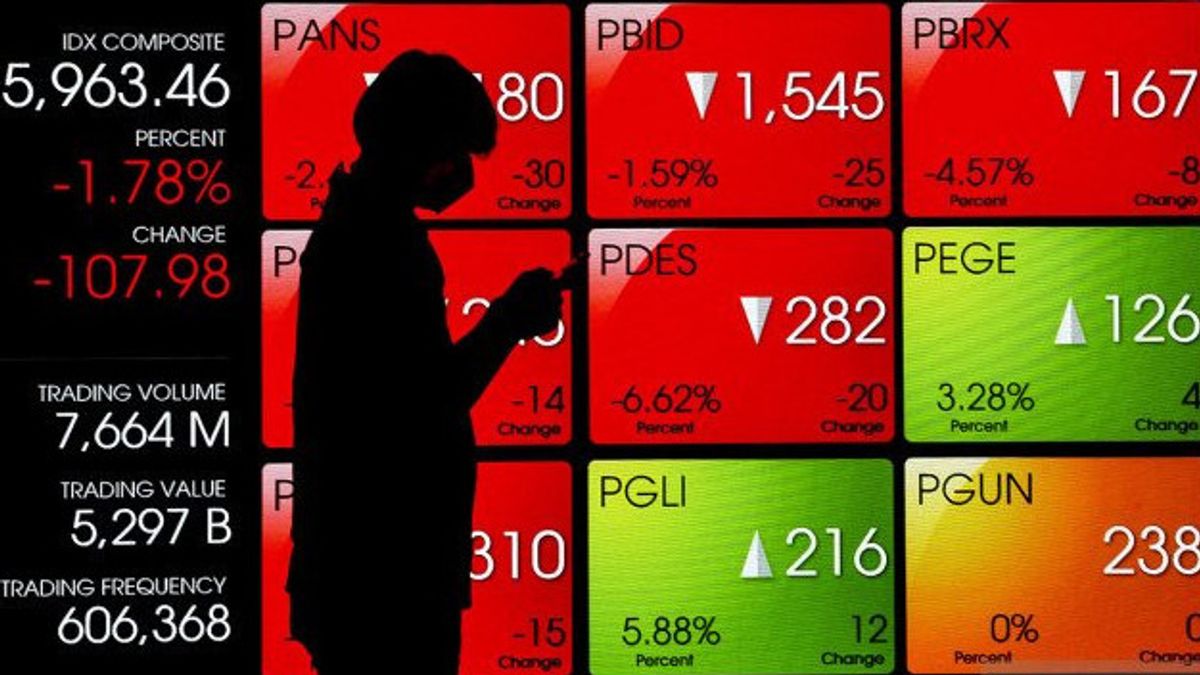

JAKARTA - The movement of the rogue Composite Stock Price Index (JCI) is subject to various sentiments in today's trading, Monday, July 31, after last weekend's gain of 0.05 percent or 3.567 points to 6.900.23.

Phintraco Sekuritas in his research said the JCI has the potential to test support levels of 6,830 in trading this Monday, and resistance at 6,950, as well as a 6,880 pivot.

The benchmark interest rate is expected to still affect the JCI this week. The latest hints from the Fed and European Central Bank (ECB) will likely start holding the benchmark interest rate starting at the end of the third quarter of 2023 or early IV 2023

"Still from external, the European Region will release data on the GDP Growth Rate YoY Flash in the second quarter of 2023 and the YoY Flash Inflation Rate in July 2023. The realization of this data will affect the policy direction and economic projection of the European Region in the future," explained research by Phintraco Sekuritas.

اقرأ أيضا:

Domestically, market participants are still anticipating the release of the II 2023 financial report from the rest of the issuers on the Exchange. From economic data, the Central Statistics Agency (BPS) will release inflation data in July 2023 on August 1.

Indonesia's inflation is expected to fall to 3.11 percent yoy in July 2023 from 3.52 percent yoy in June 2023.

Market participants can pay attention to stocks with potential rebounds next week, including JPFA, INDF, ICBP, UNVR, ISAT, EXCL and HEAL.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)