JAKARTA - The huge Muslim population has become a magnet for the global economy. Likewise with Indonesia. This could be a potential for new economic growth for each country.

In fact, from various existing records, since the last few years, a number of countries have continued to compete in developing the sharia economy, from the halal industry to the Islamic finance industry.

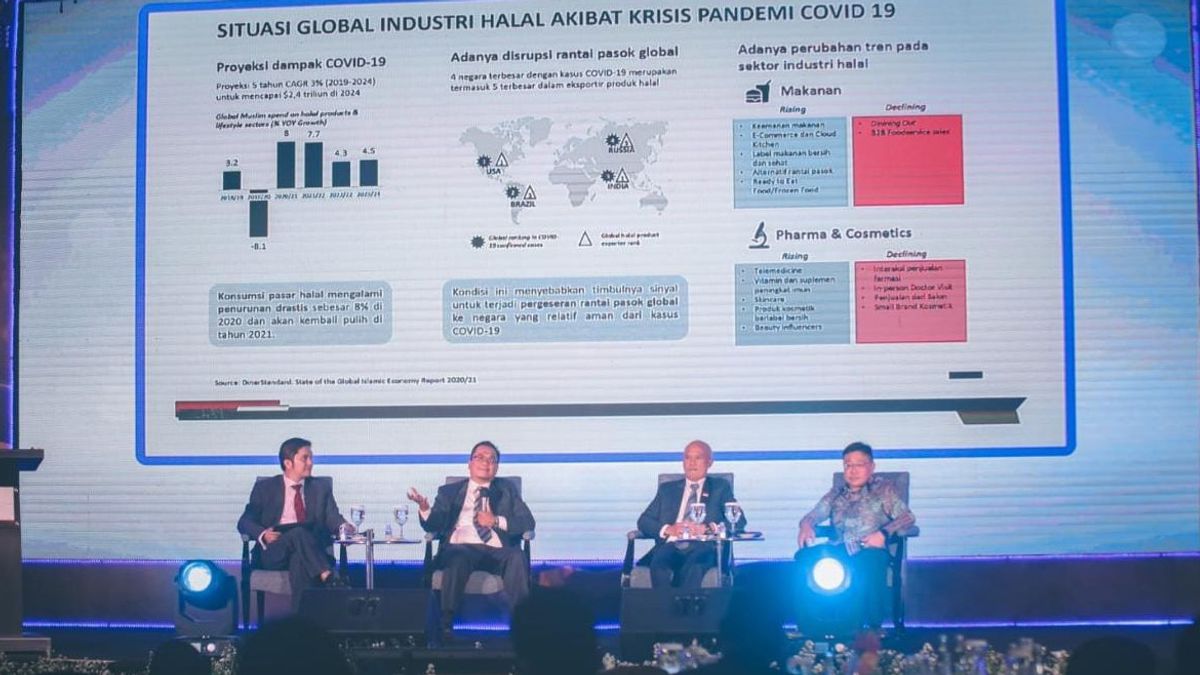

Based on data reported by the State of the Global Islamic Economy Report 2022, throughout 2021 where the world is in the middle of a pandemic, the world's Muslim population has spent US$2 trillion, or grew by 8.9 percent compared to 2020.

In 2022, the number of expenditures is predicted to increase by 9.1 percent, and by 2025 the number of expenditures is projected to reach USD2.8 trillion. This is certainly a potential for Indonesia to become the center of the world's halal industry.

With the number of Indonesian Muslim populations ranked third in the world, of course, Indonesia is a great strength. Unfortunately, until now Indonesia is still a consumer, even though Indonesia is considered capable of maintaining its fourth position in the development of the sharia economy ecosystem.

The government together with the National Sharia Finance Committee (KNEKS) also has a number of priority programs for the development of the sharia economic ecosystem, one of which strengthens Indonesia's halal value chain.

Referring to the 2019-2024 Indonesian Sharia Economics Master Plan, strengthening the halal value chain (HVC) is part of the main strategy in realizing a Mandiri, Makmur, and Madani Indonesia Indonesia by becoming the World's Leading Sharia Economic Center. KNEKS Business and Entrepreneurship Director, Putu Rahwidhiyasa, said that his party interpreted the 2019-2024 Islamic economic and financial master plan into 13 priority programs and 17 regular programs.

"Alhamdulillah, out of the 13 priority programs, the term has netted 10 priority programs," said Putu in a seminar entitled Towards the Center for the World Halal Industry: Prospects and Challenges of Sharia Economics and Finance held by Infobank with KNEKS, in Jakarta Thursday 24 November.

One of the priority programs that KNEKS has implemented to support the strengthening of the halal value chain in Indonesia, is to develop halal product certification. Halal certified companies are dominated by the food sector by more than 90 percent of other sectors. In addition, halal certified companies in the pharmaceutical sector and the cosmetic sector continue to increase every year.

"There are four priority focuses for halal certification, which we call a safe and healthy halal culinary zone, one of which is at the Jakarta Garden food Street Rasuna," said Putu.

Then, KNEKS together with the Ministry of Tourism and Creative Economy (Kemenparekraf) encouraged the digitization of Muslim-friendly tourism through digital Islamic digital event events in 2022 and the issuance of Muslim-friendly tourism guidelines in five favorite destinations.

"Currently, there are three halal industrial areas that have been operating, the first in Cikande Banten, the second in Sidoarjo, East Java in Riau and several other halal industrial areas are applying to become halal Industrial Zones," he said.

The development of halal economics and finance in the country is also inseparable from challenges. One of them is the problem of literacy and inclusion which is still low. Nevertheless, people's Islamic financial literacy and inclusion continue to increase every year.

Meanwhile, Deputy Head of the Halal Industry Agency, BES of the Indonesian Chamber of Commerce and Industry (KADIN), Aman Suparman sees that the current halal industry is a business opportunity that must be optimized, as can be seen from the world halal industry figures that have reached 2.2 trillion US dollars. Even so, there are still challenges related to financing by Islamic finance and halal certification for halal industry players.

He also said that the opportunity for the world's halal industry, which is very potential, can encourage the halal industry in Indonesia to also be integrated with Islamic finance.

"Hopefully the halal industry will be supported by Islamic banks. So so far at BSI (Indonesian Sharia Bank) maybe the products have been very good but maybe the potential can be explored again in this halal industry, especially the need for working capital," said Aman.

He further stated that the key to the halal industry in Indonesia to continue to grow is through halal certification mandated by the Halal Product Guarantee Act (JPH) which guarantees halal certification as an obligation. However, in reality there are still many business actors who make their own halal logos, because of difficulties in obtaining these certifications.

"With the JPH Law, BPJPH or the Halal Product Guarantee Agency appears with an extraordinary target of 10 million certifications, but in fact it is still 47 thousand already in November, this is an obstacle," he added.

Aman menjelaskan fakta yang terjadi di lapangan adalah pelaku usaha membutuhkan waktu berbulan-bulan untuk mengurus sertifikasi namun tak kunjung mendapatkan sertifikasinya, juga dari pembiayaan yang masih menjadi tantangan.

"We in the business world hope that the halal industry will become the locomotive that is supported by sharia finance because the sharia system is a system based on Islamic values, not ownership," added Aman.

Director of Retail Banking Bank Syariah Indonesia (BSI), Ngatari said, Indonesia currently represents 11.34 percent of global halal economic spending with food placing the largest position of Indonesian spending at 135 billion US dollars. According to him, with the opportunity available, BSI was able to pursue the market capital (market capitalization) to become ranked 10th out of the world's 14th ranking in 2025.

"We have potential in 46 percent of Indonesia's population of sharia preferences, so there are 20.6 percent of halal sharia preferences and 25.6 percent of universalists of functional and social preferences," said Ngatari.

Even so, he showed data that the Indonesian Islamic banking market was still low, namely only 6.8% as of July 2022, for financing of 7.42 percent, and in terms of third party funds (DPK) of 7.43 percent.

Not only that, the network of Islamic banks in Indonesia currently only reaches 10 percent of conventional bank networks, which means that Islamic banks only have around 2,664 networks from conventional banks with 28,342 networks. So this encourages low Islamic financial literacy.

"When compared to neighboring countries such as Malaysia's market share, 30.1 percent, Indonesia is only 6.74 percent, even though there are many Muslim people. Let us help increase the market share of Islamic banking in Indonesia," he said.

Prudential Syariah Chief Financial Officer Paul Kartono also revealed that Indonesia as a country with the largest Muslim population is still relatively small in terms of Islamic financial assets. There are several challenges in developing the Islamic economy and finance in the country.

"If we compare it with Malaysia, Malaysia alone, the Muslim population is one-fifth of Indonesia, they are 40 million, we have 250 million, but their Islamic financial assets are bigger," Paul said.

According to him, the challenges that must still be faced by Indonesia to develop sharia finance are related to literacy in the sharia financial system that is different from conventional financial systems. The reason is, practitioners from the sharia financial system are still comparing to offer their products conventionally but do not explain the whole problem with the sharia system.

"That's what I think is the biggest challenge when actually if we do direct sharia literacy, the impact will be better. For example, when selling insurance products when people sell the insurance they offer is insurance risk management the same as umbrellas after explaining recently that there is a sharia version, it will be an obstacle," he explained.

Seeing the potential for a large Muslim population and other indicators, Indonesia should be one of the players or producers of the world's halal industry and Islamic financial services. However, there is a lot of homework that must be completed immediately by all relevant stakeholders. Starting from the low level of Islamic financial literacy, to the lack of maximum sharia financing for halal industry players.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)