JAKARTA - The Deposit Insurance Corporation (LPS) has set a deposit guarantor interest rate of 25 basis points for commercial banks, foreign exchange and the People's Credit Bank (BPR).

Chairman of the LPS Board of Commissioners Purbaya Yudhi Sadive detailed, the guarantee interest rate for rupiah in commercial banks to 4.25 percent, the guarantee interest rate at BPR to 6.75 percent and the guarantee interest rate for foreign exchange in commercial banks to 2.25 percent.

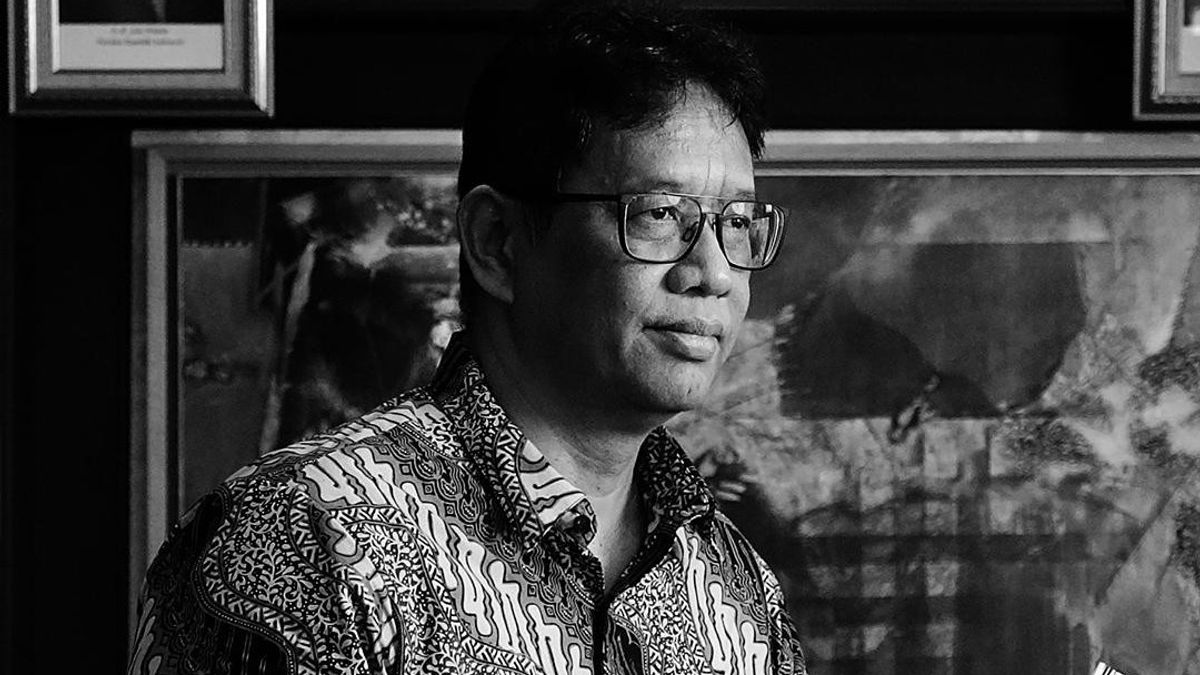

"The LPS board meeting has determined to increase the interest rate of rupiah deposits in commercial banks and BPR by 25 bps and foreign currencies in commercial banks by 25 bps," Purbaya said at a press conference in Jakarta, Tuesday, February 28.

The increase in deposit guarantee interest is valid from March 1, 2023 to May 31, 2023. This guarantee rate is shown as a reference for the maximum interest rate limit for banking deposits.

The determination of the guarantee interest rate is a determination outside the regular period which is usually done 3 times a year, namely January, May and September.

"Bank conditions are recorded to be quite good and healthy. Liquidity based on AL/DPK reached 29.13 percent and third party funds (DPK) reached 8.03 percent," he explained.

Meanwhile, the performance of intermediation in taxes continues to increase. In January 2023, yoy, banking credit grew 10.53 percent. Banking credit grew consistently in line with the increasingly strong trend of economic recovery.

The current recovery of intermediation performance is also followed by maintained aspects of credit risk management.

The gross ratio of NPL in January 2023 is at a controlled level of 2.59 percent. This was followed by Loan At Risk (LAR) which continued to decline to the level of 14.52 percent.

"LPS guarantee coverage is at a very adequate level. The amount of savings guaranteed by LPS is 2 billion customers per tub equivalent to 28.2 times GDP per national capita in 2022," he added.

He further said that in determining the guaranteed interest rate, LPS paid attention to the direction of the movement of deposit interest rates in the banking industry, space for healthy competition between banks in raising funds and considering forward looking factors in order to maintain the stability of the national financial system and encourage national economic recovery.

"We appeal to the bank to transparently convey to customers and potential storage customers about the current guarantee interest rate," concluded Purbaya.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)