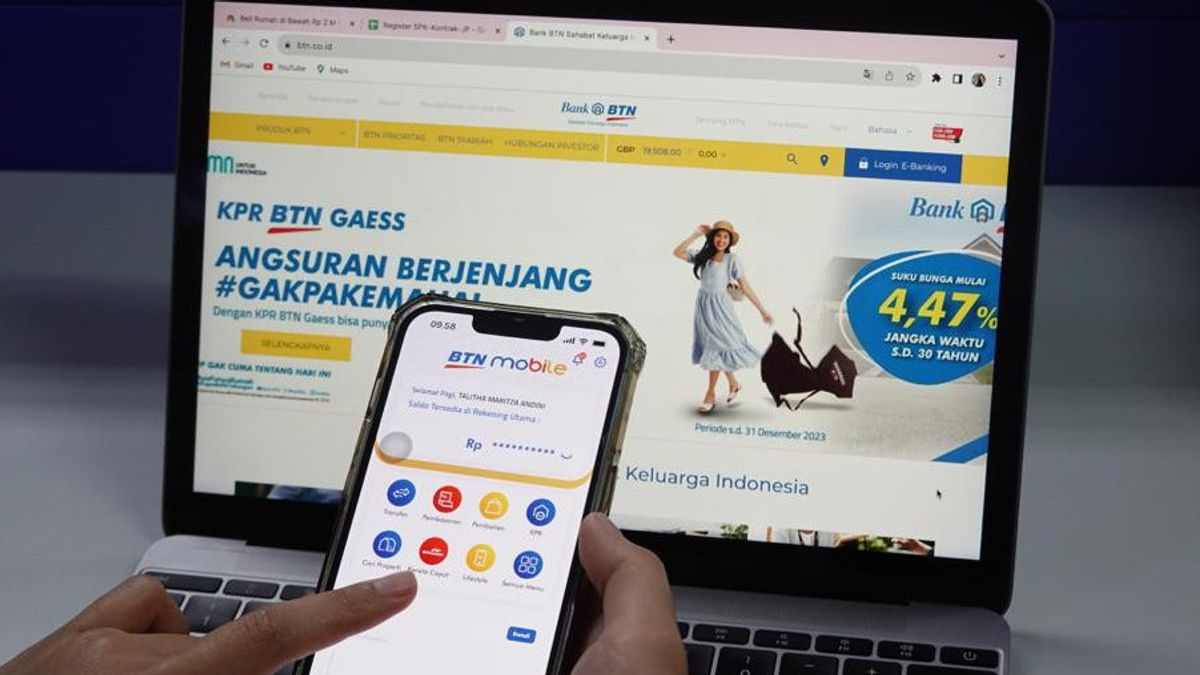

JAKARTA - PT Bank Tabungan Negara (Persero) Tbk (BTN) continues to innovate to facilitate the digital life of its customers. Most recently, the company presents some of the latest services at BTN Mobile, namely the Mortgage feature, Accident Insurance, and Fast Train

President Director of Bank BTN Nixon LP Napitupulu said the various innovations were the company's efforts to make it easier for its customers to make various transactions through only one platform.

"We are preparing a mobile banking application, namely BTN Mobile, which provides extensive, easy, and fast access to banking transactions for customers. Because we want to continue to facilitate the digital life of BTN Bank customers," Nixon said in Jakarta, Thursday, November 2.

Meanwhile, the Mortgage feature in BTN Mobile makes it easier for customers to search for their ideal residence, apply for home ownership loans (KPR), to check the status of mortgage loans.

"Until now, the online submission of Bank BTN mortgages has recorded an increase of up to 50 percent on an annual basis. We are optimistic that this achievement figure will continue to increase in line with the various facilities we offer," said IT & Digital Bank Director of BTN Andi Nirwoto.

Andi continued that customers can also enjoy the ease of purchasing accident insurance through the lifestyle feature at BTN Mobile. This insurance can be accessed by all groups including the millennial and gen Z groups.

The accident insurance package feature is a collaboration between Bank BTN and IFG Life, life and health insurance companies. There are 3 package options that can be accessed by Bank BTN customers, namely LifeSaver Lite, LifeSaver, and LifeSaver +. The price of these packages varies from Rp. 29,000 to Rp. 99,000. The benefits received also range from physioters, sports injury media protection, death or permanent defects, and medical protection of accidents of up to Rp. 400 million.

SEE ALSO:

Another new feature is the direct fast train payment service on the Home BTN Mobile page. For the payment of the high-speed train, Bank BTN customers only need to enter a virtual account number in the quick Train feature on the BTN Mobile home page.

According to Andi, Bank BTN as One Stop Digital Housing Services continues to develop digital ones that provide convenience and security for transactions for our customers.

"Of course, on a regular basis, we also continue to present various promos for electronic channel transactions for our loyal customers," said Andi.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)