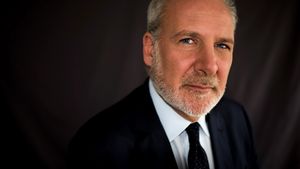

JAKARTA - The heated debate about Bitcoin's value and future has warmed again after sharp comments from renowned Bitcoin economist and critic Peter Schiff. On October 9, through social media X (formerly Twitter), Schiff suggested sarcastically that MicroStrategy CEO Michael Saylor take a loan of US$4.3 billion (Rp67 trillion) to buy Bitcoin to be sold by the US government.

Schiff's statement came after the US Supreme Court ruled that the government could sell 69,370 Bitcoins seized from the Silk Road black market, which is worth about US$4.3 billion (Rp67 trillion). This Bitcoin was previously involved in a long legal case before it was finally auctioned off by the government.

Schiff, known to prefer gold over crypto, seems to insinuate Saylor's investment strategy which relies heavily on Bitcoin. "Once in a while, the government is doing something smart," Schiff wrote, as if insinuating Saylor's investment decision to continue to increase his company's Bitcoin holdings.

Michael Saylor and his company, MicroStrategy, have been one of the most aggressive companies in accumulating Bitcoin since 2020. In September 2023, MicroStrategy even raised more than 1 billion US Dollars (Rp15.6 trillion) to buy 7,420 Bitcoins, bringing their total holdings to 252,220 coins, which are currently worth around 16 billion US Dollars (Rp250 trillion).

SEE ALSO:

However, Saylor's move is often considered risky by Schiff. According to him, massive investment in Bitcoin is a dangerous gambling. Schiff, who often promotes gold as a safer asset, took advantage of this opportunity to mock Saylor's decision with the advice of a US$4.3 billion loan (Rp67 trillion) in satire.

Dilainsir dari Crypto Potato, cuitan Schiff memicu respons dari berbagai pihak, termasuk pendukung Bitcoin yang langsung mengutah pernyataannya. Salah satu pengguna, Henry Scavacini, membela Bitcoin dengan menyebutkan enam sifat utama aset ini dayahan, portabilitas, penyebaran, keleagaman, kelangkaan, dan penerimaan. Scavacini juga menambahkan satu kebenarian unik lainnya:UNtibilitas, yang hanya dimiliki oleh aset berbasis blockchain.

This debate then extends with many other users defending Bitcoin as "hard money" that cannot be faked or manipulated. On the other hand, Schiff remains firm on its stance, stating that Bitcoin "does not have real value." According to him, although the current market assesses Bitcoin as more than 62,000 US Dollars (Rp970 million) per coin, the actual value is highly dependent on perception and not on real assets like gold.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)