JAKARTA - PT Bank Mandiri (Persero) Tbk (BMRI) recorded a consolidated net profit of IDR 42 trillion in the third quarter of 2024 or grew 7.56 percent year on year (yoy).

Bank Mandiri President Director Darmawan Junaidi emphasized that this achievement was also supported by the expansion of a digital-based ecosystem and optimization of business in improving sustainable asset quality.

Meanwhile, the intermediation function is balanced with consolidated growth of third party funds (DPK) which grew by 14.9 percent on an annual basis to Rp1,667.5 trillion in the third quarter of 2024.

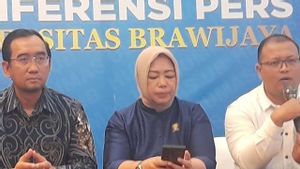

"The increase in the DPK was supported, among others, by the growth in demand funds which increased 17.8 percent yoy to Rp596 trillion and savings which shot 12.6 percent (yoy) to Rp635 trillion," he said at a press conference, Wednesday, October 30.

On the other hand, Darmawan conveyed that his party's consistency in supporting sustainable business growth, also continues to be realized through the application of Environmental (Lingungan), Social (Social), and Governance (Gata Kelola) or ESG principles. This is realized through a consistent increase in sustainable portfolios.

Darmawan revealed, until September 2024, Bank Mandiri's total sustainable portfolio had grown by 12.8 percent or reached IDR 285 trillion when compared to the previous year period.

As for this amount, the composition of the green portfolio grew significantly by 16.4 percent on an annual basis, reaching Rp142 trillion.

Meanwhile, the contribution from the New Renewable Energy (EBT) sector to the portfolio has reached IDR 10 trillion with an increasing trend every year.

"In the future, we will continue to improve our ESG services, especially on sustainable financial instruments such as the Sustainability-Linked Loan, Green Loan, Corporate-in-Transition Financing, and Social Loan in various sectors," said Darmawan.

Darmawan said that his party will also focus on developing sustainable business in the potential sector such as the management of Biological Natural Resources (SDA) and the use of sustainable land, environmentally friendly transportation, renewable energy to waste management.

Furthermore, Darmawan explained that Bank Mandiri's solid performance growth is also inseparable from the ongoing digital transformation, focusing on innovation to produce the best service for customers.

SEE ALSO:

Through a series of innovations carried out until the middle of the year, Livin' by Mandiri has now managed to record user growth of up to 32 percent on an annual basis at the end of September 2024 reaching 27.6 million.

Meanwhile, the transaction frequency in Livin' by Mandiri reached 2.8 billion transactions or grew 35 percent on an annual basis, and the transaction value exceeded IDR 2,940 trillion, which grew 25 percent on an annual basis.

This solid performance is the result of continuous innovation which will continue to be launched throughout 2024. We are optimistic that the expansion of Bank Mandiri's digital ecosystem will continue to increase through a series of innovations that have been carried out," he said.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)