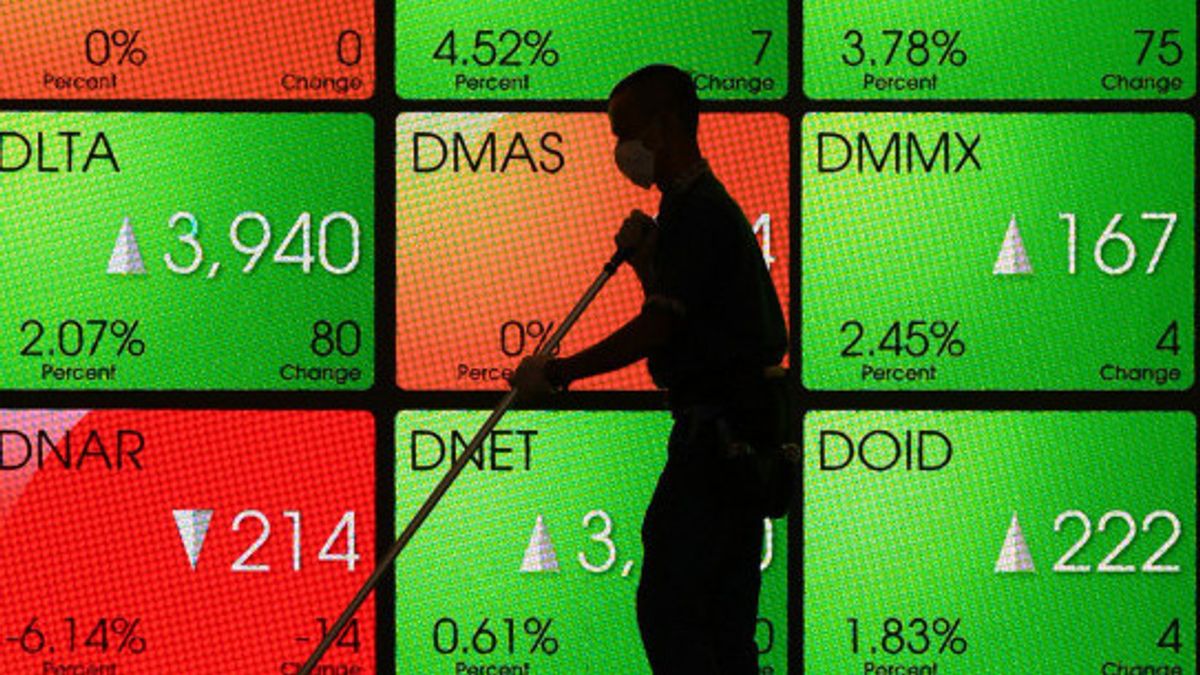

JAKARTA - The movement of the Composite Stock Price Index (IHSG) is expected to continue to move lower in today's trading, Tuesday, April 11, after yesterday's slight decline of 0.32 percent to 6,771.23.

Phintraco Sekuritas in its daily research said that the weakening of the JCI on Monday was a natural pullback to get out of the overbought area. Apart from that, there are no indications of a bearish reversal because the weakening was followed by a decrease in transactions.

“If the pullback continues, strong support is expected at 6,700 with resistance at 6,800 and pivot at 6,750,” wrote Phintraco.

From within the country, foreign exchange reserves rose 4.9 billion US dollars on a monthly basis to 145.2 billion US dollars at the end of March 2023. This condition is equivalent to 6.4 months of imports, far above the international adequacy standard of around 3 months of imports.

This strengthened the position of the rupiah exchange rate below the psychological level of IDR 15,000 per US dollar at Monday's trading close. Another sentiment from within the country comes from the anticipation of Consumer Confidence Index (IKK) data in March 2023.

VOIR éGALEMENT:

For information, Indonesia's IKK will stay above 120 in January-February 2023. Phintraco said the above conditions open opportunities for buy-on support at BMRI, BBNI, BBCA, and BBTN.

Furthermore, expectations of increased consumption and mobility ahead of Eid al-Fitr can be a short-term positive catalyst for AKRA, MYOR, MAPI, and INDF.

"Other alternatives that can be considered are MNCN, BTPS, TBIG, and SSMS," said Phintraco.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)