YOGYAKARTA - Bad credit (Non-Performing Loan/NPL) is a condition in which the debtor is unable to pay his installments or debts. If this happens, the bank as the creditor will execute the collateral by auctioning the house or assets with bad credit.

The execution of bad credit house auctions is based on Article 6 of Law Number 4 of 1996 concerning Mortgage Rights on Land and Objects Related to Land.

The article reads: "If the debtor defaults, the holder of the first Mortgage has the right to sell the object of the Mortgage on his own power through a public auction and take the settlement of his receivables from the proceeds of the sale."

Auctions for bad credit houses will be carried out through the Directorate General of State Assets (DJKN). The house is being auctioned, and installed at a low price. If you follow this auction process, you can get a cheap property below market value.

Interestingly, buying bad credit auction houses can be done on credit. So, what is the procedure for bad credit house auctions?

Bad Credit House Auction Procedures

Auction is the sale of goods open to the public with written and/or oral price bids that increase or decrease to reach the highest price, which is preceded by an auction announcement.

In Indonesia, rules regarding auctions were promulgated in 1908, when the Dutch were still in power. In that year, the legal basis for auctions was known as Vendu Reglement (Stbl. 1908 No. 189) and Vendu Instructie (Stbl. 1908 No. 190). Until now, the basic rules of the auction are still valid in Indonesia.

Summarized from various sources, Monday, February 20, 2023, the following is the procedure for participating in a bad credit house auction:

- Search the Information of the Asset to be Auctioned

The first bad credit house auction procedure is to find information about the assets to be auctioned off by the banks.

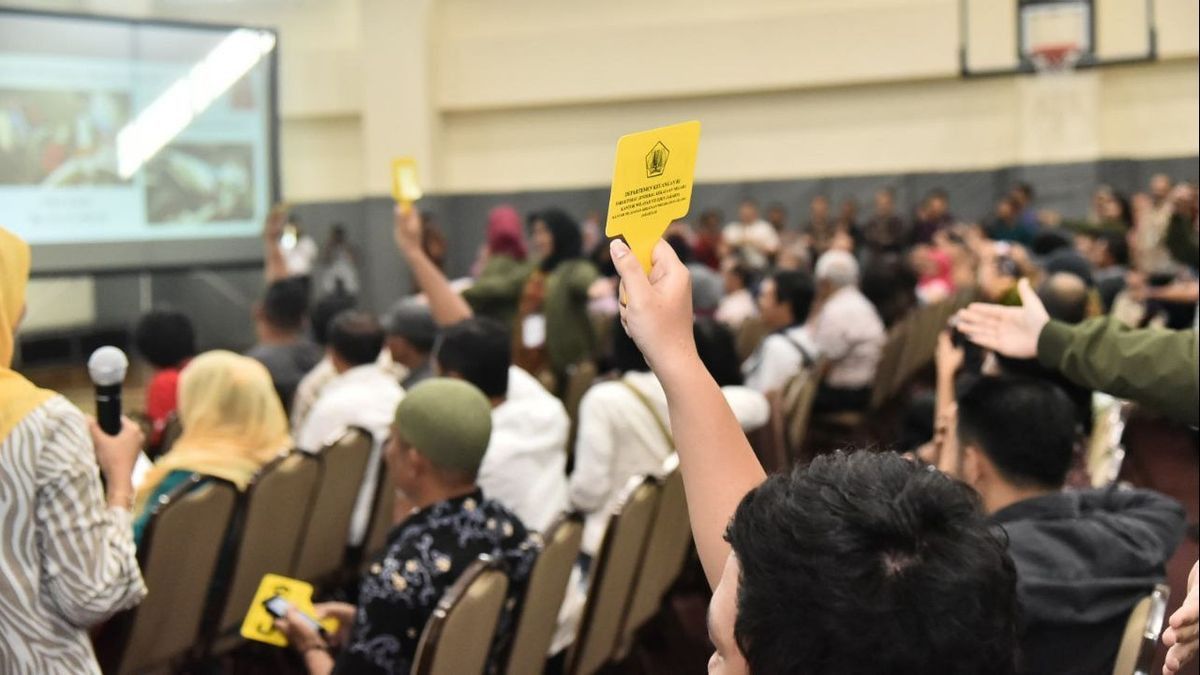

Related to this, you can take part in the Investor Gathering Auction which is regularly held by the bank. However, now there is an easier way, namely by visiting the bank's website which is intended as a forum for information on assets being auctioned.

- Find the Preferred Assets You Want

Banking parties usually have their own auction platform to make it easier for bidders to choose the desired asset.

After selecting one of the bad credit auction assets that you want to buy, you are required to contact the officer who manages the collateral so that you can conduct a survey.

Next, you must inform when you want to conduct a survey. This stage is very important to do, so that you can dig up as much information about the object of the auction and the debtor.

This asset survey is mandatory because the assets that are used as collateral are sometimes not fully built, or even in a state that needs to be renovated. You also have to check the completeness of the legal documents.

You need to remember, property auctioned off by banks is collateral that has credit problems. There is a possibility that administrative data may not be complete when it is about to be taken over.

- Submitting an Auction Request

The next procedure or step is to apply for an auction by creating an auction account on the Auctions page, the official website of the Directorate General of State Assets (DJKN).

Fill out the interest form and the bank officer will list you as a bidder and process the due diligence. Then, the process will take place in accordance with the provisions of the auction or statutory regulations in order to fulfill the legality aspect.

- Depositing Security Deposit

After making an auction request, you can deposit the security deposit at the State Wealth and Auction Service Office (KPKNL). The security deposit can also be deposited via the Auction page. The amount of the security deposit is 20% of the specified limit price.

In this regard, you have the option of processing it with the bank to submit a payment agreement in credit installments until the process of the Letter of Approval for the Provision of Credit is released.

- Participate in Auctions and Make Payments

Finally, you must take part in the auction at the KPKNL, where the bad credit assets are registered. All auction mechanisms are carried out online, aka e-auction, through the KPKNL official website.

If you win the auction, then the credit contract can be implemented immediately. A credit contract is a payment made by a bank or auction participant to the KPKNL.

SEE ALSO:

However, if you lose the auction, the security deposit will be returned.

Repayment of bad credit assets or homes that you have successfully purchased can be done in five working days. Some banks allow you to pay off a maximum of 3 months after winning the auction. Terms of repayment of 5 working days is the policy of the Minister of Finance.

This is information about bad credit house auction procedures. Get other interesting news only at VOI.ID.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)