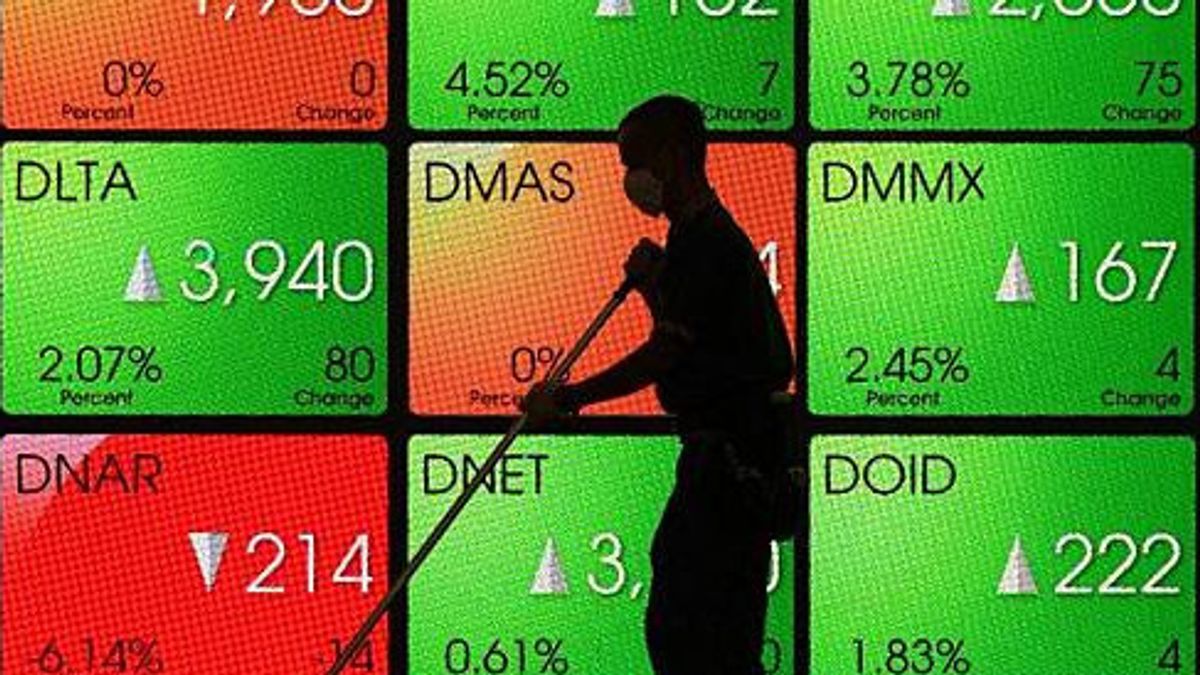

JAKARTA - The movement of the Composite Stock Price Index (JCI) is predicted to strengthen in trading earlier this week, Monday, December 27 after last Friday closing trading in positive territory by strengthening 0.11 percent or 7.35 points so that it parked at the level of 6,562.90.

Artha Sekuritas analyst Dennies Christopher Jordan said last week the JCI closed higher, ignoring concerns about the Omicron COVID-19 variant in the US and Europe. According to him, the strengthening of the index was supported by US GDP data which was better than expected.

On the other hand, domestic sentiment is still minimal. As for today's trading, Dennis predicts the JCI will strengthen.

Dennies said, technically the candlestick formed a higher high and a higher low accompanied by a stochastic indicator that formed a golden cross in the oversold area indicating the potential for strengthening in the short term.

SEE ALSO:

"Movement is expected to be quite limited due to the lack of domestic sentiment and concerns about the COVID-19 Omicron in the US and Europe," said Dennies in his daily research.

He estimates JCI will move with support at 6,549 and 6,537 and resistance at 6,578 and 6,595. The stocks he recommends include PT Astra International Tbk (ASII), PT Summarecon Agung Tbk (SMRA), and PT Sarana Menara Nusantara Tbk (TOWR).

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)