JAKARTA - The movement of the Composite Stock Price Index (IHSG) is haunted by various sentiments today, Monday, October 16. Phintraco Sekuritas in its research also said that the JCI is prone to further pullbacks to support at 6,900 and 6,875.

"JCI formed a high upper shadow supported by increased volume on Friday 13 October. This was also supported by the Stochastic RSI entering the overbought area and a decreasing positive slope on the MACD," explained Phintraco Sekuritas research.

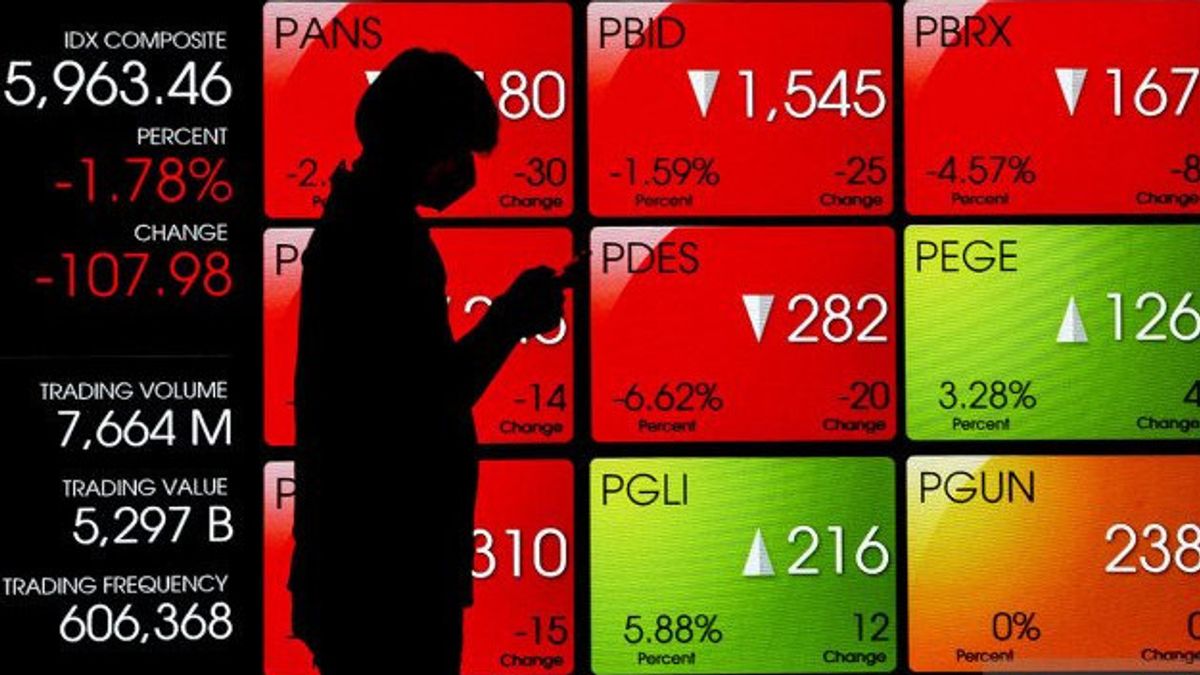

As is known, JCI closed lower on Friday trading last week. The composite index fell 0.12 percent or 8.37 points to 6926.78.

Throughout trading, the JCI moved in the range of 6,902 to 6,973. Market capitalization was recorded at IDR 10,594.80 trillion.

The weakening of the JCI on Friday responded to a number of global data. Regionally, China recorded China New Yuan Loans of 2,310 billion yuan in September 2023, lower than the estimate of 2,500 billion yuan. This shows that the potential for economic improvement in China will not be too expansive.

Still externally, the escalation of the conflict in the Middle East between Israel and Palestine has increased again following the latest news. This makes market players tend to be more careful about high-risk investments.

BACA JUGA:

Domestically, BI will hold the October BI RDG on 18-19 October 2023. The market will be waiting for clues about BI policy and Indonesia's projected growth outlook for the remainder of 2023.

Based on the conditions above, Phintraco recommends several shares. The market can pay attention to defensive stocks with potential for further rebound and rebound such as HRUM, CPIN, JPFA, UNVR, CMRY, KLBF, AKRA and RAJA.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)