YOGYAKARTA - Taxpayers must know how to fill out the 1770 S and 1770 SS annual returns, considering that the annual SPT reporting period has been open since January 1, 2023.

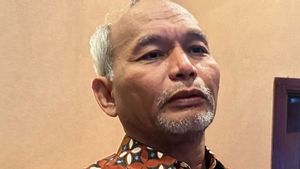

Director General (Dirjen) of Taxes Suryo Utomo said, the deadline for reporting individual SPTs is March 31, 2023, while business entity SPTs are up to April 30, 2023.

Suryo suggested that taxpayers report SPT online or e-filing. The reason is, these services can save time and costs because taxpayers do not need to come directly to the tax office.

"We are minimizing the use of manuals," said Suryo in a media briefing, Friday, January 20, 2023.

How to Fill in the Annual Tax Return 1770 S and 1770 SS

Adapted by VOI from the Directorate General of Taxes website, Wednesday, January 25 2023, there are two types of forms that taxpayers with employee status must choose according to the amount of income for a year.

The 1770 S Annual SPT Form is intended for taxpayers with employee status and gross income of more than IDR 60 million and or working in more than one company within one year.

Meanwhile, the 1770 SS Annual SPT form is for taxpayers with employee status and gross income of not more than IDR 60 million, or working for one company within a year.

The two types of forms have different filling methods on the DJP Online page.

Here's how to fill out the SPT 1770 S form on the DGT online page:

- Go to the djponline site.

- Login by entering the NPWP, password and captcha code.

- Select the "Report" menu, then select the e-Filing service and create an SPT.

- Follow the e-Filing filling guide.

- Fill in the tax year, SPT status, and rectification status.

- Complete PART A. INCOME TAX. Civil servant example: enter data according to form 1721-A2 provided by the treasurer.

- Complete PART B. INCOME TAX. Example: Received a raffle prize of IDR 2,000,000, has been deducted by Final Income Tax of 25 percent (IDR 500,000) and received an inheritance (exempt from objects) of IDR 3,000,000.

- Fill in PART C. LIST OF ASSETS AND LIABILITIES. Example: Assets owned include a motorbike worth IDR 18,000,000, a gold necklace IDR 5,000,000, and furniture worth IDR 8,000,000. Obligations held in the form of remaining motorcycle loans amounting to IDR 14,000,000.

- Complete PART D. DECLARATION by clicking the “Agree” box until a check symbol appears. If so, a verification code will be sent to the registered email address or telephone number.

- Enter the verification code that was sent and click the send SPT button.

- Taxpayers will receive an electronic receipt for the Annual SPT sent by email.

Meanwhile, the steps to fill out the 1770 SS Annual Tax Return include:

- Go to the djponline site.

- Login by entering your NPWP, password and captcha code.

- click "Login". Select the "Report" menu, then select the "e-Filing" service.

- Select "Create SPT".

- Choose to fill in the form "By Form Form".

- Fill out form data, including the Tax Year form, SPT Status, and Correction (if you apply for SPT correction).

- Proof of tax cuts. If you have Tax Withholding Receipt, add it in the second step, or click "Add+".

- Fill in the New Withholding Receipt data consisting of the Type of Tax, Tax Withholding/Collecting TIN, Name of Withholding/Collecting Tax, Number of Withholding/Collecting Evidence, Date of Withholding/Collection Proof, and Total Income Tax Withheld/Collected.

- Specifically for ASN, the Deduction of Civil Servant Salary by the Treasurer is stated in form 1721-A2.

- Once saved, the site will display a summary of the withholding taxes in the next step.

- Contents of Domestic Net Income in Relation to Employment.

- Fill in Other Domestic Income, if any.

- Fill in Foreign Income, if any.

- Fill in Income that does not include tax objects, if any. Example: inheritance of IDR 7 million.

- Fill in Income that has been deducted by Final Income Tax, if any. Example: Lottery Prize worth IDR 10 million, 25 percent Final Income Tax has been deducted (IDR 2.5 million).

- Add your Assets. If in the previous year you reported a list of assets in e-Filing, you can display it again by clicking "Assets in Last Year's SPT".

- Add the Debt you have. If in the previous year you reported a list of debts in e-filing, you can display it again by selecting "Debt on Last Year's SPT".

- Add your dependents. If in the previous year you reported a list of dependents in e-filing, you can display it again by selecting "Dependents on Last Year's SPT".

- Fill in the nominal amount of Zakat/Compulsory Religious Contribution that you pay to a Management Institution approved by the Government.

- Fill in the appropriate "Status of Husband and Wife Liability". In this case, please pay attention if you carry out tax obligations separately with your husband/wife, live separately, or enter into an agreement for separation of assets.

- Fill in the return/deduction of PPh Article 24 from foreign income, if any.

- Fill with Article 25 PPh Payment and Article 25 PPh SPT Principal, if any.

- Finally, check the Calculation of Income Tax (PPh).

- Also check if there is an "Overpaid" or "Underpaid" or "None" status. If "None", do Article 25 Income Tax Calculation, if any, click "Next Step".

- Confirm by clicking "Agree/Agree" in the box provided and select "Next Step".

That is the information about how to fill out the 1770 S and 1770 SS Annual Tax Returns on the DGT Online page. Hope it would be useful!

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)