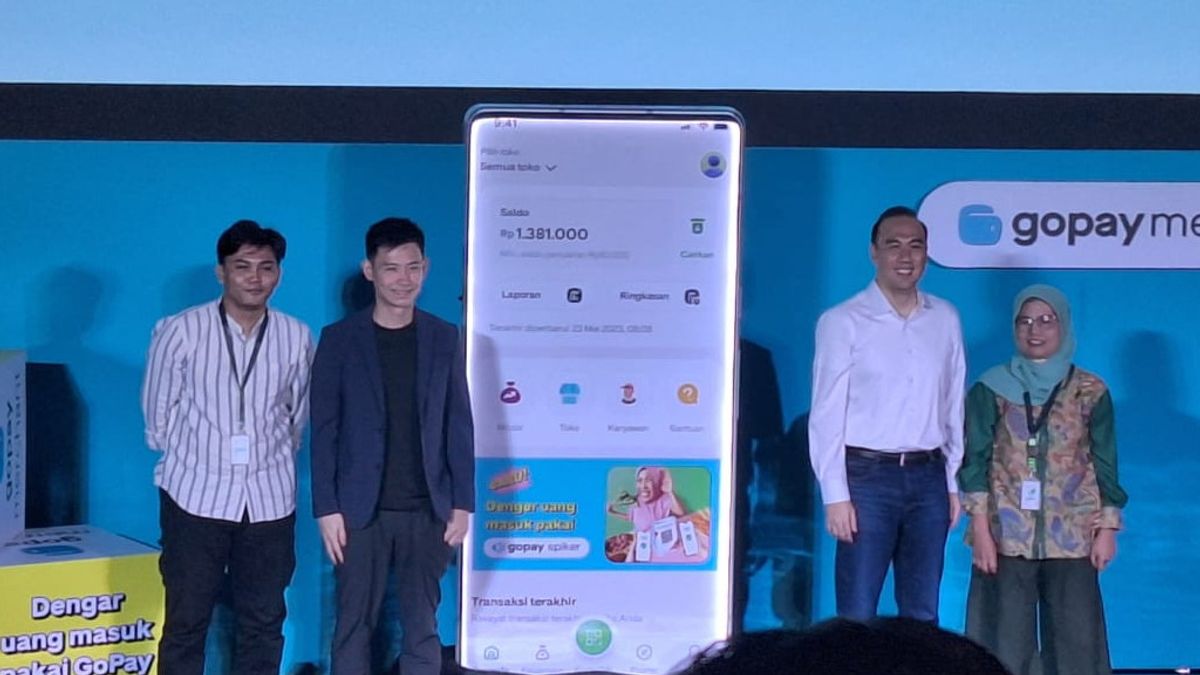

JAKARTA - GoTo Financial, GoTo's financial technology business unit, launched the GoPay Merchant application to provide easy and safe access to financial services, especially for MSME players.

"GoPay Merchant is an application to provide safe and complete financial services, from digital payments to business capital, so running a business is easier," said Haryanto Tanjo, GoTo Financial Group Head of Merchant Services at the launch of GoPay Merchant on Thursday, July 25.

Haryanto also mentioned several advantages offered by GoPay Merchant for MSMEs, including:

The QRIS registration process is simple and fast to pass. QRIS can be immediately 30 seconds after the registration is complete and is immediately used to accept payments in stores or stalls.

The process of disbursing flexible money, this feature provides the right solution for MSMEs with a fast circulation of money to maintain business continuity. In addition to being able to disburse money at any time, merchants can also schedule disbursement of selling products at the end of store operating hours every day.

Subscription to GoPay Spiker devices exclusively. GoPay Spiker issues a notification in the form of a voice for each nominal QRIS transaction carried out by customers. Thus, this can minimize falsification of transactions.

SEE ALSO:

"With GoPay Spiker, business actors don't have to worry about fake transactions anymore. Because if there are customers who give proof of transactions (screenshots), GoPay Spiker won't make a sound," added Haryanto.

MSME actors can download the GoPay Merchant application on Android and iOS to get a variety of financial services that can help run business operations.

Finally, MSME players can also apply for direct business capital loans in the GoPay Merchant application through the GoModal feature.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)