JAKARTA - The movement of the Composite Stock Price Index (JCI) is expected to continue to be depressed on Thursday, June 23 trading ahead of Bank Indonesia's announcement regarding the policy of the benchmark interest rate.

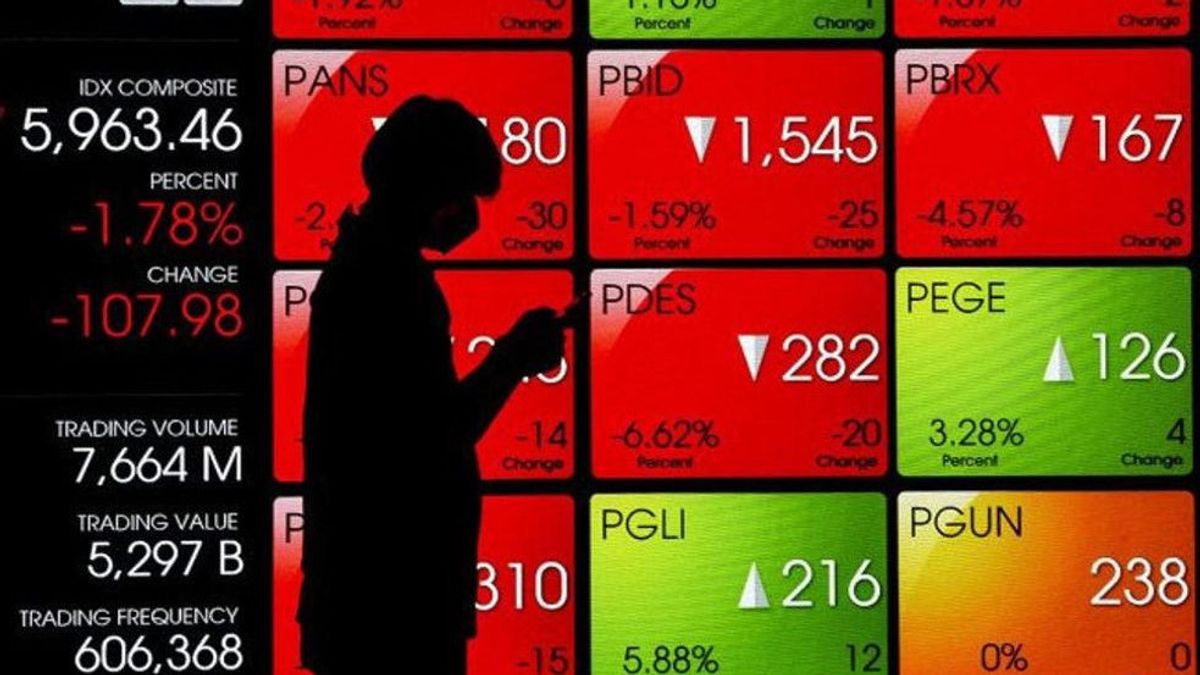

Yesterday, the JCI closed into the red zone, down 0.85 percent to 6,984.31. Throughout trading, the JCI moved in the range of 6,968.29-7,063.25.

Yugen Bertumbuh Sekuritas CEO William Surya Wijaya said the JCI movement pattern is currently overshadowed by several factors, namely the sentiment of setting the benchmark interest rate at the meeting of the Bank Indonesia board of governors, global and regional market volatility, and commodity price volatility.

"On the other hand, the support for the JCI movement still comes from the stability of the domestic economy and the start of the domestic economy. The JCI has the potential to be depressed," William said in his research.

William estimates that JCI will move in the range of 6,888-7,074. According to William, some stocks that investors can watch are JSMR, PWON, ASRI, HMSP, UNVR, TLKM, BINA, TBIG, and KLBF.

Governor of Bank Indonesia (BI) Perry Warjiyo emphasized that he would not be in a hurry to raise the benchmark interest rate amid tightening global monetary policy. Perry explained that the domestic inflation rate is still under control, with an estimated inflation of around 4.2 percent this year.

In addition, additional energy subsidies provided by the government will hinder the transmission of rising global commodity prices.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)