JAKARTA - PT Bank Danamon Indonesia Tbk (BDMN), PT Adira Dinamika Multi Finance Tbk (ADMF) and MUFG Bank (MUFG) carry four pillars of added value at the Indonesia International Motor Show (IIMS) 2024 to accelerate national economic growth by providing financial solutions.

This year, Danamon and Adira Finance are supported by MUFG not only making IIMS 2024 an automotive exhibition, but also targeting pillar of entertainment, KidZania, and the Community.

With these four pillars, it is hoped that it can provide optimal added value to each part of the financial supply chain automotive, from upstream to downstream, to support Indonesia's economic growth.

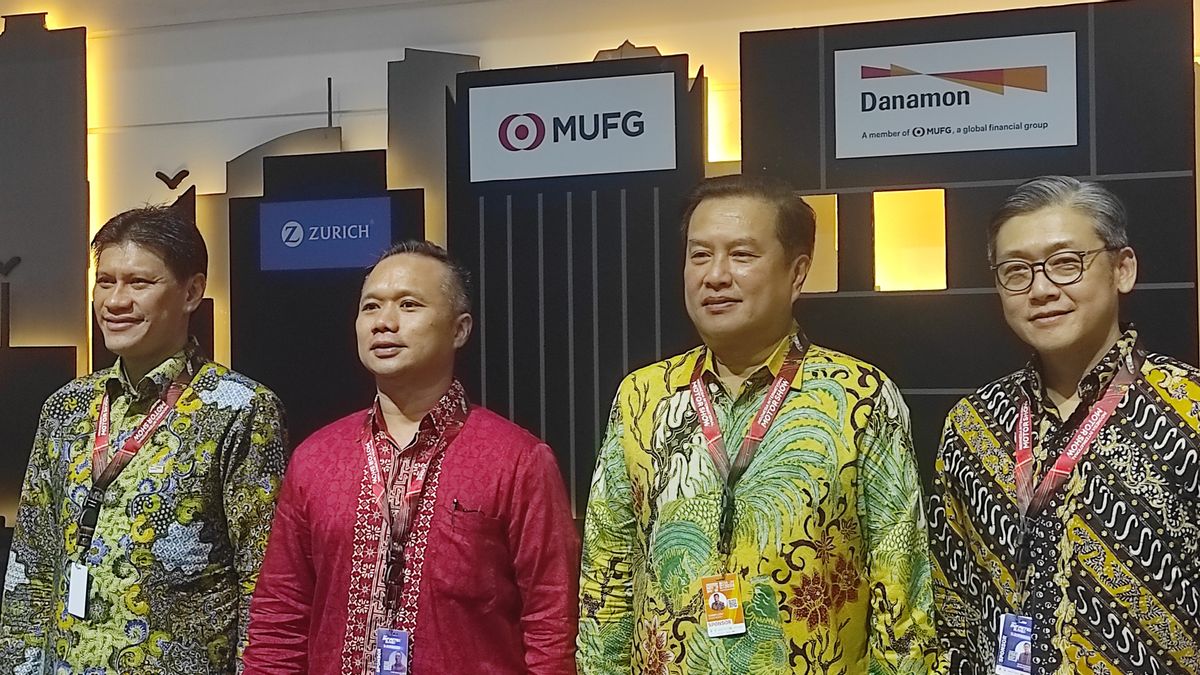

Executive Officer Country Head of Indonesia, MUFG Bank, Ltd Kazushige Nakajima said, this Group has a unique position to be able to serve the entire chain of the Indonesian automotive industry.

"As a Financial Group, MUFG, Danamon, and Adira Finance, it is the key to our ability to provide strong support for all parts of the financial supply chain of the Indonesian automotive industry from upstream to downstream," he explained in his statement, Thursday, February 15.

Kazushige said, MUFG, as the largest financial group in the world, helps Danamon and Adira Finance expand its business synergy and ecosystem network, which is able to connect customers with clients and business partners both domestically and abroad.

He added that the group's capabilities and capabilities continued to grow along with the increasing number of MUFG networks through various strategic acquisitions of financial institutions in Indonesia.

Recently, this group, both directly and through companies under the MUFG network, has acquired financial service provider companies, such as Akulaku, Home Credit Indonesia, and Mandala Finance, whose acquisition process is still ongoing.

Meanwhile, President Director of PT Bank Danamon Indonesia Tbk Daisuke Ejima added that his party realized that the IIMS 2024 automotive event should be able to provide maximum added value for the Indonesian economy.

Daisuke said that on the way to grow as a financial group, his party must always innovate and create breakthroughs in providing complete financial services and in accordance with the needs of each customer.

"We have the ability to support the financial needs of the entire automotive ecosystem, ranging from suppliers, producers, distributors, dealers, to various types of final buyers, including fleet and heavy equipment financing. This is to support our aspirations to become a bank of choice for the Indonesian automotive ecosystem.," he said.

SEE ALSO:

On the same occasion, President Director of PT Adira Dinamika Multi Finance, Tbk (Adira Finance) Dewa Made Susila said that with the close collaboration between Adira Finance, Danamon, and support from MUFG, his party continues to provide comprehensive financial solutions for the company's ecosystem, including customers, partners, and business partners.

At IIMS, Dewa said that his party brought all financing products to answer the automotive and non-automotive needs, including Cash Fund Loans with BPKB guarantees.

"We also present a lightweight interest program starting from 1.99 percent p.a for car financing and introducing our digital services. This initiative reflects our commitment to supporting the growth of the national automotive industry," he concluded.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)