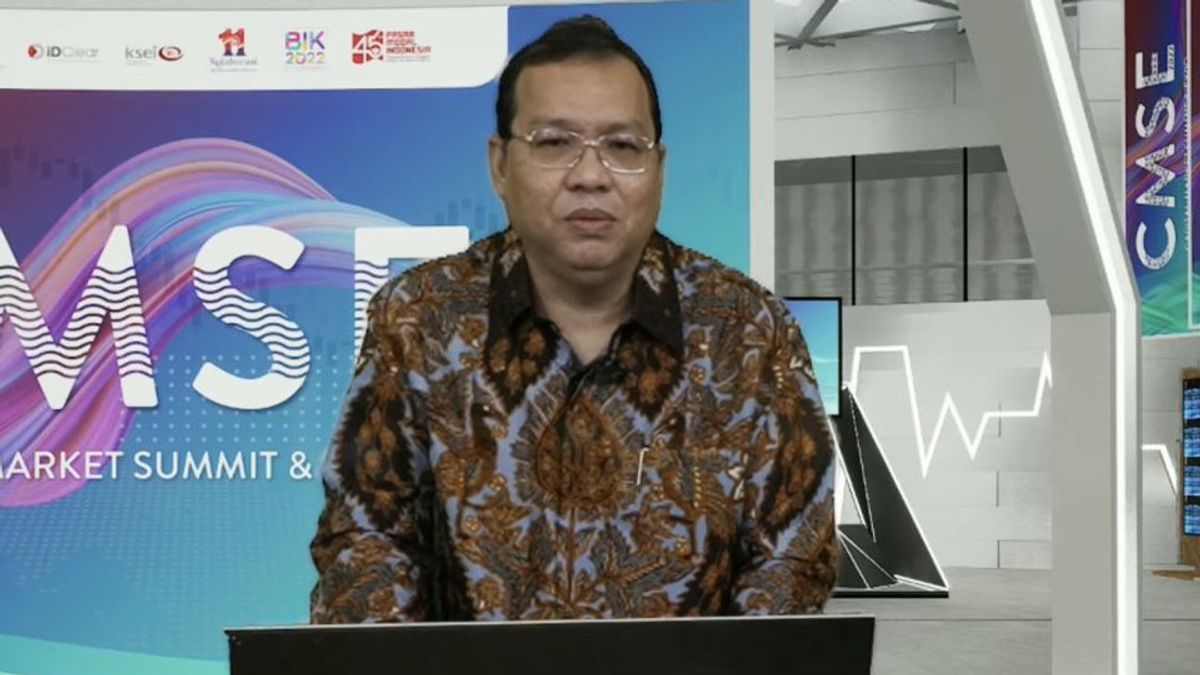

JAKARTA - President Director of PT Bursa Efek Indonesia (IDX) Iman Rachman conveyed a number of challenges that still haunt the capital market until the end of 2024.

"(First), so if we look at the stock exchange, the impact of inflation is more significant than the impact of rising interest rates. So, the index is more afraid of inflation than rising interest rates," he said at the 2024 Midyear Challenges Indonesia Business event, quoted from Antara, Tuesday, July 30.

Global demand that contracts, normalizes energy prices, and decreases logistics costs has the potential to help reduce inflation. However, the decline in inflation is expected to have a negative impact on people's purchasing power later.

The second challenge is related to strict monetary policy. The era of the high benchmarkish rate by global central banks is predicted to continue amid high inflation, thus putting pressure on the global financial sector.

Furthermore, the slowdown in China's economy and the low level of global demand have led to a decline in manufacturing activity in various countries, as well as slowing world economic growth.

Fourth, the increase in demand for safe haven instruments amid increasing economic risks.

This encourages the movement of funds from investors who previously had risky assets.

The last is the prolonged geopolitical tension in the Middle East which has an impact on commodity price disruptions, inflation, and a slowdown in economic growth in the long term.

On the other hand, the IDX sees several opportunities for the development of the Indonesian capital market.

The first is domestic economic resilience which grew stronger than other countries, which was 5.11 percent in the first quarter of 2024.

Second, there has been an increase in the consumption activity of political parties ahead of the simultaneous regional head elections (pilkada) which have the potential to boost domestic economic growth.

"Of course, regarding the election, it is a wait and see of foreign investors related to the formation of a new cabinet in October," said Iman.

Third, several government investment projects have a positive impact on the economy. Starting from national strategic projects, developing the State Capital (IKN), and downstreaming industries.

The next opportunity regarding the number of capital market investors is expected to continue to grow, thus having a positive impact on increasing market liquidity and capital market growth in general.

Finally, other factors such as the application of the Law on the Development and Strengthening of the Financial Sector (UU P2SK) and the development of more diverse investment products.

To maximize opportunities and overcome existing challenges in the capital market, the IDX focuses on three things.

The first point is investor protection by developing sustainable market integrity (continuous market integrity development), including the implementation of special monitoring boards, special notifications, and precautions and education of capital market stakeholders.

SEE ALSO:

On the market deepening side (market deepening), related to the increase in the number of Initial Public Offering (IPO) and listings, also regarding IDX incubators and acceleration boards to accommodate Small and Medium Enterprises (SMEs)/startups listing, main boards of new economy, E-Registration and e-IPO engineering, to ESG (Environmental, Social, and Governance) initiatives.

"We have now subsidized 80 listed companies to conduct ESG scoring," he said.

The second point also includes increasing trade liquidity and optimizing capital market products.

The final focus is on regional synergy and connectivity related to IDX Data Service Review and the development of cloud computing to respond to the increasingly rapid development needs of the capital market, especially for stock exchange members.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)