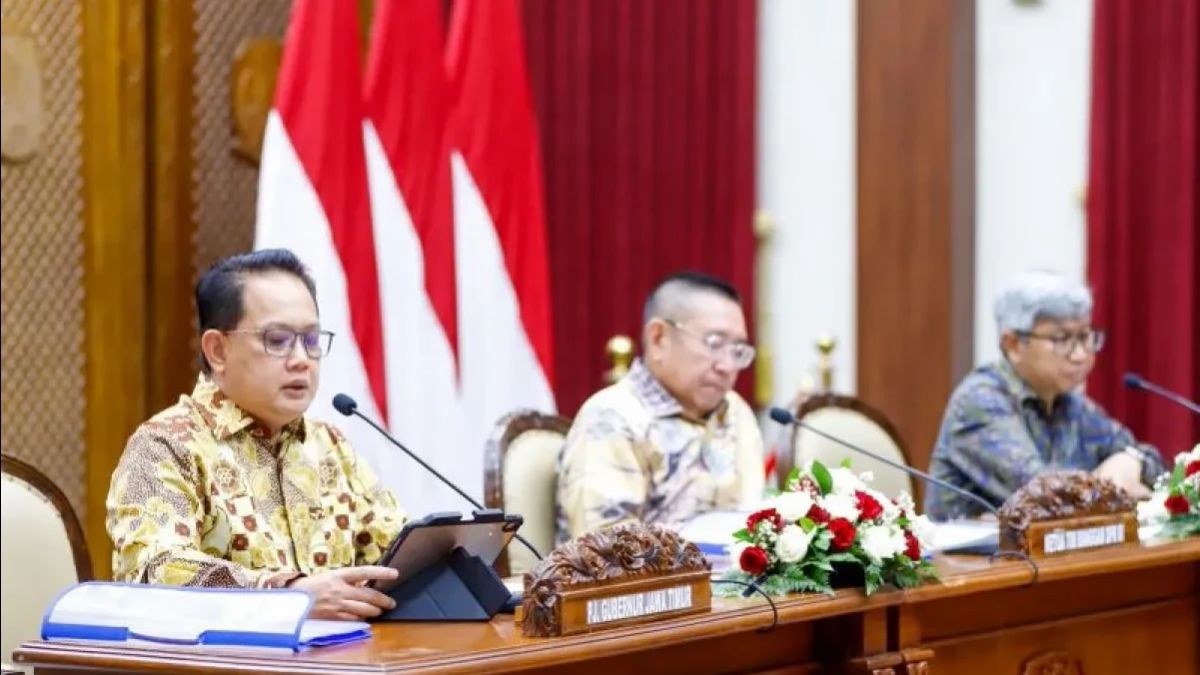

JAKARTA - Deputy Chairman of the DPR RI Budget Agency (Banggar) Wihadi Wiyanto said the 12 percent Value Added Tax (VAT) increase policy is a decision of the Law (UU) of 2021 concerning Harmonization of Tax Regulations (HPP) is a legislative product for the 2019-2024 period and initiated by the PDI-P (PDIP).

"The 12 percent increase in VAT is the decision of the Law (UU) in 2021 concerning Harmonization of Tax Regulations (HPP) and to 11 percent in 2022 and 12 percent until 2025, and it was initiated by the PDI-P," said Wihadi in a statement received in Jakarta, Sunday, December 22, quoted by Antara.

The legislator from the Gerindra faction said that the Working Committee (Panja) discussed the increase in VAT as stated in the HPP Law at that time was chaired by the PDIP faction.

For this reason, he assessed that the current PDIP's stance on the implementation of the 12 percent VAT policy was very contrary when it formed the HPP Law.

"So we can see from the one who led the Panja even from the PDIP, then now the PDIP is asking for a postponement, this is something that corneres the Prabowo government (President Prabowo Subianto)," said the member of Commission XI of the DPR RI.

VOIR éGALEMENT:

VOIR éGALEMENT:

He also reminded certain parties not to lead the issue that the 12 percent increase in VAT was the decision of President Prabowo Subianto's government because the policy became the legal umbrella decided by PDIP in the 2019-2024 period.

"So if there is information now that there are things that relate this to Pak Prabowo's government, which seems to decide that is not true, what is true is that this law is a product of the DPR which at that time was initiated by the PDI-P and now Mr. President Prabowo is only running it," he said.

On the other hand, he assessed that the current PDIP attitude is like an effort to "throw hot balls" to the government of President Prabowo, even though the 12 percent increase in VAT which is contained in the HPP Law is a product of the DPR for the previous period from PDIP.

"So in this case, we see that the PDIP's attitude is in terms of 12 percent VAT, so we remind you that if you want to support the government, it is not in this way, but if you want to take opposition steps, then this is the right of the PDIP," he said.

He also emphasized that President Prabowo had originally "hit" the policy so as not to have an impact on the lower middle class, one of which was by implementing the increase in VAT imposed on luxury goods.

"So that Pak Prabowo's thought that the lower middle class maintains its purchasing power and does not cause economic turmoil, this is a wise step from Pak Prabowo," he said.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)