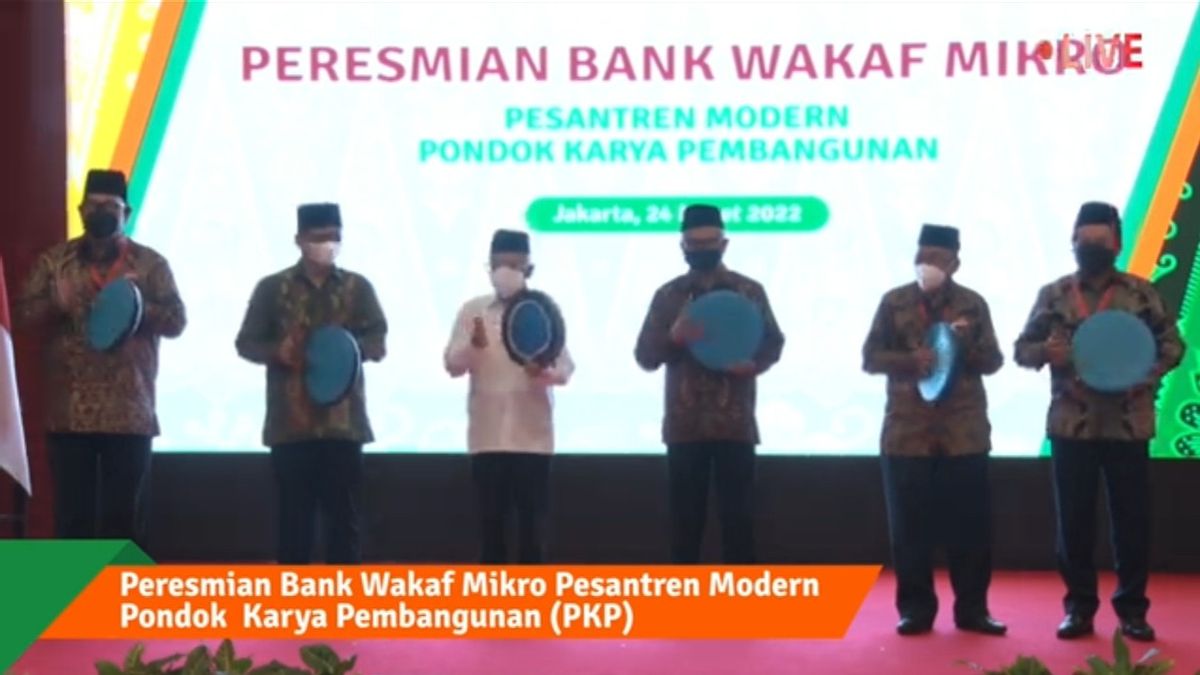

JAKARTA - The Financial Services Authority (OJK) today inaugurated the Micro Waqf Bank (BWM) for the Pondok Karya Pembangunan Modern Islamic Boarding School in DKI Jakarta.

Chairman of the OJK Board of Commissioners, Wimboh Santoso, said that the presence of BWM in the capital city area is expected to encourage the expansion of cheap financial access for micro, small and medium enterprises (MSMEs) while empowering the pesantren community and its surroundings.

"This is the government's support and partisanship in increasing the benefit of the people through the development of MSMEs and the development of Islamic microfinance institutions," he said while giving an opening speech broadcast virtually, Thursday, March 24.

According to Wimboh, the position of MSMEs is important because this sector contributes about 61 percent of gross domestic product (GDP). In addition, this sector also absorbs a large number of workers, which is 96 percent of the total productive workforce.

"The contribution of MSMEs to exports is quite large, around 15 percent and we must continue to support this through access to adequate capital," he said.

For this reason, continued Wimboh, OJK fully supports the expansion of Micro Waqf Banks as a form of providing financial access and providing assistance to MSME actors, especially those in the environment around Islamic boarding schools.

"Since it was launched 5 years ago, as many as 62 BWM have been established and spread across 20 provinces throughout Indonesia whose presence and benefits have been felt by around 55,000 customers with accumulated financing distributions reaching Rp. 87.2 billion," he explained.

To note, the inauguration of the first Micro Waqf Bank was carried out by President Joko Widodo on October 20, 2017 in Kempek, Cirebon. The ceremony also marked the presence of the first 10 BWM in the country.

Meanwhile, the characteristics of the Micro Waqf Bank lies in the mentoring process. It is stated that BWM will conduct a selection for prospective customers, then conduct training and mentoring as well as financing patterns that are made in groups or jointly and severally.

In Micro Waqf Banks there is no collateral scheme because the maximum value of financing disbursed is only IDR 3 million with the addition of a refund fee of 3 percent of the loan amount. Given the absence of collateral, the way to maintain credit quality is through customer groups.

If there is one customer who does not pay it will be the responsibility of the group. For this reason, the role of the group is very important in recommending new prospective customers who really have a good business and maintain the ability to pay.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)