New Zealand announced on Tuesday 29 August that it would introduce legislation for digital service taxes on large multinational companies starting in 2025 after talks for global implementation did not reach consensus in the Organization for Economic Cooperation and Development (OECD).

More than 140 countries should start implementing a 2021 deal next year that changes ancient rules on how governments tax multinational companies are considered obsolete as digital giants such as Apple or Amazon can record profits in low-tax countries.

However, the proposal was postponed last month after countries with digital service taxes, except Canada, agreed to postpone their implementation for at least another year.

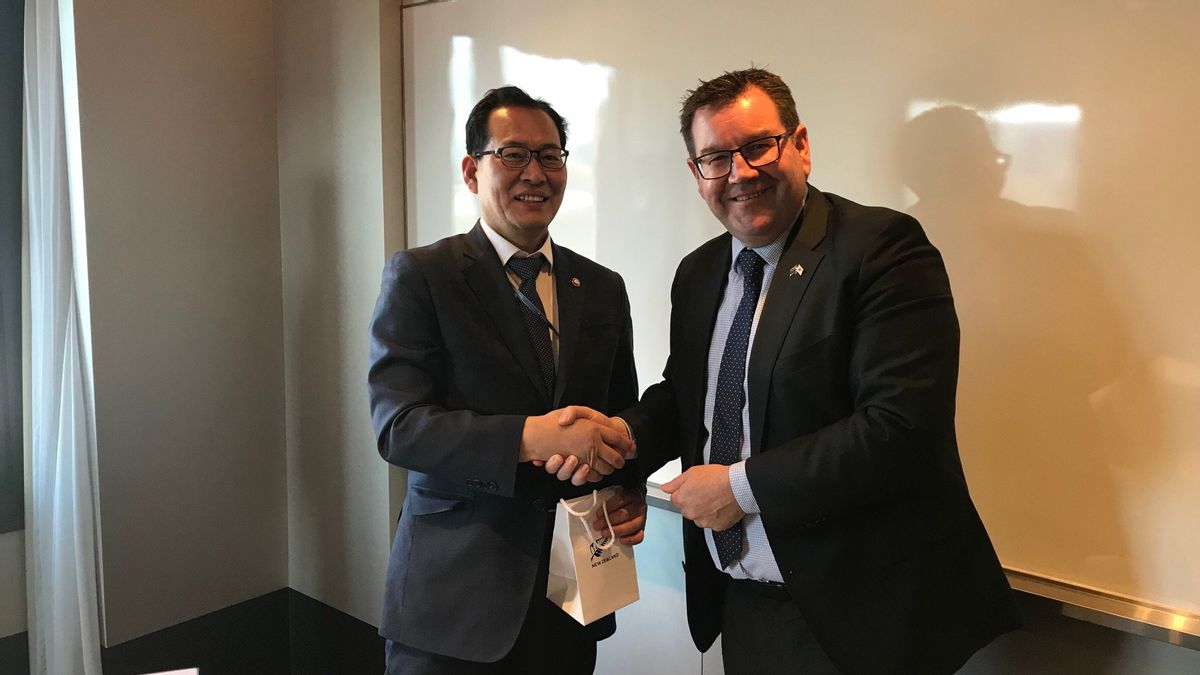

"While we will continue to work to support multilateral deals, we are not willing to just wait until then to find out," Finance Minister Grant Robertson said in a statement.

"We don't think it's fair for New Zealanders to pay their taxes fairly but there is no tax obligation for large multinational companies," Robertson said.

SEE ALSO:

The proposed digital service tax will be targeted at multinational businesses that earn revenue from New Zealand users from social media platforms, search engines, and online markets.

The tax will be imposed on businesses that generate more than 750 million euros (IDR 12.3 trillion) per year from global digital services and more than 3.5 million new Zealand dollars per year from digital services provided to New Zealand users. The tax is expected to generate 222 million New Zealand dollars, over four years.

The tax will be charged at 3% of New Zealand's gross taxable digital service revenue, a similar rate adopted by similar countries such as France and the United Kingdom. The bill will be proposed to parliament on Thursday.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)