JAKARTA - The National Cyber and Crypto Agency (BSSN) advises banking industry players in the country to increase the detection aspect of cyber crime attacks.

"Especially for banking, there is indeed a 'PR' in the detection aspect, which of course in the future will need further development," said Director of Cyber Security and Crypto for Finance, Trade and Tourism, BSSN Edit Prima at the event "The Finance Executive Forum: The Future of Digitalization and Cyber Crime Mitigation Towards 2045" in Jakarta reported by ANTARA, Tuesday, November 14.

Throughout 2023, BSSN has conducted assessments of the level of maturity in terms of cyber resilience in the banking industry.

In general, he said, banking in Indonesia is included in the level 4 category based on the Cybersecurity Maturity measuring instrument or in the good category.

"This maturity assessment instrument has been implemented by BSSN since 2021, and now in the latest OJK regulations, it has been adopted and enriched according to banking needs so that it becomes a guide in the assessment," he said.

SEE ALSO:

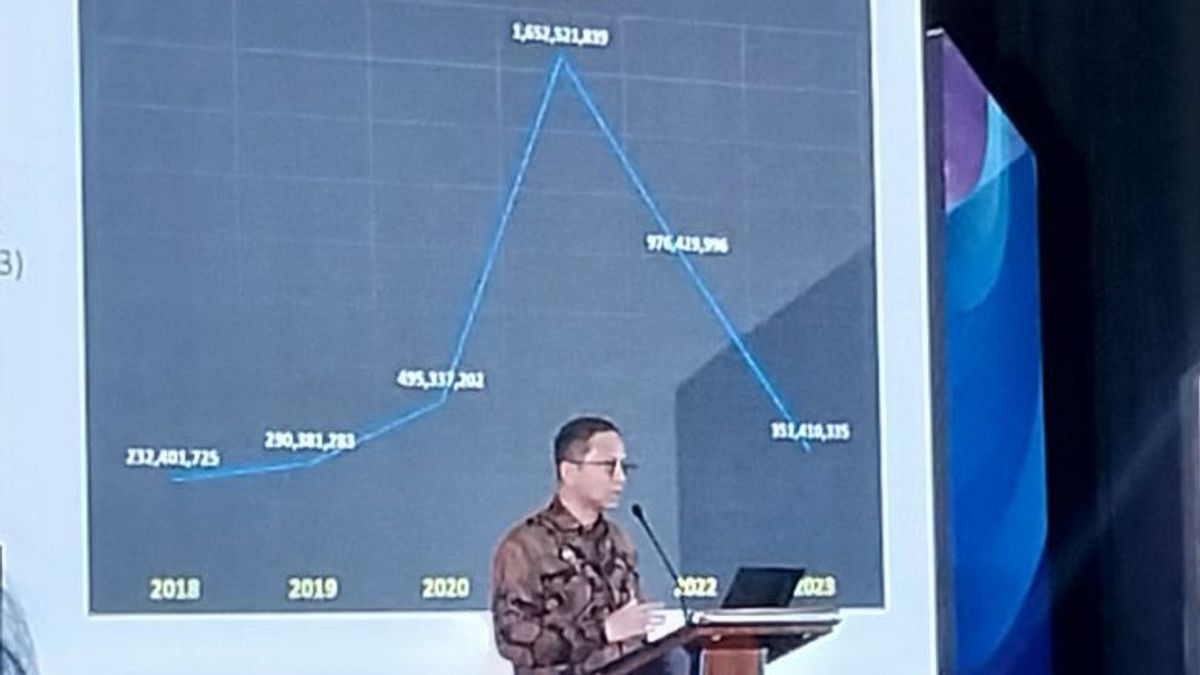

In 2023, BSSN recorded 160 million anomalyware. Of that number, nearly 1 million anomalies were indicated by malware ransomware.

The anomaliransomware, continued Edit, also had a further impact on the company's bankruptcy and reputational damage.

"So of course this is also a 'PR' together, including banking because ransomware is still a significant threat," he said.

Edit hopes that the banking industry can improve reliable detection technology in order to prevent and overcome cyber attacks as early as possible so as not to cause greater losses.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)