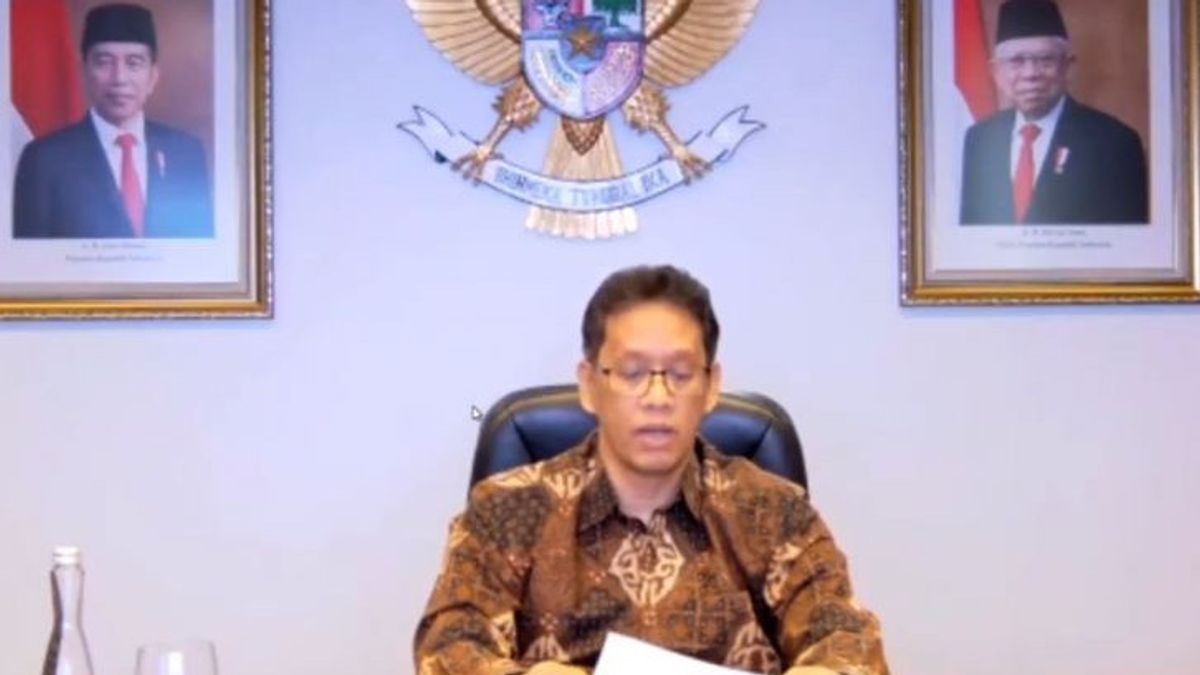

JAKARTA - Chairman of the Board of Commissioners of the Deposit Insurance Corporation (LPS) Purbaya Yudhi Sadewa revealed that currently the room for interest rate cuts is limited. Related to that, he said that the decline in the LPS Guarantee Interest Rate (TBP) was followed by a decrease in the banking cost of funds and loan interest rates.

"Along with the normalization of monetary policy in various countries, the global cost of funds has begun to increase, so that the reduction in the cost of funds for Indonesian banks is increasingly limited," he said in an official statement, Wednesday, August 10.

To continue to encourage the momentum of national economic recovery, he continued, IDIC will be careful in changing the guarantee interest rate. "The most important thing is that LPS and other KSSK members will always coordinate, and LPS will continue to monitor all developments that occur both domestically and globally," he continued.

Meanwhile, for domestic liquidity conditions, Indonesia can actually reduce the impact of policy influences in the United States or globally through good domestic policies.

“We can control the money supply in our financial system, and this has been done by Bank Indonesia. M0 growth or growth in base money reached 20 percent, even the latest figures show growth at 28 percent. This means that there is enough money in our economic system,” he said.

It is often said that the world economy is facing the threat of tightening liquidity. This is related to the tapering off carried out by the US Central Bank (The Fed), which among other things aims to control inflation and bring the economy to a more stable level, namely by raising interest rates and tightening monetary policy.

“In the United States, which is currently nearing a recession, it is estimated that the tapering conducted by their Central Bank is also almost over. So we see that the end of the tapering is slightly visible. Further tightening will not be too significant. This means that global constraints, in this case the negative impact of tightening monetary policy in the US, will not be as big as previously thought," he explained.

The liquidity situation in our financial system which is more than adequate is also shown by other indicators, such as the Liquid Assets Ratio or Non-Core Deposit (AL/NCD) at the level of 133.4 percent and Liquid Assets/DPK (AL/DPK) at the level of 133.4 percent. level of 29.9 percent in June 2022. This value is above the minimum threshold of 50 percent and 10 percent, respectively.

“The bottom line is that national banking liquidity is well maintained. It should be emphasized again that the liquidity condition is not only dependent on global conditions, because the actual condition of banking liquidity is under our own control. Our Central Bank always maintains banking liquidity and monitors it from time to time. And KSSK has found the right way to maintain or maintain national banking liquidity," he concluded.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)