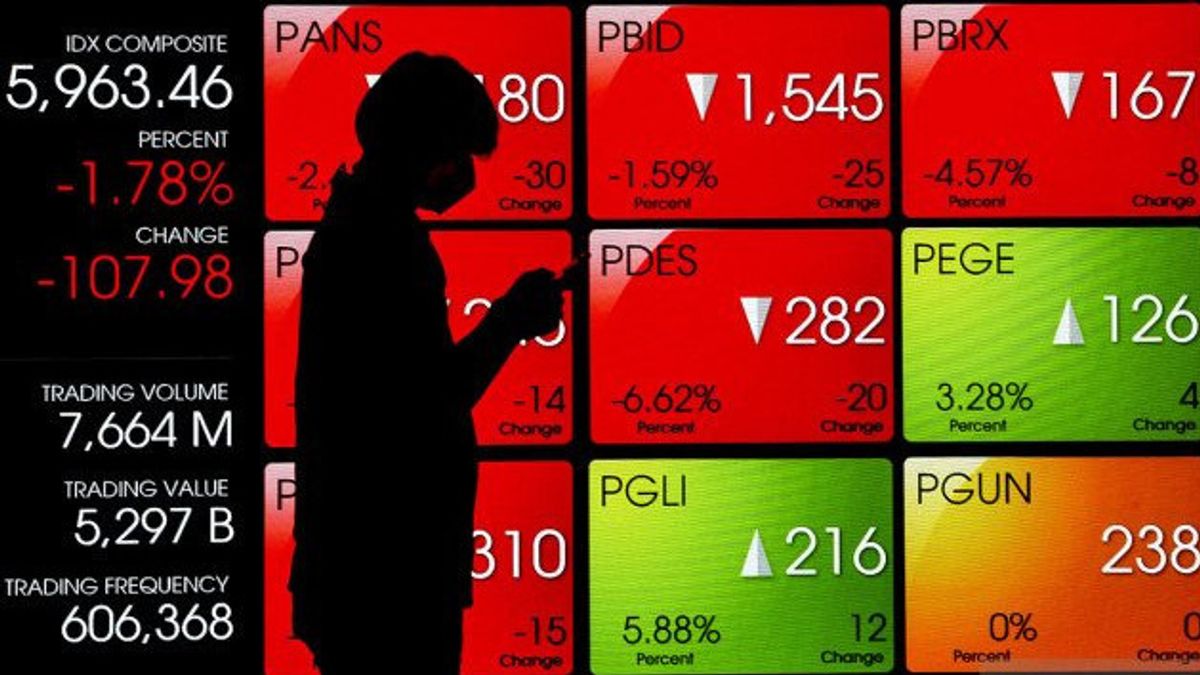

JAKARTA - The Composite Stock Price Index (JCI) is predicted to be prone to correction in today's trading, Friday, October 13. Phintraco Sekuritas estimates that the JCI will be loaned today at 7.000 resistance, 6.950 pivot, 6,900 support.

"The JCI today is still prone to corrections. Moreover, there are indications of overbought in the Stochastic RSI," wrote Phintraco Sekuritas in his research.

Phintraco Sekuritas said the market confidence appeared to be under pressure again by the realization of the latest inflation and jobless claims data in the US which sparked fears of an increase in the benchmark interest rate at FOMC November 2023.

However, Phintraco Sekuritas said regional data from China may dampen external negative sentiment. Chinese inflation is estimated to rise to 0.2 percent yoy in September 2023 from 0.1 percent yoy in August 2023. Export value decreased 7.8 percent yoy and imports weakened 6 percent yoy is expected to still fall in September 2023, although it is not as deep as the decline in August 2023.

Phintraco Sekuritas added that the Rupiah exchange rate continued its limited strengthening until Thursday afternoon.

SEE ALSO:

"Thus, the potential for further rebounds in BBRI, BBCA and BRIS, as well as potential resistance tests on BMRI, can be observed today," explained Phintraco Sekuritas.

Phintraco Sekuritas also recommends other stocks that can be considered ahead of this weekend, including ICBP, AUTO, ADMR, TKIM and UNVR.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)