JAKARTA - As a form of Indonesia's commitment to decarbonization towards Net Zero Emission in 2060, PT Bursa Efek Indonesia (IDX) as the organizer of carbon trading in Indonesia, is fully responsible for producing positive output to be enjoyed by the wider community.

Through IDX Carbon, the government intends to encourage the industrial sector to be more active in reducing carbon emissions for those produced below the set threshold. The mechanism that runs is that every company that is proven to produce output in the form of carbon emissions above the predetermined limit will receive sanctions.

On the other hand, entities that are able to reduce their exhaust emissions will get incentives in the form of carbon credit. Now, this carbon credit is then certified by the Ministry of Environment to become an asset and can be traded to other institutions that have produced carbon emissions more than the predetermined limit.

UGM's Faculty of Economics and Business lecturer, Poppy Ismalina said, this policy is not only able to boost industrial efforts to reduce carbon emissions, but also opens up wide opportunities for investment.

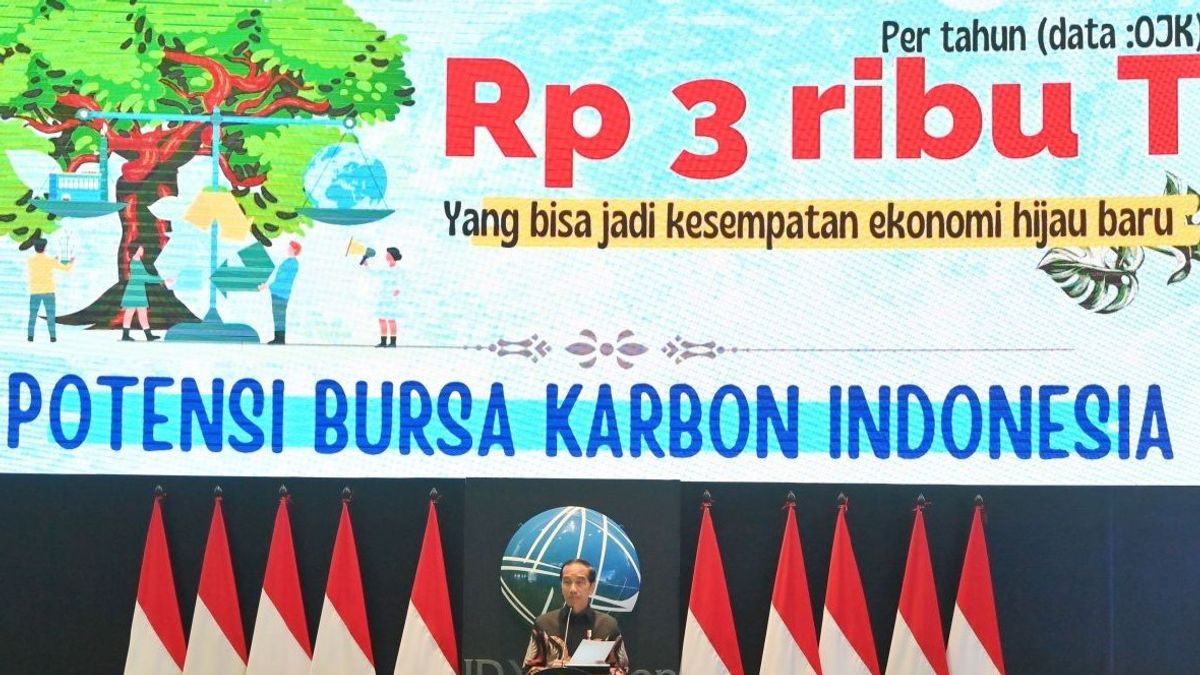

President Joko Widodo (Jokowi) revealed that Indonesia has extraordinary potential in nature-based solutions and is the only country whose 60% reduction in carbon emissions comes from nature.

According to him, there is the potential of about 1 gigaton carbon dioxide (CO2) that can be captured and utilized. If calculated, the potential for the Indonesian carbon exchange can reach more than IDR 3,000 trillion.

A very large “Angka, which will also be a new sustainable and environmentally friendly economic opportunity, is in line with the direction of the world that is heading towards a green economy, ” Jokowi explained.

Overtake Malaysia And Singapore

Now starting September 26 yesterday, every institution can start buying and selling carbon directly at IDX Carbon. IDX Director of IDX, Jeffrey Hendrik, said that since then, IDX Carbon users have experienced a significant increase, from 15 to 29 in early November.

Now the latest data states that the total number of carbon exchange service users recorded on IDX Carbon has reached 33 users. This shows that the interest of institutions in the carbon emissions trade in Indonesia is very significant.

Bahkan BEI menyebut sudah ada 24 entitas lain yang kini mengajukan diri untuk menjadi pengguna jasa bursa carbon (PJBK). Sebagai catatan, sampai dengan 20 November kemarin, volume yang tercatat sudah mencapai 468 ribu ton carbon dioxide.

The number is higher than the Malaysian and Singapore carbon exchanges which reached 160 thousand tons of CO2, Jeffrey explained.

Build Transparency Via Blockchain

Carbon trading activity in Indonesia is not the first time this has happened. Based on data from the Institute for Essential Services Reform (IESR), since the last few decades, this country has known the Carbon Voluntary Market (VCM) before finally deciding to form a mandatory carbon market to meet the national contribution target (NDC) in certain sectors.

For example, such as the Sumatra Merang peatland project, which managed to sell 3 million carbon loans to jumbo companies and the Indonesia Climate Exchange (ICX), a trading platform built to build an ecosystem for a voluntary private sector.

But now, carbon trading has become mandatory for several obedient sectors known as PTBAE-PU aka carbon quota and carbon credit or referred to as SPE-GHK. To build transparency and efficiency in carbon trading mechanisms, the IDX uses blockchain-based technology owned by the AirCarbon Exchange (ACX).

This technological marriage is done not without reason. Blockchain technology itself has been known as advanced technology such as distributed ledgers that cannot be changed or modified.

Each party can monitor transactions in real-time with a much faster transaction completion time. Data from the International Institute for Management Development (IMD) reveals that the use of blockchain technology can help carbon credit to maintain credibility by keeping the process clean and stopping fraud.

In addition, the visibility of the project is also predicted to be more clear, because through blockchain it is able to help provide transparency related to the methodology applied and calculations carried out by certain projects.

The “Supervision of the carbon credit market provided by blockchain not only cleans the market, but also helps it develop through carbon credit tokenization,” wrote IMD.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)

Most Popular Tags

#Prabowo Subianto #golkar #OTT KPK #Pilkada Dki #online gamblingPopular

28 November 2024, 07:07

28 November 2024, 01:09

28 November 2024, 10:05