JAKARTA - President Director of PT Bank Rakyat Indonesia (Persero) Tbk. as well as the chairman of Himbara (Association of State-Owned Banks) Sunarso promised, his party would double the placement of Rp30 trillion from the government within three months.

He said, Himbara immediately mapped the expansion plan within three months. This was done after the Himbara consisting of BRI, Bank Mandiri, BNI and BTN, was asked to help restore the economy by placing the money.

"As a consequence, what we received, must be leveraged at least three times in the form of credit expansion, especially to drive the real sector, especially in more specifically MSMEs. For example, if you get IDR 10 trillion in three months you have to expand IDR 30 trillion," said Sunarso. press conference virtually, Wednesday, June 24th.

According to him, BRI focuses on the distribution of MSME loans that encourage the food and agriculture sectors, as well as the distribution of medical devices. That way, the funds will be used for MSME credit distribution in rural areas by 50 percent, urban 30 percent, and 20 percent intersection or border areas.

"The segments and targets are clear, areas based on urban and rural areas are clear. Hopefully this plan will be able to bring back our economic growth," he said.

Meanwhile, the President Director of PT Bank Mandiri (Persero) Tbk. Royke Tumilaar said that the placement of government funds will be used for credit expansion in areas that are considered to have opportunities for growth.

"Especially what we are aiming at is the tourism sector which will be opened as well as trade and other sectors that can be the goal for MSMEs to recover," he explained.

Then, the President Director of PT Bank Negara Indonesia (Persero) Tbk. Herry Sidharta explained that his party is committed to utilizing the funds placed by the government to expand credit in labor-intensive and economic sectors that stimulate economic growth.

Meanwhile, Pahala N. Mansury, President Director of PT Bank Tabungan Negara (Persero) Tbk, said that lending from the placement of government funds will be focused on the housing sector. He is committed to three times the expansion of the funds that the government has placed in BTN.

"And our focus is 40 percent on subsidized KPR and currently running the second stimulus package, in which we are given the confidence to distribute approximately 146 thousand subsidized houses. And the total will be around Rp. 18 trillion to Rp. 20 trillion," he said.

Regarding the placement of funds to restore economic conditions from the COVID-19 pandemic, BUMN Minister Erick Thohir welcomed the trust given by the government to Himbara to pay attention to the sectors affected.

"This is the trust given to the government to us, especially at the BUMN Ministry because we know that BUMN is one-third of the national economic movement, and of course we do not think for ourselves," said Erick.

Erick said that his party will continue to ensure that SMEs in rural and urban areas are considered so that they can move again.

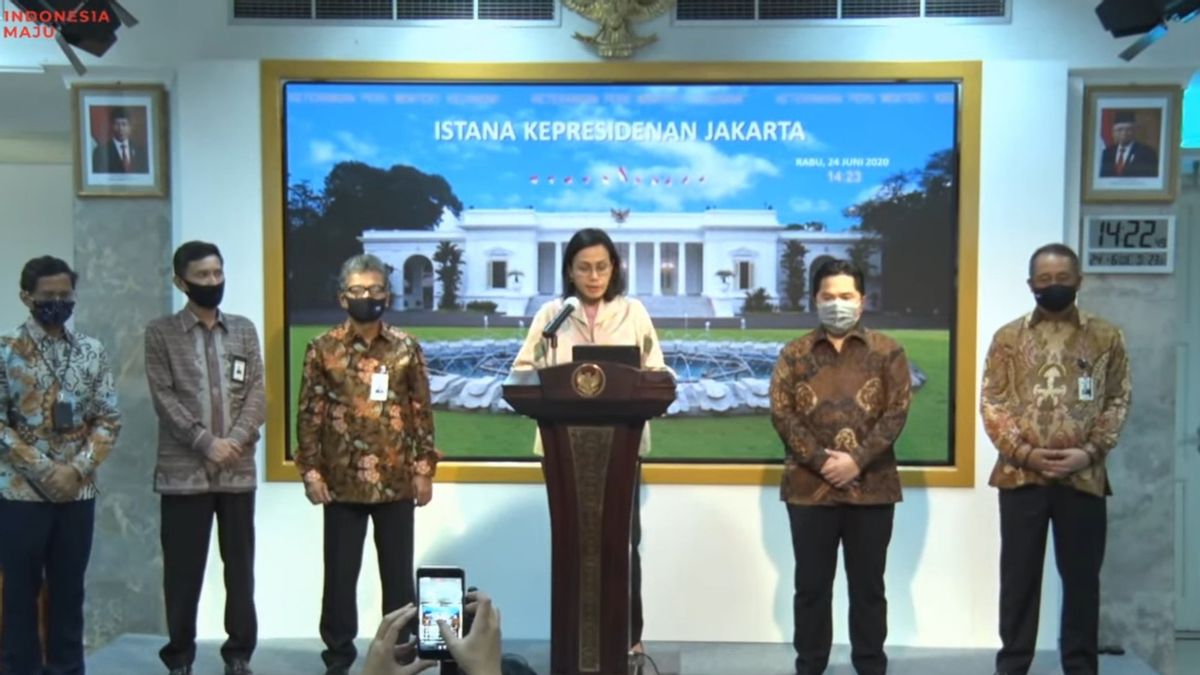

Previously, Minister of Finance Sri Mulyani said that the government would continue to monitor the distribution of government funds in banks so that they were on target with the ultimate goal of restructuring Micro, Small and Medium Enterprises (MSMEs). Hence, the government prohibits channeling banks from using the budget to provide Government Securities (SBN) and foreign exchange transactions.

"The government hopes to encourage the economy in the real sector to recover, through this stimulus the MSME sector so that restructuring and interest subsidies can actually be carried out from the absorbed budget. Channeling banks must first convey the use of these funds clearly and according to what is regulated," he said. Sri.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)