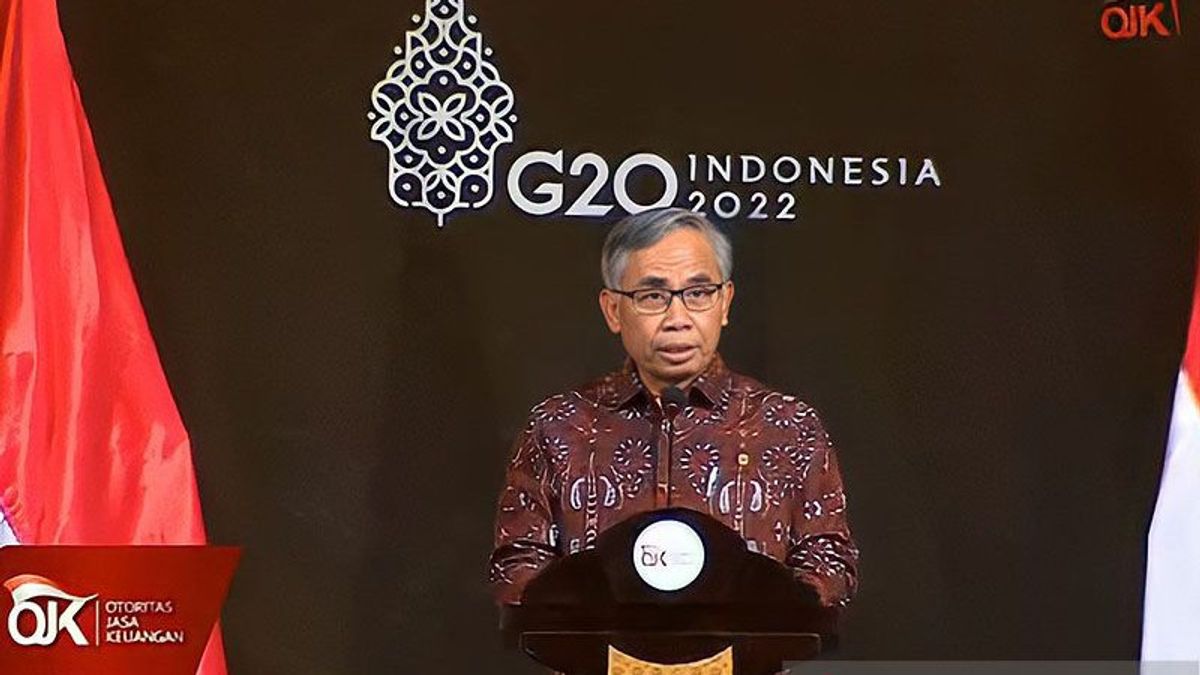

JAKARTA - Chairman of the Board of Commissioners of the Financial Services Authority (OJK) Wimboh Santoso gave his views regarding the economic turmoil that is currently sweeping almost all countries around the world.

According to him, the current conditions that tend to remain under the pressure of COVID-19 must be forced to face continued uncertainty due to the war crisis in Eastern Europe.

This was conveyed by the Chairman of the OJK when speaking with the main directors in the financial services sector regarding the implementation of the market conduct today.

"The world economy is facing a new episode related to the normalization of fiscal and monetary policies," he said through a virtual channel, Thursday, July 7.

Wimboh explained that the central bank's move to adjust the interest rate was marked by the move by The Federal Reserve alias The Fed which raised interest rates to be higher than before.

"We see the Fed raise the benchmark interest rate by 75 basis points (bps) to 1.5 percent to 1.75 percent," he said.

This then contributed in itself to the movement of inflation levels in a number of countries that were already at a high level.

In fact, the OJK boss revealed that several countries experienced inflation with a fairly worrying level.

"The disruption of the global supply chain due to the conflict between Russia and Ukraine has also affected hyperinflation in several countries such as Turkey, where inflation has reached 78.6 percent and Argentina at 58 percent," he explained.

This situation finally has an effect on Indonesia. Wimboh said that Indonesia's inflation in the June 2022 period, which was at the level of 4.35 percent on an annual basis (year on year/yoy) was one proof of supply chain disruption.

Last month's inflation was the highest since June 2017. Not to mention that Indonesia's Manufacturing PMI as of June 2022 also dropped to level 50.2 from May 2022 which was 50.8. Even so, we are still in the expansion zone," he said.

Furthermore, Wimboh explained that the financial sector itself is in a stable, well-maintained and in a positive trend. He said, as of April 21, 2022, the Composite Stock Price Index (JCI) touched the highest level at the level of 7,276.19 and then corrected as of July 6, 2022 at the level of 6,646 caused by global economic uncertainty and normalization of fiscal and monetary policies in the US.

Our banking credit grew by 9.03 percent with a capital adequacy ratio as of May 2022 increasing to the level of 24.7. The general insurance sector also recorded a premium growth of 15.1 percent and a life insurance premium growing 4.1 percent," he said.

"Although Indonesia's economic and financial sector conditions are in a trend of growth, the potential spillover (excessive effect) on the financial sector must still be watched out for and should not be taken lightly because global economic uncertainty continues, especially the conflict between Russia and Ukraine, which is still unclear when it will end," concluded OJK Chairman Wimboh Santoso.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)