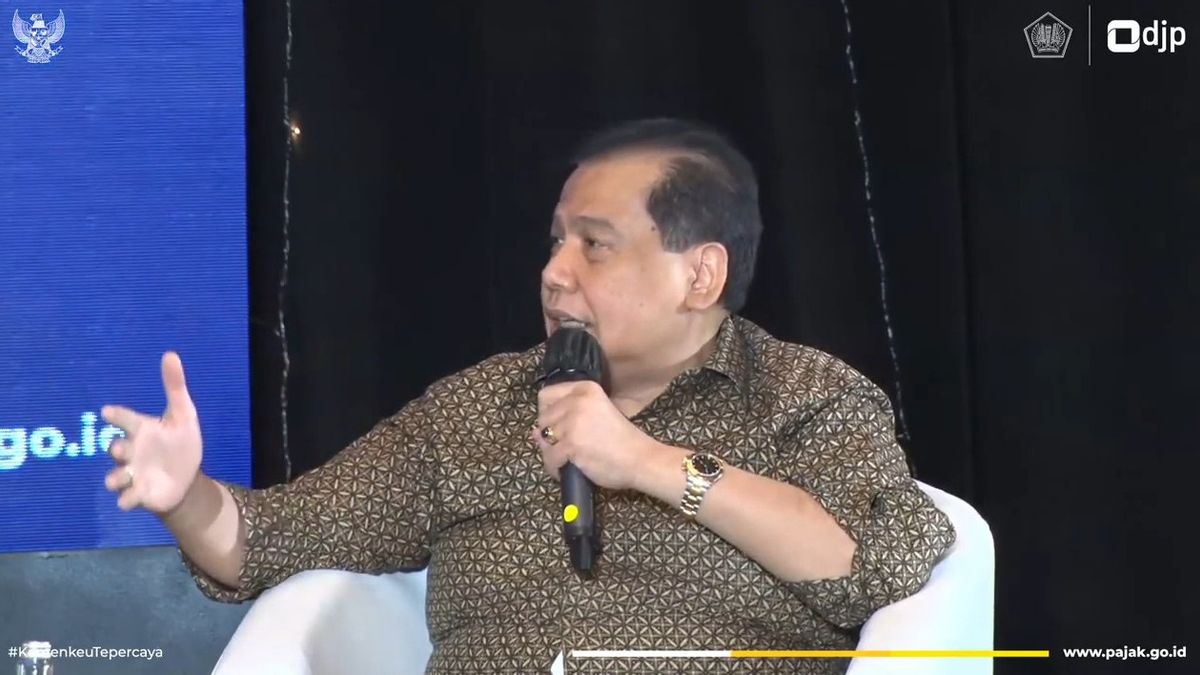

JAKARTA - The national entrepreneur who owns CT Corp Chairul Tanjung had the opportunity to speak in a public discussion on the theme of taxation in Indonesia. Unmitigated, one of the presenters who attended the forum was the Minister of Finance (Menkeu) Sri Mulyani.

When conveying his views, CT, Chairul Tanjung's nickname, had opened the veil that has rarely been known to the public. He said, many businessmen in the country are actually rich but have not been detected by the government tax office.

It is believed by CT because it is actively involved in the financial industry considering that one of its business entities is engaged in this sector.

“We know that there are a lot of entrepreneurs who are unknown to people. His efforts are also unknown. But I know exactly because I am in banking. The money is hundreds of billions or even trillions,” he said earlier this week.

According to CT, these entrepreneurs even deserve to be labeled as conglomerates. The reason is, the ownership of the wealth of this rich group has even exceeded the acquisition of wealth that he has. This suddenly made CT confused about the conditions that occurred in the field.

"That's my money compared to him, that's more of his money. Now, they have not been touched (by taxes)," he said.

Therefore, he hopes that the Directorate General of Taxes at the Ministry of Finance can optimize performance to increase state revenues in the future.

"This is PR going forward. However, I appreciate the continuous improvement. I am also sure that with Mrs. Sri Mulyani's command, things can go well. This is because I know him, we are the same generation at UI (University of Indonesia),” he said.

Citing the realization of the first semester of 2022 APBN, it was stated that tax revenues had touched the figure of Rp. 868.3 trillion. This number has skyrocketed by 55.7 percent compared to the same period in 2021 of IDR 557.8 trillion.

Just so you know, in the 2022 State Budget Law, the tax revenue target for this year is set at around Rp. 1,200 trillion. The figure was later revised to around Rp. 1,400 trillion through Presidential Regulation (Perpres) Number 98 of 2022.

Most recently, the government's outlook revealed that the tax is believed to be strong enough to penetrate the IDR 1,600 trillion range until December 2022, given the high potential for revenue from commodities and the recovery of the business world.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)