JAKARTA - Amid global economic uncertainty and volatility, gold prices continue to rise as a relatively safe and stable investment option for investors. In addition, gold commodities have long been considered a safe-haven asset, offering protection against currency inflation and fluctuations.

PT Bank BCA Syariah (BCA Syariah) recorded that until August 2024, the financing growth of Murabaah Emas iB (Emas iB) was 210.8 percent compared to the same period the previous year.

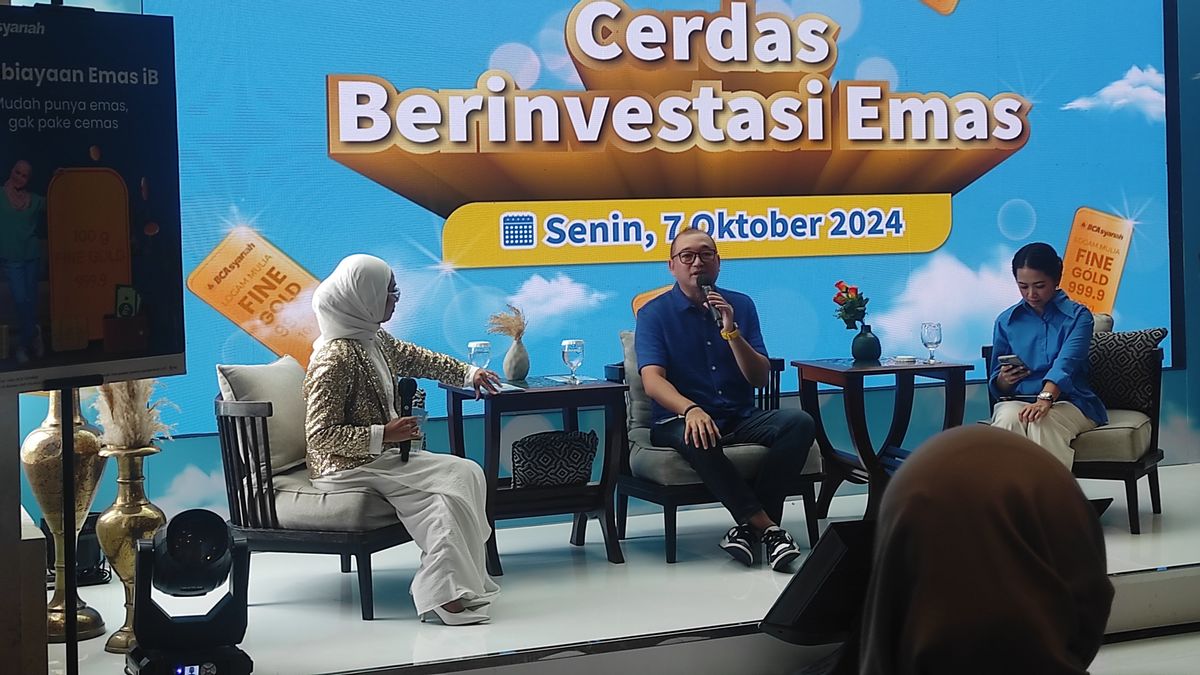

Director of BCA Syariah Pranata said that the financing product Murabahah Emas iB (Gold iB) is a financing product from BCA Syariah for possession of precious metals (gold) with sharia principles using the murabahah contract (buy sale and purchase).

Pranata assesses that the younger generation today expects easy, fast and profitable investment.

"In addition to the process of submitting very easy financing, the advantages of our gold financing include certainty of grammar and installments until the end of financing with a period of time that can be adjusted to the customer's ability," he said at the BCA Syariah media gathering event, Monday, October 7th.

As for August 2024, Pranata said that BCA Syariah managed to record positive growth for consumer financing reaching 89.1 percent. The iB Gold Financing as one of the BCA Syariah consumer products managed to get the highest growth of 210.8 percent compared to the same period the previous year.

Pranata conveyed that this achievement also reflected the increasing interest of the public to invest through gold financing at BCA Syariah.

However, when viewed from customer segmentation, 42 percent of financing customers are millennials with a financing shift ticket of IDR 21 million and the financing period most in demand is 1 year.

In addition, iB's gold financing is equipped with easy applications for financing with a contract service in place to apply for financing outside the branch. Currently, BCA Syariah is also developing an online application for iB Gold financing through the latest mobile banking, namely BSya (bi-sya) by BCA Syariah.

"Through iB's Gold financing, we want to increase public access to investment products in Islamic banks as well as help secure their financial future while still complying with sharia principles," said Pranata.

On the same occasion, Financial Planner Aliyah Natasya said gold is a safe investment product amidst global uncertainty.

SEE ALSO:

Based on data from Goldprice.org, changes in gold prices in the last ten years have reached more than 110 percent. Gold is also a liquid asset because it can be quickly disbursed in cash when needed in urgent conditions.

Aliyah said the younger generation must be literate in investment to gain financial security in the future. In the midst of geopolitical turmoil that affects the current economic conditions, the public needs to understand the right option of instruments to invest.

"Gold is one of the right choices because it is relatively safe, liquid and profitable in the medium and long term," he said.

To note, PT Bank BCA Syariah (BCA Syariah) noted that until August 2024, BCA Syariah's total assets had reached Rp14.3 trillion, growing 8.7 percent compared to the same period the previous year (yoy).

Meanwhile, the distribution of BCA Syariah financing was recorded at IDR 10.0 trillion, growing 30.4 percent (yoy). Third Party Funds (DPK) reached IDR 10.9 trillion, an increase of 9.2 percent (yoy).

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)