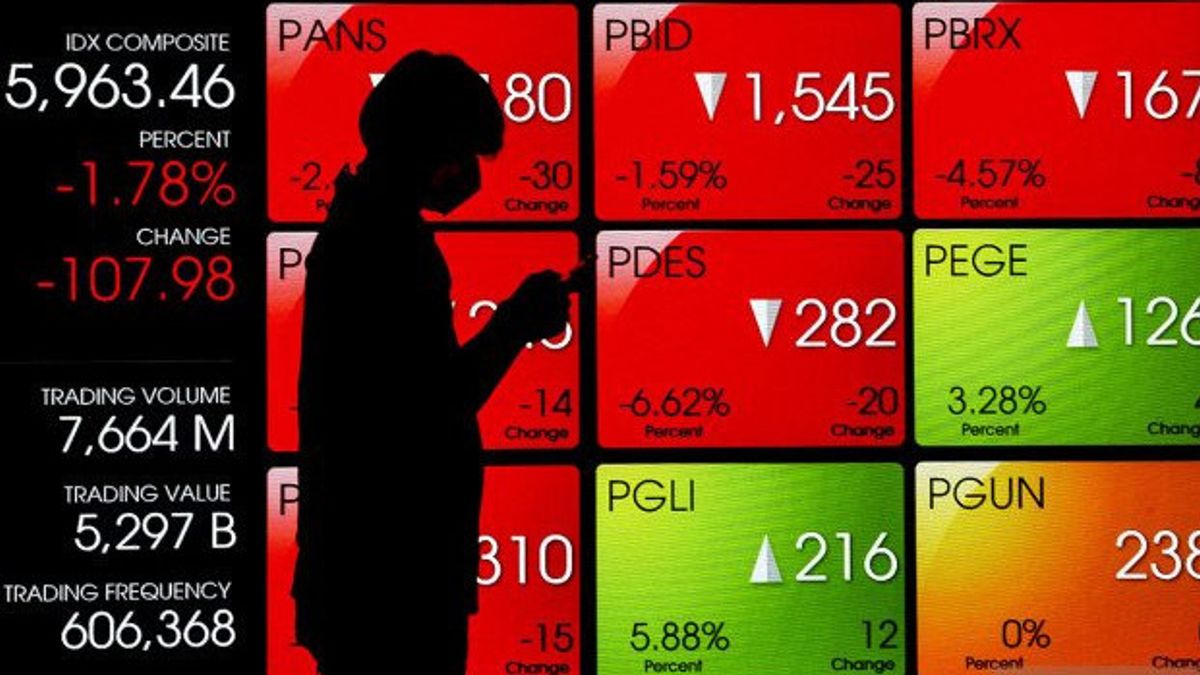

JAKARTA - The movement of the Composite Stock Price Index (JCI) is projected to continue the weakening trend in trading at the beginning of Monday, May 28, after last weekend's decline of 17.23 points or 0.26 percent to the level of 6,687.00.

Phintraco Sekuritas in his research said the JCI has the potential to close lower again after experiencing a correction of 0.25 percent to the level of 6,687 in trading last weekend. The JCI has the potential to be corrected again after the breaklow psychological level of 6,700 in trading last weekend.

"The stochastic RSI tends to move down, in line with the formation of a death cross in MACD. Therefore, be aware of further weakening to support areas of 6,640-6,660 on Monday," wrote the research team Phintraco Sekuritas.

The weakening of the JCI is still overshadowed by a decrease in Indonesia Banking Sector (SPI) loan growth to 8.08 percent year-on-year (YoY) as of April 2023. In addition, Bank Indonesia (BI) maintains the benchmark interest rate at 5.75 percent.

另请阅读:

However, the risk of the Fed's increase in the benchmark interest rate is still quite large even though the benchmark interest rate from BI is still far above inflation. From an external perspective, market participants are said to still pay attention to the development of the debt ceiling agreement in the United States (US).

Market participants are worried about the potential for default if an agreement has not been reached until June 1, 2023. Meanwhile, China will release PMI Manufacturing NBS data on Wednesday, May 31, while the US will release PMI Manufacturing ISM data June 1, 2023.

Some of the stocks chosen by Phintraco Sekuritas for today are UNVR, SMGR, INTP, TBIG, TOWR, BRIS, JPFA and CPIN.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)