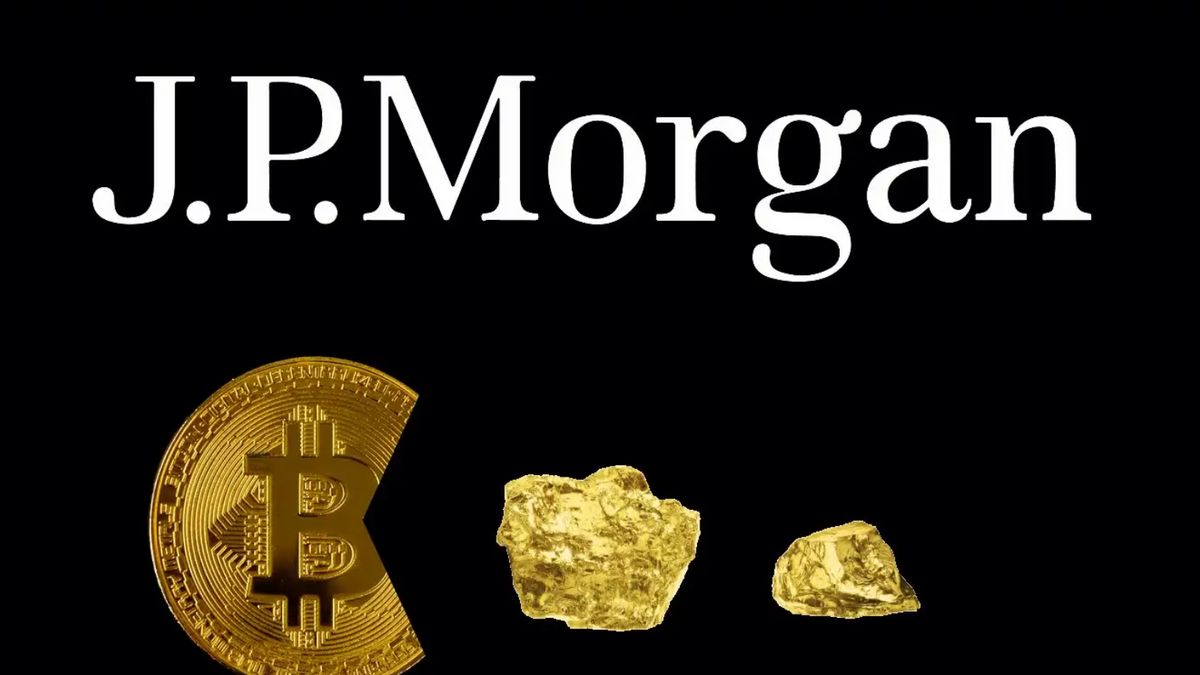

JPMorgan Chase, one of the largest financial institutions in the world, has shown a twofold attitude between criticism and optimism for Bitcoin (BTC), the most popular crypto asset today.

On the one hand, JPMorgan CEO Jamie Dimon criticized Bitcoin while testifying before the US Senate committee. On the other hand, JPMorgan analysts expressed their confidence that the US Securities and Exchange Commission (SEC) would approve a financial product called Bitcoin Spot ETF.

Dimon Will Close Bitcoin

On Wednesday, December 6, 2023, Dimon testified in a Wall Street surveillance hearing by the Senate Committee for Banking, Housing and Urban Development Affairs on Capitol Hill, Washington, DC. This hearing aims to evaluate the performance and impact of major banks on the economy, environment, and society.

One of the topics being discussed is crypto, which has been in the spotlight in the financial world lately. Senator Elizabeth Warren, known as a crypto critic, asked Dimon about his concerns about money laundering. In response, Dimon stated that he would "cover up" Bitcoin if he became government.

The reason Dimon rejects Bitcoin is because he believes that this cryptocurrency is used by bad actors in carrying out illegal activities, such as cybercriminals, drug dealers, tax evasion, and money laundering. Dimon also emphasized that stablecoins, namely cryptocurrencies whose value is associated with other assets, such as US dollars, need to be regulated.

관련 항목:

Dimon's view of Bitcoin is nothing new. He once called Bitcoin a scam aka fraud in 2017, and said he was not interested in this crypto asset. However, he acknowledged that blockchain technology, which is the basis of Bitcoin and other cryptocurrencies, has the potential to increase efficiency and transparency in the financial sector.

JPMorgan Analyst Optimistic On Bitcoin Spot ETF

Amid criticism from Dimon, JPMorgan does not appear to be turning a blind eye to crypto development. Recently, several analysts from JPMorgan led by Nikolaos Panigirtzoglou, issued a report stating that the US SEC would most likely approve a financial product called Bitcoin Spot ETF.

The Bitcoin Spot ETF is a securities that tracks the price of Bitcoin in the spot market, which is the current price for immediate delivery. This product is different from the future-based Bitcoin ETF, which was approved by the previous SEC, which tracks the price of Bitcoin in the derivative market, which is the price for future shipments.

According to JPMorgan analysts, if the SEC rejects the Bitcoin Spot ETF app from more than twelve applicants, it will most likely draw legal action that could destroy the regulator. Therefore, they argue that the SEC will approve the Bitcoin Spot ETF in the first quarter of 2024.

JPMorgan also said that Spot's Bitcoin ETF could increase demand for Bitcoin, which could push the price of this cryptocurrency up. Currently, the price of Bitcoin is around $44,000 per coin, up more than 160% since early 2023.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)