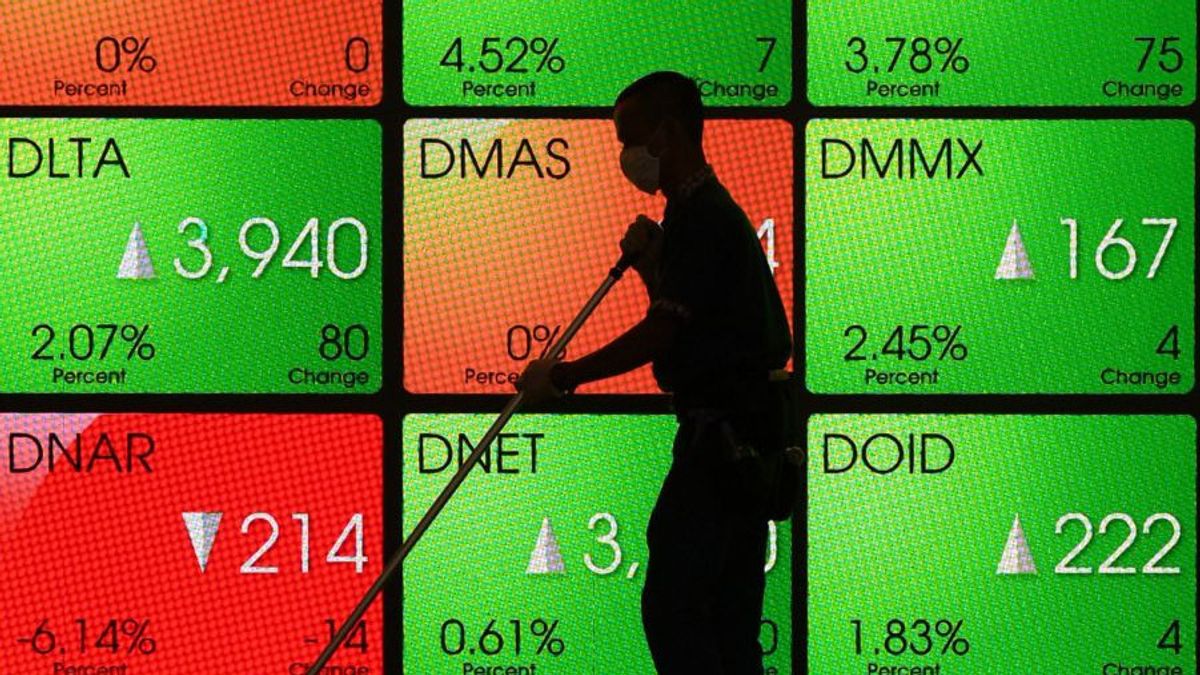

JAKARTA - The Composite Stock Price Index (JCI) is projected to continue strengthening in today's trading, Thursday, April 25, after yesterday closing in the green zone with an increase of 0.90 percent or an increase of 63.72 points to the level of 7,174.53.

JCI is predicted to test the upper limit of resistance at the level of 7,200 at Perdagna this Thursday. Phintraco Sekuritas in its research said that the strengthening of the JCI coincided with the announcement of the decision of the Board of Governors' Meeting (RDG) of Bank Indonesia (BI) to raise the benchmark interest rate by 25 bps to the level of 6.5 percent on Wednesday 24 April.

This decision has implications in the short term, where there was a strengthening of the rupiah exchange rate of 0.40 percent to IDR 16,150 on Wednesday.

Meanwhile, the increase in lending by 12.40 percent on an annual basis or year on year (yoy) in March 2024 is considered to be a good provision in facing the increase in benchmark interest rates this time.

SEE ALSO:

In addition, the determination of the election results by the General Election Commission (KPU) on Wednesday, April 24, after the Constitutional Court's decision in the trial of the dispute over the election results became a positive sentiment for the investment climate in Indonesia.

"Market participants seem to be starting to estimate the potential for more "smooth" political consolidation in the first 100 days of Prabowo-Gibran's leadership," explained research by Phintraco Sekuritas.

The stocks recommended by Phintraco Sekuritas include MAPI, INDF, JPFA, MYOR, and ERAA.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)