JAKARTA - An important moment for for forex traders around the world has just arrived. On Friday 4 November 2022 at 19.30 WIB, the US Bureau of Labor Statistics announced job creation data outside the agricultural sector or NFP (Nonfarm Payrolls) for the October 2022 period.

NFP data describes the large number of jobs created in the US every month, outside the agricultural/agricultural sector. Launching data from the Federal Reserve Bank of St. Louis, NFP data includes about 80 percent of the total workers who contribute to the US economy.

Nonfarm Payrolls

If NFP data is released above expectations, then market participants will see that the US economy is speeding faster than economist expectations. As a result, the US dollar will tend to strengthen.

The majority Above Expectation

Throughout 2022 (excluding data releases on Friday), the US Bureau of Statistics has released NFP data 9 times, namely for the January-September 2022 period. As a result, 7 times above the consensus, while the rest are under consensus.

No wonder the "Super Dollar" phenomenon occurs in 2022, where the US Dollar significantly strengthens against the currency pairs of other countries.

Index Dollar movement in 2022

Of the 9 NFP data releases that have occurred throughout 2022, the majority produce opportunities to buy action against the US dollar, such as the EURUSD and GBPUSD currency pairs.

It should be remembered, when the EURUSD and GBPUSD currency pairs move downwards, it means they can be read as EUR and GBP weaken while USD strengthens.

A Tale of Two Words

Indeed, the release of NFP data throughout 2022 continues to provide fresh air to the US economy which had been hit by the COVID-19 pandemic in 2020.

Now, the condition of the job market in the US has relatively improved. Along with NFP data which continues to be positive, the unemployment rate has fallen to around 3 percent.

US Unemployment Rate for the Last 5 Years

But actually, if NFP data continues to be announced to be above expectations, it will complicate the situation for the Fed as the US central bank.

Currently, the US and the rest of the world are faced with a unique problem. This problem is called inflation, which has been at a very high level for a long time.

US Inflation Level

Inflation that is occurring worldwide is currently a cost-push inflation, due to rising crude oil and natural gas prices, due to Russia's invasion of Ukraine.

Unfortunately, these costs of inflation occur when the world economy is still trying to recover from the COVID-19 pandemic which has made the economic growth rate negative.

Based on calculations, from 2019 to 2021, the global economy only enjoys growth of 2.9 percent. In fact, every year the global economy averages growth in the range of 3.7 percent.

Global Economic Growth Level 2019-2021

Compared to people's weak purchasing power, central bank officials around the world are faced with difficult choices. They are forced to raise the benchmark interest rate for “ turn off” people's purchasing power. The hope is that when people's purchasing power “ turned off”, demand will drop so that inflation gradually drops.

But, on the way to restart the world's economic order, how much suffering does society have to bear? Throughout 2022, it can be seen that US economic growth has slowed down when compared to 2021, so it is natural that the US is projected to experience a recession again.

US Economic Growth Annually

On Thursday 3 November, the Fed approved an increase in the benchmark interest rate by 75 basis points (bps) which marked an increase of 75 bps over four consecutive months.

If the trend of NFP data continues to be above the consensus, it is feared that this will make the Fed stop its intention to put a brake on the rate of monetary tightening. The implication is that the Super Dollar phenomenon could continue, regardless of the position of the US Dollar, which throughout 2022 strengthens a lot on other and commodity currencies.

So for a medium-term (6 months) and long-term (1 year) strategy, putting up a long position against the US Dollar could be the best option.

You can read more research & analysis here.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)

Most Popular Tags

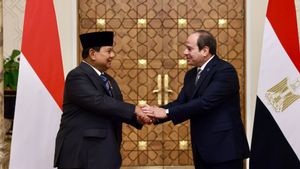

#Prabowo Subianto #New Year #Syria #nataru #NatalPopular

19 Desember 2024, 06:33

19 Desember 2024, 07:07

19 Desember 2024, 08:15

19 Desember 2024, 08:49