JAKARTA - The Ministry of Cooperatives and SMEs (Kemenkop UKM) said, until now, total bad loans or problems reached Rp22.9 trillion.

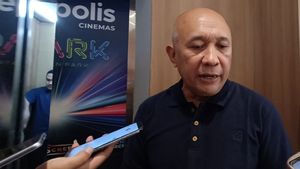

"Based on the results of the evaluation of the implementation of the MSME Restructuring Program, the total problem credit is IDR 22.9 trillion which includes 421 thousand MSME actors," said Minister of Cooperatives and SMEs (Menkop UKM) Teten Masduki in a working meeting (raker) with Commission VI DPR RI in Jakarta, Thursday, November 23.

Minister Teten said, based on the results of the evaluation, there were three directives from President Joko Widodo (Jokowi) that had been conveyed to him during a cabinet meeting.

First, look for solutions and evaluations of MSME credit problems that favor MSME players.

"Second, increasing the portion of MSME loans from 25 percent in 2023 to 30 percent in 2024," said Teten.

Third, completing matters related to removing books, removing collections, and restructuring MSMEs with a period of less than one month.

He added that there are a number of legal grounds for the implementation of collection deletion, including Law Number 4 of 2023 concerning Financial Sector Development and Strengthening (PPSK), which states that bill deletion can be carried out.

"Then, PP Number 7 of 2021 concerning convenience, protection, empowerment of cooperatives and MSMEs, which states that recovery includes credit restructuring, restructuring of capital assistance businesses, and other assistance," said Teten.

Then, OJK Regulation Number 32 of 2018 concerning the maximum limit of lending and providing large funds for commercial banks.

SEE ALSO:

"In this regulation, it is stated that bad credit is one of them that can be resolved by restructuring credit,"

Furthermore, Teten said, there were a number of proposed criteria for the elimination of debt bills for MSME traffic jams, namely debtors with MSME status as regulated in PP Number 7 of 2021, a maximum loan value limit of IDR 500 million, and receivables that have been stuck for class 5 and have been deleted by books.

Next, the debtor still has the intention to continue and develop the business, the debtor has died and does not have a third party heir who can complete the credit, and is recommended to have at least 10 years of age to delete the book and so on.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)