JAKARTA - PT Bank Mandiri (Persero) Tbk experienced performance growth in the first six months of 2021. President Director of Bank Mandiri Darmawan Junaidi said the company's net profit achievement grew 21.45 percent year on year (yoy) to Rp 12.5 trillion.

This was supported by net interest income growth of 21.50 percent yoy to Rp35.16 trillion, as well as growth in fee-based income from the issuer codenamed BMRI by 17.27 percent yoy to Rp15.94 trillion.

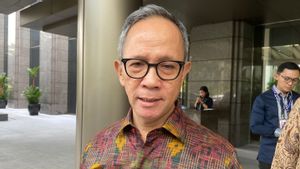

"We view this growth trend as a positive signal that demand is still there and is expected to continue to increase. However, we will remain vigilant in executing business plans going forward," Darmawan said at his virtual public expose, Thursday, July 29.

In terms of collecting third party funds (DPK), Bank Mandiri's TPF on a consolidated basis until the second quarter of 2021 grew 19.73 percent yoy to Rp1,169.2 trillion, with a composition of low-cost funds of 68.49 percent or Rp800.8 trillion. The growth of low-cost funds was mainly driven by the growth of demand deposits (bank only) of 40.9 percent yoy in the second quarter of 2021.

"Our success in maintaining this low-cost fund growth trend has also helped reduce Bank Mandiri's cost of funds (CoF) on a YtD (bank only) basis to 1.71 percent, down from the level of 2.53 percent at the end of last year," he said.

Darmawan added, the significant increase in third party funds and a positive increase in credit distribution in the first half of 2021 contributed to the formation of Bank Mandiri's assets on a consolidated basis to reach IDR 1,580,5 trillion, an increase of 16.26 percent on an annual basis.

"The achievement of Bank Mandiri's positive performance in the second quarter of 2021 shows that growth is starting to occur. We will of course periodically monitor economic conditions, including exploring business potentials to support sustainable performance growth," concluded Darmawan.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)