JAKARTA - Economist of the University of Indonesia's FEB Institute for Economic and Community Research (LPEM FEB UI) Teuku Riefky recommends that Bank Indonesia (BI) should maintain the benchmark interest rate at the level of 5.75 percent while still monitoring rupiah stability and maintaining inflation.

"Most of the decline in domestic inflation occurred thanks to BI's efforts to continue consistent monetary policy," Riefky in a study entitled BI Board of Governor Meeting, quoted from Antara, Wednesday, August 23.

In addition, thanks to coordination with the government in implementing various inflation control programs, such as the National Food Inflation Control Movement (GNPIP) Program and the Cheap Food Market (GPM).

For information, inflation in July 2023 recorded a decline to 3.08 percent year on year (yoy), from the previous 5.28 percent (yoy) in the previous month.

Not only inflation, continued Riefky, strong economic growth has increased investor confidence in Indonesia, compared to other developing countries.

The national economy was recorded to be on a positive trend with a growth of 5.17 percent (yoy) in the second quarter of 2023, which was driven by strong household consumption thanks to the presence of Ramadan, Eid, and Eid celebrations.

The national economy will continue to grow, although later in the coming quarters, as seen from the slight downward trend in leading indicators in July 2023, Riefky said.

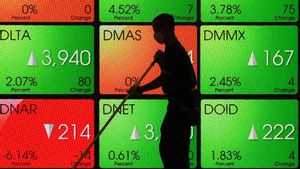

On the other hand, Riefky revealed that the ongoing outflow in Indonesia's financial markets could be much worse if BI did not implement consistent monetary policy, as well as limited direct intervention instruments.

For information, from mid-July-August 2023, Indonesia recorded a portfolio outflow of US$1.04 billion, which was caused by higher interest rates in developed countries and Asian market volatility which was exacerbated by disappointment with China's economic growth this year.

Riefky explained that the US central bank The Fed at FOMC July 25-26 raised interest rates by 25 bps to 5.22- 5.50 percent, which is estimated to be the last increase in 2023 as US inflation dropped drastically to 3.0 percent (yoy) in June 2023.

اقرأ أيضا:

However, market expectations changed after the release of new inflationary data showing a slight increase in US inflation to 3.2 percent (yoy) in July 2023.

This has led to concerns over plans to raise interest rates by the Fed, which the Fed can continue to raise interest rates amid several bank failures, financial market volatility, and relatively unchanged employment levels.

"Therefore, investors are anticipating the Fed to raise interest rates once again before the end of this year," said Riefky.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)