JAKARTA - The act of deceit and high interest from online loan companies (pinjol) reached the ears of President Joko Widodo (Jokowi). Not a few people are entangled with this loan business.

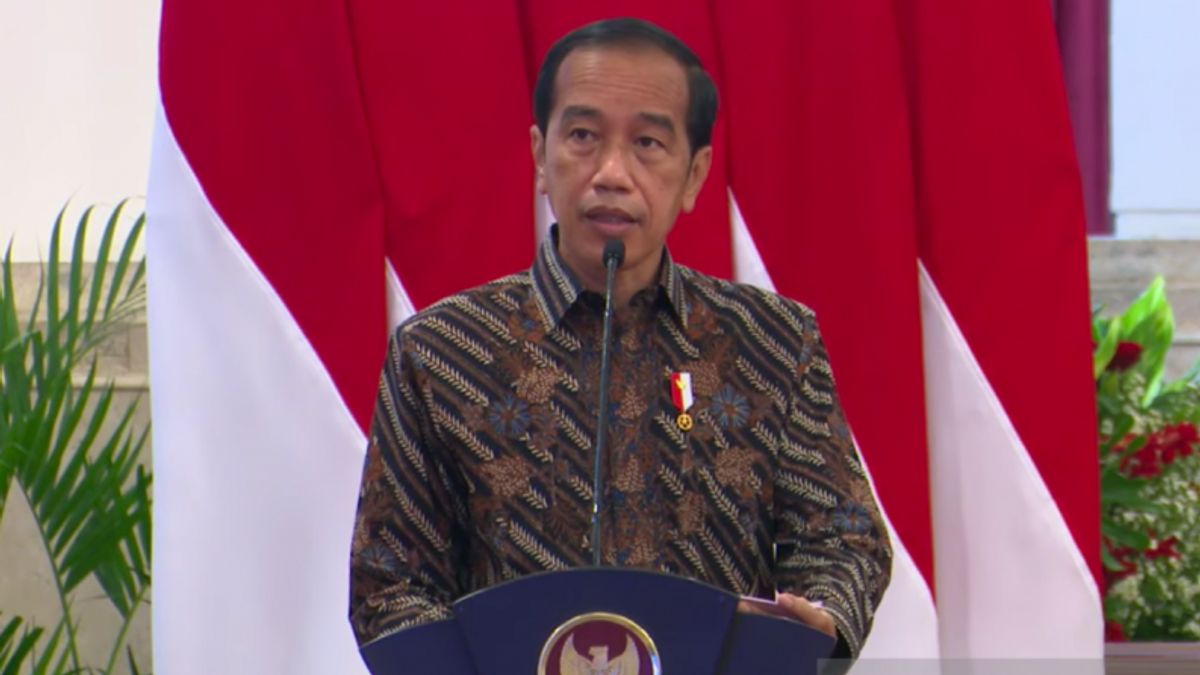

Therefore, President Jokowi at the OJK Virtual Innovation Day at the State Palace asked the Financial Services Authority (OJK) and financial services industry players to maintain and supervise the development of digitalization of the financial sector.

“I have also received information that many frauds and financial crimes have occurred. I heard that the lower class people were deceived and ensnared by high interest rates by online loans, which were pressured in various ways to repay their loans," Jokowi said as quoted by Antara, Jakarta, Monday, October 11.

This supervision aims to enable the digitalization of the financial sector to grow in a healthy manner and contribute to the community's economy.

Also present on the occasion were Chairman of the OJK Board of Commissioners Wimboh Santoso, Coordinating Minister for Economic Affairs Airlangga Hartarto, Cabinet Secretary Pramono Anung, and other relevant officials.

The phenomenon of the impact of online loans (pinjol) emerged along with the rapid wave of digitalization in the midst of the COVID-19 pandemic, which gave rise to digital banks, digital insurance, electronic payments (e-payments), and technology-based financial services (fintech).

"We have to act quickly and precisely, we see digital-based banks appear, digital-based insurance also appears, and various e-payments," he said.

The President asked OJK and financial service industry players to build a responsible, strong and sustainable digital financial ecosystem.

The digital financial ecosystem must also have a risk mitigation policy against legal and social issues to prevent losses and provide protection for the community.

OJK and industry players, said the President, also need to provide financial literacy and digital financial literacy to the public so that the public can benefit widely from the growth of the digital financial sector.

In addition, the President also hopes that the digital economy and finance industry can provide greater access to economic activities for the lower classes, so that they can help reduce social inequality.

"I entrust it to OJK and business actors in this ecosystem to ensure that the financial inclusion that we pursue must be followed by acceleration of financial literacy and digital literacy, so that the advancement of digital financial innovation benefits the wider community and encourages an inclusive economy," said President Jokowi.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)