JAKARTA - President Director of PT Bank Central Asia Tbk (BCA) Jahja Setiaatmadja stated that he did not want to rush the company's subsidiary, namely BCA Digital, to the stock exchange through an initial public offering (IPO) mechanism.

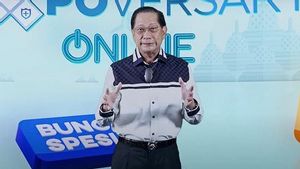

"Some people ask, when will BCA Digital go for an IPO. This is still very new, right, when you are really serious about determining the date of the IPO," joked Jahja, during a virtual public expose, Thursday, July 22.

According to Jahja, his party must first see how the development of BCA Digital is. He did not want to rush and had to see the interest of investors.

So far, he said, investors are considered less interested in emerging small companies. Investors tend to be more attracted to companies that are already big enough.

"But right now when it comes to digital business, everything is like an overheated worm. Maybe investors are interested in that right now. What is clear is that in the digitalization mood, we will also get involved in this," said Jahja.

Jahja assessed that currently investors, including retail investors, who are increasing in number, are lulled and eager to enter the digital banking business. Nevertheless, BCA as the parent company wants BCA Digital to be able to develop and be more mature in the digital banking industry.

"I think BCA Digital has just been born. It's called a newborn baby, so there must be preparations, they are sent to school first, they have started to teach ethics as well. After that, if we have prepared more thoroughly and have an overview. We don't want to sell stories. but we sell the facts that we have lived," said Jahja.

また読む:

Jahja further emphasized that in order to be listed on the stock exchange, he wanted BCA Digital to become a large enough digital bank. His party also plans to provide a capital injection for BCA Digital, but he is reluctant to mention the amount of the capital.

"If you want an IPO, it must be sizeable. So it's not too small so people don't underestimate it. I think with the consequences, there should be an addition for BCA Digital bank. play," said Jahja.

BCA Digital itself has just launched a digital application called "blu" in early July in order to provide the best service to the millennial and digital savvy segments, as well as to answer the challenges of digitalization competition in the younger generation market segment which now dominates the demographics of the population in Indonesia.

As an initial stage, blu issued a number of creative savings products, namely "bluAccount" for main transaction accounts, "bluSaving" which is a savings account for various needs, "bluGether" as shared savings with other customers.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)