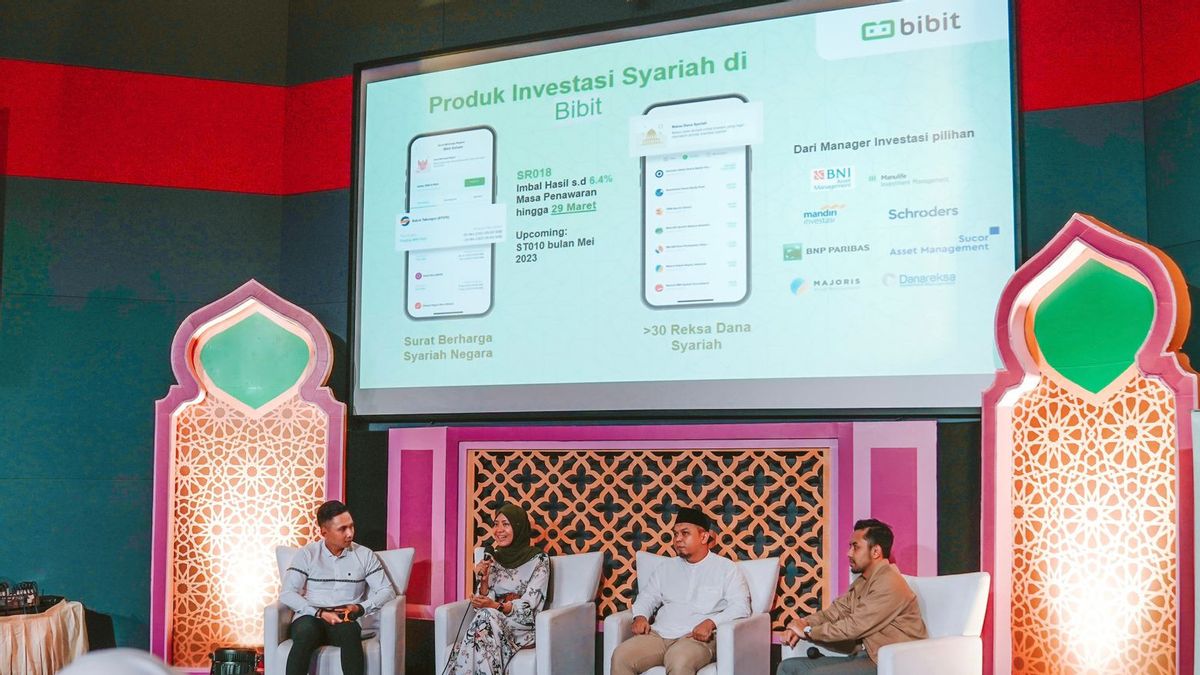

JAKARTA - Bibit.id, the leading digital investment application in Indonesia, affirms its commitment to helping the Indonesian people diversify their investment portfolio. After coming with the Fixed Rate State Bond (FR) product last March, Bibit now answers the needs of its users who have Sharia preferences.

Most recently, Bibit users can invest in Project Based Sukuk's State Sharia Securities products issued with Sharia principles and 100 percent guaranteed by the state.

In addition to the principle of sharia and 100 percent nominally guaranteed by the state, yields from Project Based Sukuk are relatively high and can beat inflation rates. Head of Investment Research Bibit, Vivi Handoyo Lie, Tuesday, June 13, gave an example, the yield (yield) Project Based Sukuk series PBS003 which matures in 2027 is 5.52 percent per year, while yields for PBS033 which matures in 2047 are 6.62 percent per year. In comparison, in the period May 2023, inflation is at 4 percent. Vivi said, investors need not worry about the long-seed decline in Project Based Sukuk due to this instrument being tradeable in the secondary market so that its nature is liquid. That is, if there is an urgent need, investors have the option to sell it before maturity.

He added that Project Based Sukuk also has several other advantages that make it very suitable for investors who want to diversify their investment portfolios.

First, Project Based Sukuk offers a steady passive income because when buying, investors can know for sure how much coupon they get every six months. Second, the tax imposed on Project Based Sukuk is only 10 percent, different from for example deposits that are at 20 percent.

Third, different from deposits guaranteed by the Deposit Insurance Corporation (LPS) and having a maximum limit of IDR 2 billion per bank per customer, the amount of Project Based Sukuk investment remains guaranteed by the state without maximum limits. Bits also contribute to increasing Syariah's financial activity by making Project Based Sukuk's investment more inclusive. At least the amount of Project Based Sukuk investment in Bibit is IDR 1 million so that more Indonesians can buy it.

اقرأ أيضا:

Vivi emphasized that in terms of clarity, all products invested through Bibit, ranging from mutual funds, shares, FR Bonds, and Project Based Sukuk, were registered at the Indonesian Central Securities Depository (KSEI) so that all investments were recorded on behalf of the user/investor as the asset owner.

"In addition to profit, calm in investing is an important aspect for investors in Bibit," said Vivi. In line with Vivi, Head of the Indonesian Stock Exchange Sharia Capital Market Division, Irwan Abdalloh, said that calm in investing is one of the key factors why the younger generation invests in the capital market.

Tren yang berlaku pada anak muda sekarang adalah hijrah. Banyak generasi muda yang mulai tertarik investasi di pasar modal Syariah, mereka pun mulai menyadari bahwa investasi bukan hanya untuk mendapat keuntungan, tapi juga untuk mendapatkan ketenangan, ujar Irwan.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)