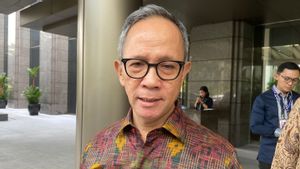

JAKARTA Bank Indonesia (BI) has taken a policy not to raise the benchmark interest rate in the March 2023 period. This was conveyed directly by BI Governor Perry Warjiyo in a press conference in Jakarta after chairing the Board of Governors' Meeting (RDG).

"Decided to keep the BI 7-Day Reverse Repo Rate (BI7DRR) at 5.75 percent. Likewise, the Deposit Facility interest rate remains at 5.00 percent, and the Lending Facility interest rate at 6.50 percent," he said on Thursday, March 16.

According to Perry, this step is in line with the central bank's pre-emptive and forward looking monetary policy stance.

"This is also to ensure the continued decline in inflation and inflation expectations in the future," he said.

Perry added, Bank Indonesia believes that BI7DRR is 5.75 percent adequate to ensure core inflation remains in the range of 3 percent plus minus 1 percent in the first semester of 2023.

"Also to direct the inflation of the Consumer Price Index (JCI) back into the target of 3 percent plus minus 1 percent in the second semester of 2023," he said.

VOI noted that the monetary authority's decision to maintain the benchmark interest rate was the second time after last month. Previously, Bank Indonesia gradually raised the BI rate by 225 basis points (bps) since August 2022, which at that time was perched at the level of 3.50 percent.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)