JAKARTA - At the end of January 2020, PT Taspen reported that it had successfully earned a net profit of IDR 388 billion throughout 2019. However, until mid-February 2021, Taspen has not reported its 2020 performance.

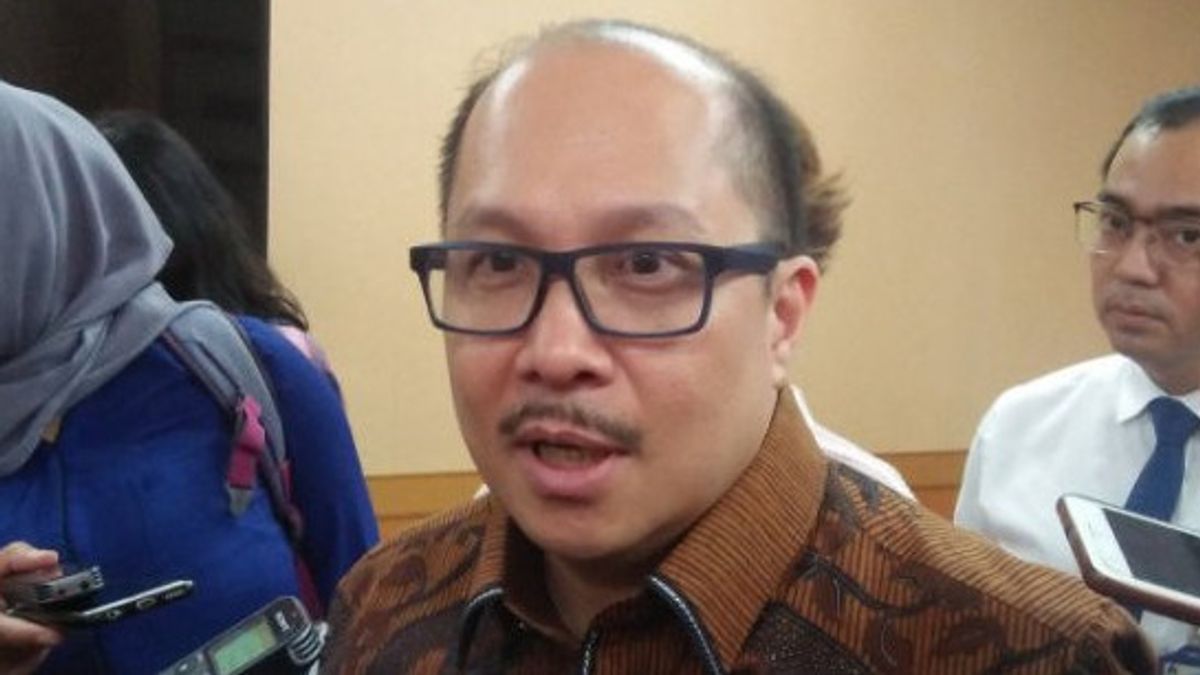

President Director of Taspen Antonius Kosasih once said that his party targets to be able to get a net profit of more than IDR 400 billion for the 2020 financial year. Antonius Kosasih himself has only been appointed by State-owned Enterprises (BUMN) Minister Erick Thohir to be Taspen President Director since January 2020.

However, it seems that this target will be difficult to achieve because Taspen has experienced a decline in investment returns as of September 2020.

As is known, income from the investment is the largest contributor to Taspen's income in 2019. Taspen's income from investments in 2019 reached IDR 1.47 trillion.

So, in 2020 or during the COVID-19 pandemic that hit the country, the state-owned pension insurance company recorded a decrease in investment returns or yield on investment (YOI) in the third quarter of 2020.

Taspen achieved an investment return of 6.3 percent as of September 2020, down from 8.5 percent in 2019. Taspen's biggest investment is in debt securities, which is 67.9 percent of the total investment. Following deposits 17.3 percent, mutual funds 6.9 percent, 5.7 percent shares, and 2.2 percent direct investment.

Although the return on investment has decreased, quoted from Kontan.co.id, Antonius Kosasih believes that Taspen is still one of the best players so that any investment allocation will make the market conducive.

Moreover, said the former Managing Director of PT Transjakarta, every Taspen investment placement applies several principles. Among other things, taking into account the level of risk that is acceptable as well as investments that provide optimal yield.

Then Taspen invests in the right instrument and through comprehensive analysis, as well as the ease of disbursement of value and investment return and allocation of investment assets with due regard to market conditions.

Apart from that, Taspen also relies on investment in Jabodetabek properties. Even when property sales were difficult during the pandemic, the company actually got global investors up to trillions of rupiah.

"We can also get investment alternatives during the COVID-19 period when the yields were low. We are quite high in the market at 6.5-7 percent of the investment returns, which results are better", said the former Wijaya Karya Finance Director.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)