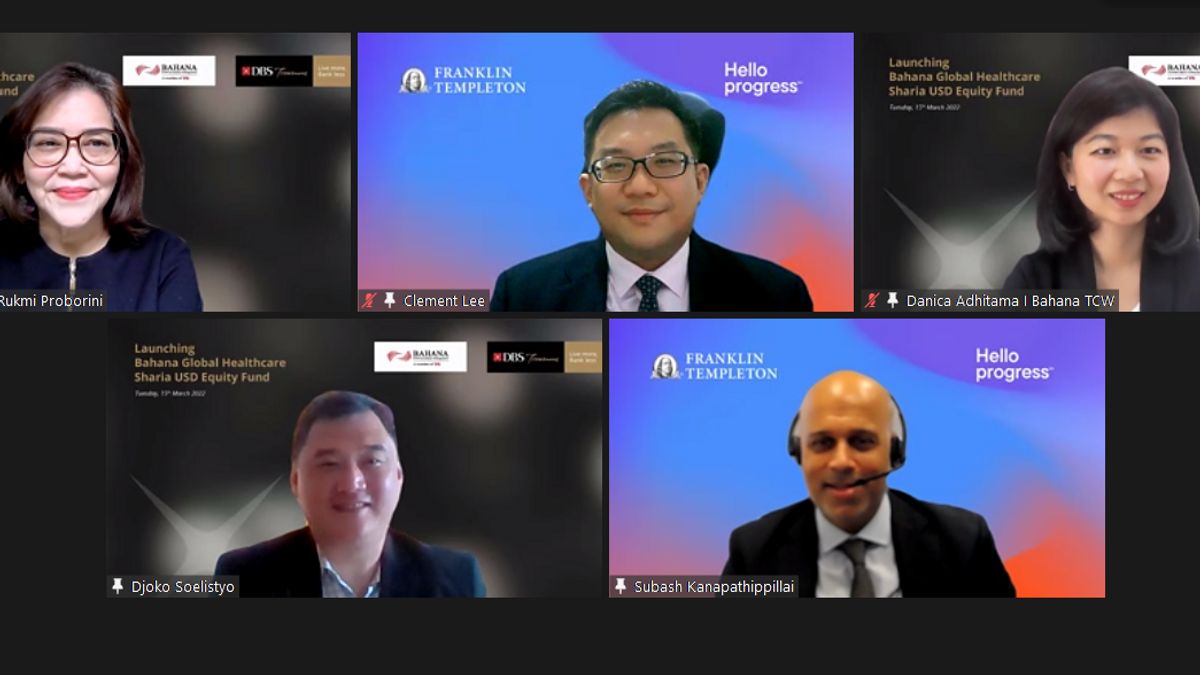

JAKARTA - DBS Treasures and Bahana TCW collaborate to present the Bahana Global Healthcare Sharia USD Equity Mutual Fund for the first time in Indonesia. This product is a sharia investment instrument that focuses on the health sector industry in the offshore market and integrates Environmental, Social, Governmental (ESG) in its management.

Head of Consumer Banking Group PT Bank DBS Indonesia, Rudy Tandjung, said that as a wealth management partner, DBS Treasures continues to enrich the choice of investment solutions that are personalized and communicated to customers.

"Through the Bahana Global Healthcare Sharia USD Equity product which will be effectively available starting March 25, 2022, DBS Treasures opens access for customers who want to diversify their USD-denominated investments, focusing on the health sector strengthened by technological innovations that are growing rapidly," said Rudy, in a statement. his statement to VOI, Wednesday, March 16.

Rudy continued, customers can optimize portfolios by seizing opportunities at the right time through digital omnichannel flexibility that includes phone instructions, and the digibank by DBS application which makes the Single Investor Identity (SID) registration process easy, buying, selling, and switching mutual funds that can be used. done online from anywhere and anytime.

Referring to DBS Group CIO Insight data globally, the health sector is one of the important sectors where the global allocation reaches 11.4 percent among other sectors. One indicator of the growth of this sector globally is seen from the growth in health spending in the United States which has increased in the last three decades, where in 2020 alone it reached 4 trillion US dollars.

This value is equivalent to 20 percent of the United States' gross domestic product (GDP) in total, making it one of the country's largest expenditures.

On the same occasion, the Marketing Director of Bahana TCW, Danica Adhitama, said that through this collaboration, his party seeks to present various investment products for investors, especially to meet investment interests in assets with global standard corporate securities.

“This product is a sharia mutual fund product that focuses on the United States stock market, which is currently concentrated in the health sector. This product is also actively managed in accordance with ESG principles,” he said

Collaborating with Franklin Templeton, who has experience and global capabilities in strategic design, this product applies sharia principles and integrates ESG in product portfolio management.

The progress which is predicted to continue to grow will have an impact on increasingly diverse demand, thus making the healthcare industry one of the most promising industries for investors.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)