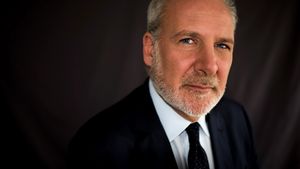

JAKARTA - Peter Schiff has made a sharp criticism of Bitcoin. According to Schiff, for those who still intend to buy Bitcoin this year, it's too late. In his view, the growth in this year's gold market capitalization is five times larger than the total market capitalization of Bitcoin, which according to CoinGecko data currently stands at 1.15 trillion (around IDR 17 quadrillion).

Although Schiff is skeptical, Bitcoin has seen an increase of 38.5% so far this year. Some analysts have even predicted a higher price spike potential. Hedge fund manager Mark Yusko and analyst from Fundstrate, Tom Lee, estimates Bitcoin could reach 150,000 US Dollars (approximately IDR 2.3 billion) by the end of this year. In addition, Mike Novogratz of Galaxy Digital is also optimistic that Bitcoin could surpass the figure of 100,000 US Dollars (approximately IDR 1.5 billion) before the year ends.

SEE ALSO:

The long-term target for Bitcoin is no less spectacular. Cathie Wood of Ark Invest, one of the leading figures in the investment world, estimates Bitcoin could reach 3.8 million US Dollars (approximately IDR 58 billion) in the long term. According to Wood, for this optimistic target to come true, institutional investors should allocate at least 5% of their assets to Bitcoin. However, Wood did not mention when this prediction could occur.

Meanwhile, Michael Saylor, founder of MicroStrategy, who is famous for supporting Bitcoin, provided a bolder projection. In his latest interview on CNBC, Saylor predicts the price of Bitcoin could shoot up to 13 million US Dollars (around Rp200 billion) by 2024, with the best scenario reaching 49 million US Dollars (around Rp754 billion). According to Saylor, Bitcoin has the potential to control 7% of world capital.

Schiff, known as Bitcoin's biggest critic, recently challenged Michael Saylor to argue about the future of this cryptocurrency. Saylor, who continues to believe that Bitcoin will become a major asset in the world, repeatedly defends his position. Meanwhile, Schiff insists that Bitcoin is too risky and investors are better off turning their attention to gold.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)