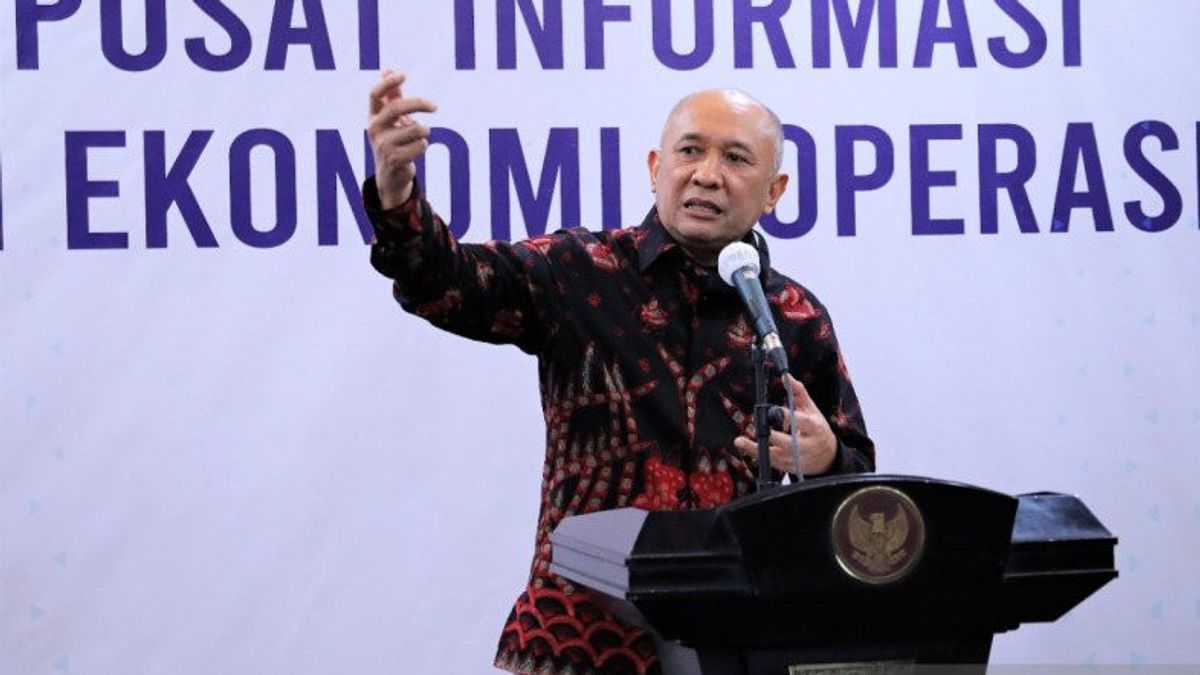

JAKARTA - Minister of Cooperatives and Small and Medium Enterprises (UKM) Teten Masduki warned the public to be vigilant and careful with illegal online loans (Pinjol) under the guise of Savings and Loans Cooperatives (KSP). This follows the many reports of people claiming to have been harmed by using illegal loan services.

Teten said there are several things that must be considered so as not to be caught in an illegal loan. First, the community can detect if their activities are not in accordance with cooperative principles.

"The first mode is usually cooperatives making illegal applications to trick the public as if the online loan offer has legality from the Kemenkop UKM," he said in a virtual press conference, Friday, August 20.

Then, said Teten, illegal lenders also create applications or cooperative sites that appear to have legality from the Kemenkop UKM, and take the names and logos of cooperatives that have permits from the Kemenkop UKM.

Not only that, the next mode is illegal lending under the guise of a cooperative that will provide loans easily where non-members can also borrow. Moreover, the loan terms are not in accordance with the agreement.

"In fact, cooperatives (which are legal should only be) to members. Then they ask for data and cellphone contacts so that they can be accessed during application installation," he said.

Teten said, in order not to be deceived by illegal loans under the guise of cooperatives, the public can confirm through various means, such as checking the cooperative legal entity number from the Ministry of Law and Human Rights, including the legality of the business license from the Online Single Submission (OSS). You can also check with the local MSME Cooperative Service and the Kemenkop UKM through the ODS and NIK systems.

"If it is related to fintech peer to peer lending, you can check the system at the Financial Services Authority (OJK) regarding the official fintech list," he said.

According to Teten, if there is no list of wanted loans, it means that the loans are illegal. Teten said that this is what the community must continue to do, namely rechecking before using online loan services.

The public must also be more vigilant in prioritizing rationality towards providing loan interest which is indeed higher or unnatural than other financial institutions, as well as prior research on the performance profile and management of cooperatives from credible sources.

Teten also reminded the Kemenkop UKM to also open a public complaint service, one of which is related to illegal loans through the lapor.go.id portal or call center 1500 587.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)