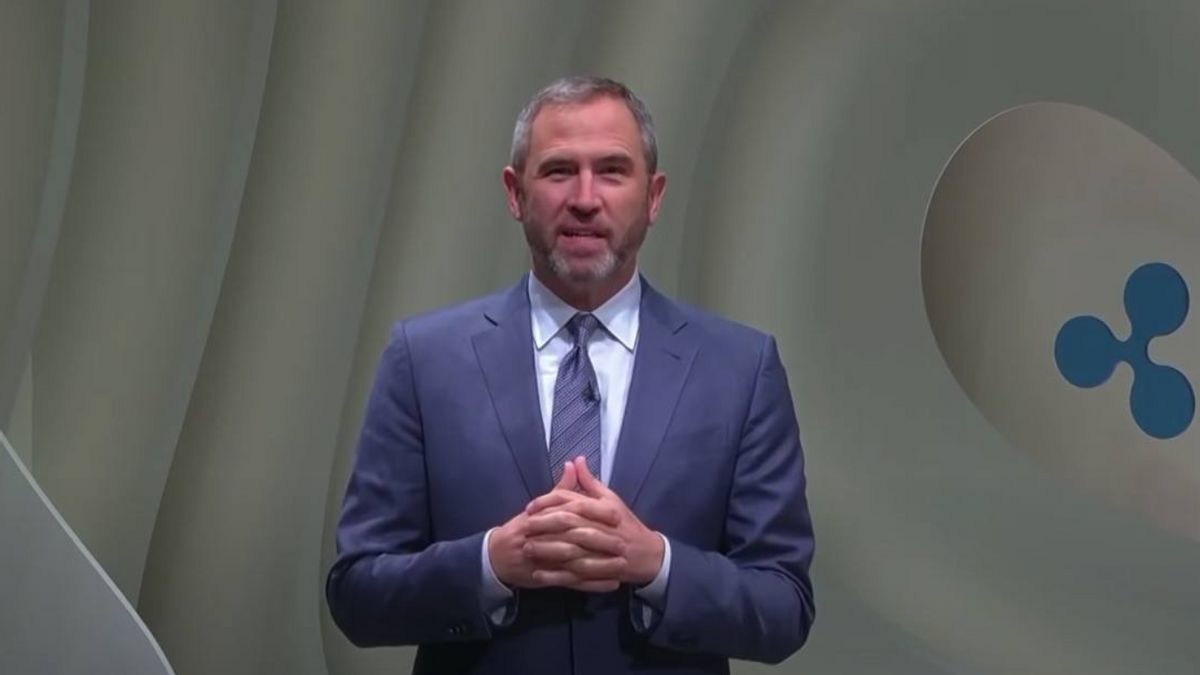

JAKARTA - In a recent statement, Brad Garlinghouse, CEO of Ripple, not only expressed his support for XRP, but also expressed his solidarity with Ethereum (ETH) amid heated debates over token classification as a securities. This statement is also a scathing criticism of the Securities and Exchange Commission (SEC) and its chairman, Gary Gensler.

"Ethereum is not a security," Garlinghouse said in an interview with Michael Arrington. "SEC should stop confusing and scaring the crypto industry with unclear and arbitrary legal interpretations."

The affirmation of Garlinghouse against Ethereum comes amid growing speculation about the legal status of ETH. Leading figures such as Michael Saylor, founder of MicroStrategy, have suggested that Ethereum may be classified as unregistered securities by the SEC.

Ripple CEO's vocal support for Ethereum was delivered at the XRP Las Vegas 2024 event. There, Garlinghouse condemned SEC's involvement in an investigation into securities against Ethereum and XRP, calling Gensler "unethnic."

SEE ALSO:

Garlinghouse's statement reflects his belief that the SEC may fail to classify ETH as a security, similar to the XRP case. Both XRP and ETH are currently involved in legal disputes with the SEC, stemming from the 2020 lawsuit by the agency against Ripple. The SEC initially classified XRP as a security, but this classification was later rejected by a federal judge.

The Ethereum classification ambiguity by the SEC has prompted further research and legal action. Consensies Inc., an Ethereum software development company, sued the SEC for excessive regulatory actions. The debate surrounding Ethereum's classification is heating up, especially with Ripple's upcoming response to the ongoing legal saga.

The recent SEC opposition to Ripple's motion further reinforces speculation about the future of the regulatory landscape for cryptocurrencies. Garlinghouse's support for Ethereum and its criticism of the SEC demonstrates the determination of the crypto community to counter what they consider unfair and limiting regulations.

Impact For Crypto Investors

The debate about Ethereum's classification has had a significant impact on crypto investors. If the SEC classifies ETH as a security, it could have a negative impact on its prices and trades. Investors may be reluctant to invest in ETH if they feel that their legal status is unclear.

On the other hand, if the SEC classifies ETH as a commodity, it can provide greater regulatory clarity and encourage institutional investment. This could have a positive impact on the price of ETH and the entire crypto market.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)