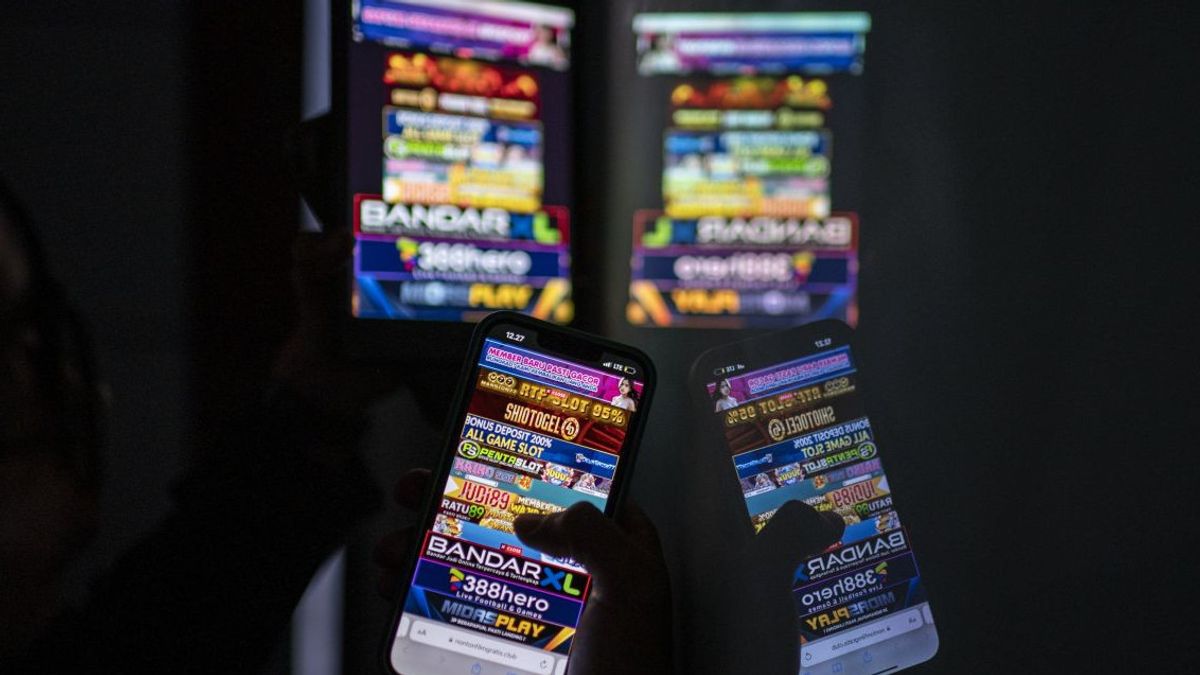

JAKARTA - Bank Indonesia (BI) found as many as 689 accounts indicated to be involved in online gambling from 27 Payment Services Providers (PJP) in the last four weeks.

In addition, BI also found 123 Unform Resource Locitor (URL) online gambling and 150 accounts traded on e-commerce platforms and social media in the last four weeks.

"BI has asked PJP to identify and investigate, as well as follow up in accordance with statutory regulations, such as follow-up to blocking, closing accounts, and reporting the closure of URLs indicated online gambling to Kominfo," said Head of the BI Payment System Surveillance and Consumer Protection Department Anton Daryono in Jakarta, quoted from Antara, Wednesday, August 28.

Until the end of July 2024, he continued, the Ministry of Communication and Information (Kemenkominfo) had informed BI regarding the 504 account accounts indicated to be used for online gambling activities.

Of this number, as many as 431 accounts were registered as PJP users, with details as many as 88 accounts identified as carrying out reasonable transactions and 343 accounts have been identified as used for online gambling transactions, so that all electronic money accounts have been closed.

On this occasion, Anton said that BI as the payment system authority has developed technology Supervision, in the form of Cyber Patrol and also Fraud Detection System (FDS) to detect illegal activities.

"From the results of the FDS, there were 1,858 merchants who did not match the profile and 147 were proven to be illegal accounts that had been followed up with the termination of merchant cooperation," said Anton.

Based on Presidential Decree (Keppres) No. 21 of 2024, BI is a member of the field of prevention of online gambling, which is implemented through an active role in conducting direct or indirect supervision of payment service providers or PJP.

SEE ALSO:

Bi's direct supervision is carried out, including through on-side inspection activities as preventive measures to ensure PJP risk management and compliance or the payment service provider, against applicable regulations.

Meanwhile, BI's supervision is indirectly carried out by monitoring, identification, and assessing data submitted by PJP or through the intelligence market.

Then, (KYC) BI has also periodically submitted a letter asking PJP to actively take efforts to prevent the practice of illegal activities including online gambling through fulfilling the obligations of the principle of Know Your Customer, the principle of prudence and risk management of payment systems.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)