JAKARTA - The Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas) targets an investment of US$186.7 billion to achieve the oil production target of 1 million barrels per day (BOPD) and natural gas of 12 billion cubic feet per day (BSCFD) standards in 2030.

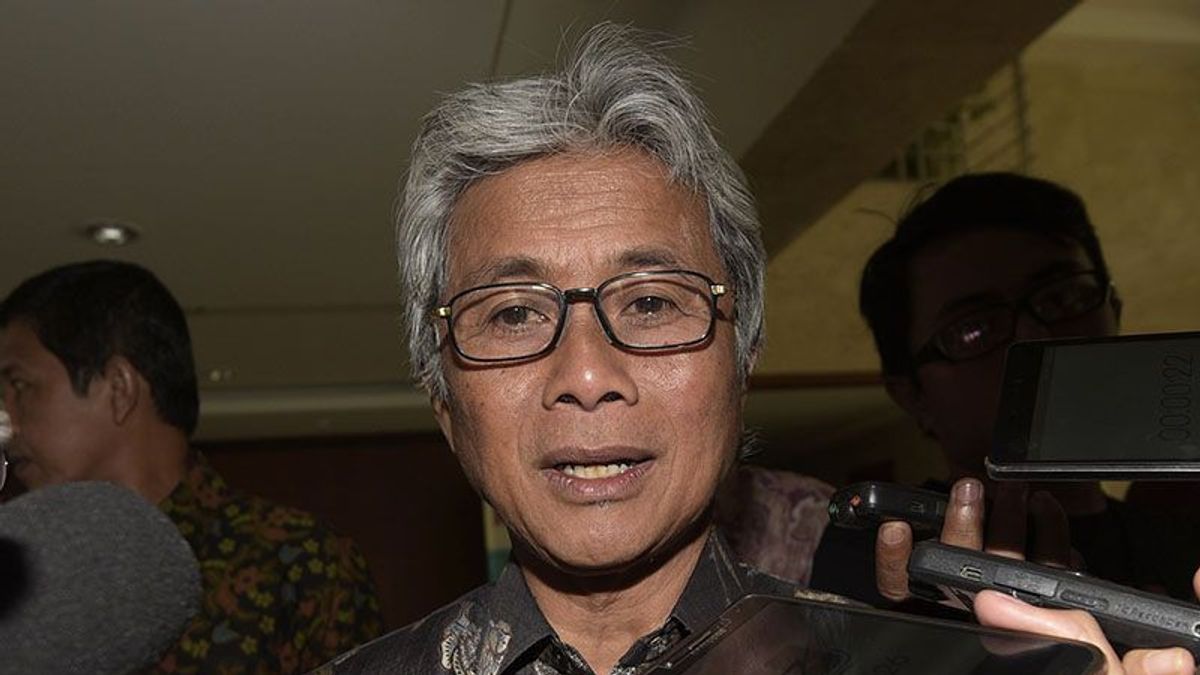

Head of SKK Migas Dwi Soetjipto said that currently, the upstream oil and gas sector continues to strive to increase national oil and gas production in order to meet the increasing domestic needs as national economic growth increases.

"In 2050, oil consumption volume is estimated to increase by 139 percent, while gas consumption volume is predicted to increase by 298 percent," Dwi told the media, Thursday, September 7.

According to him, investment support is needed so that oil and gas field exploration and development activities can be carried out massively.

The investment climate in the upstream oil and gas sector continues to be improved through incentives and fiscal policy changes.

"The attractive investment in the upstream oil and gas sector in Indonesia has actually improved, but there are still things that must continue to be improved," said Dwi.

He admitted that various efforts made to improve the upstream oil and gas investment climate began to show a positive impact.

Since 2021, investment in upstream oil and gas has continued to increase.

In 2022, continued Dwi, investment in upstream oil and gas will reach 12.3 billion US dollars, an increase of 13 percent compared to the previous year.

The increase was recorded at 5 percent higher than global investment growth.

"Meanwhile, this year, upstream oil and gas investment is targeted to reach 15.5 billion US dollars, an increase of 26 percent compared to last year," he said.

This target is higher than global investment growth (6.5 percent) and the Long Term Plan (LTP) SKK Migas, which previously set a target of 13 billion US dollars.

In addition, SKK Migas continues to strive to increase national oil and gas production, especially natural gas.

Natural gas plays an important role as a primary energy source during the transition period towards the use of clean energy through achieving the Net Zero Emission (NZE) target by 2030.

Natural gas is also needed as raw material for industry, such as the steel industry, ceramics, fertilizers, petrochemicals, and other industries.

On the other hand, efforts to achieve the gas production target of 12 BSCFD also require equal infrastructure support throughout Indonesia.

The availability of infrastructure capable of reaching all regions allows natural gas produced by oil and gas fields in Indonesia to be optimally absorbed to meet domestic needs.

Moreover, several national strategic projects are scheduled to start producing before 2030, namely Tangguh Train 3, Indonesia Deepwater Development (IDD), and Abadi Masela.

Of the three projects, the total investment reached 38.58 billion US dollars with an additional 65,000 barrels of oil production per day and gas of 3,644 million standard cubic feet per day (MMSCFD).

"Currently, the allocation of gas for domestic has reached 65 percent of total gas production, according to the needs of domestic gas users. Along with the increase in gas production in the future, of course, it is hoped that there will be a growth in the capacity of the gas user industry so that gas can be utilized domestically to support development," explained Dwi.

Investment in natural gas development projects needs to be increased to ensure the availability of gas supply for the domestic market.

"The attractive investment in the upstream oil and gas sector in Indonesia has actually improved, but there are still things that must continue to be improved," said Dwi.

By 2024, investments for the development of gas fields are targeted at US$8 billion or 50 percent of the total investment target in the upstream oil and gas sector which reaches US$16 billion.

In the following years, the value of gas investment is targeted to continue to increase to reach 12 billion US dollars by 2030.

Currently, the discovery of new oil and gas reserves and approval of the plan of development (POD) is dominated by gas, so that the development of new projects in the future will further lead to gas.

Continuing to increase investment in oil, one of which is an effort to curb the decline rate with a commitment to achieve zero decline and additional production from oil field projects.

One of the large investments in oil is for drilling development wells.

SEE ALSO:

For 2023, the prognosis for drilling development wells will reach 919 wells and in 2024 it is targeted to exceed the achievement in 2023.

In the midst of the upward trend in upstream oil and gas investment, Dwi revealed that there are still challenges that arise, one of which is the demand to integrate upstream oil and gas business activities by implementing Carbon Capture Storage/Carbon Capture, Utilization and Storage (CCS/CCUS) technology.

"Each oil and gas company also gets a target to achieve Net Zero Emission," concluded Dwi.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)