JAKARTA - PT Bank Negara Indonesia (Persero) Tbk (BNI) posted a net profit of IDR 16.3 trillion by the end of September 2024.

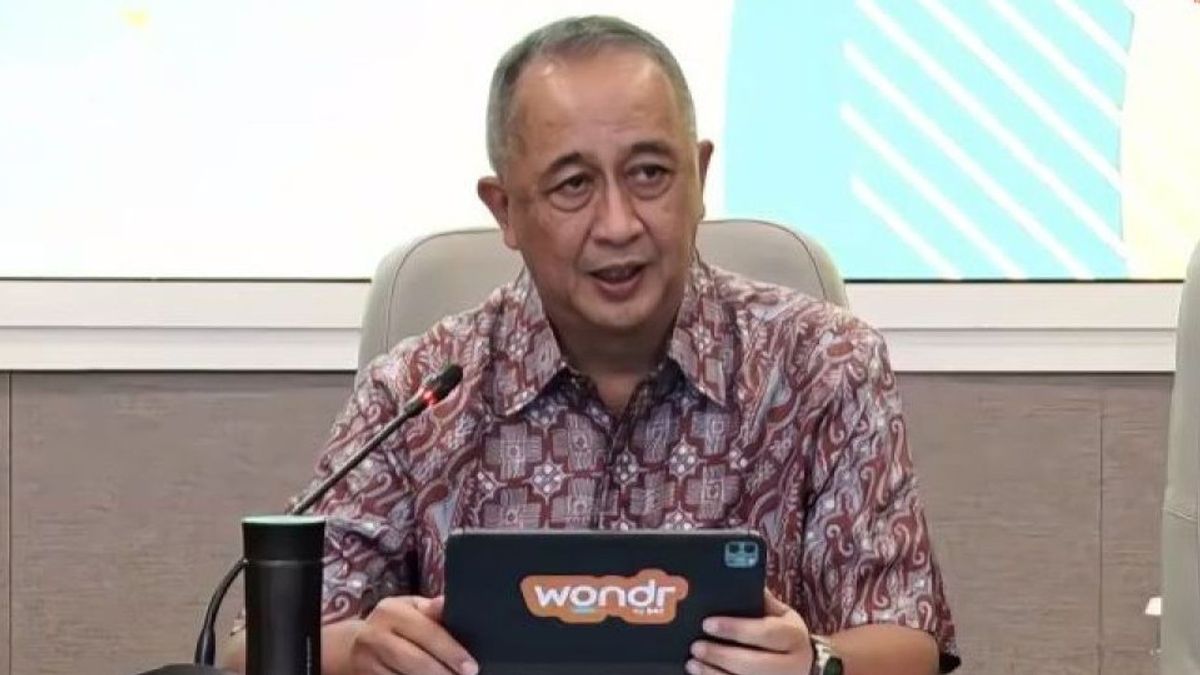

BNI President Director Royke Tumilaar said BNI recorded a performance recovery, especially in the third quarter of 2024. Operating income before backup or PPOP in the third quarter of 2024 reached IDR 8.8 trillion or almost touched its highest position in the third quarter of last year of IDR 8.9 trillion.

"This solid PPOP achievement comes from an increase in the net interest margin or Net Interest Margin (NIM) and non-interest income," he said, Friday, October 25.

Royke said, the company's NIM rose 40 bps on a quarterly basis to 4.4 percent supported by improvements in credit yields and reduced cost of funds. Meanwhile, the growth of fee income is driven by loan recovery income, trade finance, and payment transactions through the wondr by BNI application which continues to increase.

Credit disbursement rose 9.5 percent YoY to IDR 735 trillion supported by a low-risk segment. Blue chip corporate loans, both from the private sector and state-owned enterprises as well as government institutions, consumer loans, and contributions from subsidiaries are the largest sources of growth.

"The focus of our transformation this year has improved the structure of third-party funds and we hope that the diversification of these sources of funds will be even better in the future," said Royke.

BNI Finance Director Novita Widya Anggraini explained that BNI's intermediation performance also grew positively and in balance, in line with the improving national economic recovery.

This is reflected in lending which grew 9.5 percent yoy to IDR 735 trillion as of September 2024. This growth was driven by the corporate segment which recorded an increase of 15.1 percent YoY to IDR 409.2 trillion.

In addition, the consumer segment as a whole recorded a growth of 14.6 percent yoy to IDR 137 trillion, with personal loans (payroll) and Home Ownership Loans (KPR) as the main driver.

"This year, the medium and small segments are still focused on improving credit underwriting so that these two segments will be ready to diversify BNI's credit growth next year," said Novita.

SEE ALSO:

As a result of credit acceleration in the low-risk segment, BNI's asset quality continues to improve, marked by a non-performing loan (NPL) ratio that was successfully maintained at 2 percent in the third quarter of 2024.

Risk credit (LAR) has improved to 11.8 percent, so that Cost of Credit (CoC) can be maintained at 1 percent. The provisional burden also decreased by 19.7 percent YoY to IDR 5.4 trillion.

BNI's healthy credit disbursement is also supported by CASA's fund growth in the form of demand deposits and savings. As of September 2024, CASA BNI was able to grow 5.5 percent yoy, mainly supported by savings that were able to grow solidly by 7.4 percent yoy.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)