Bank Mandiri consistently presents digital innovation through the Livin' by Mandiri super app feature. Through the presence of Multi Source of Fund (SoF) and Foreign Valuta Solutions (Valas), customers can now enjoy the convenience and flexibility of daily transactions, as well as provide a more seamless banking experience.

Bank Mandiri President Director Darmawan Junaidi stated, since the first quarter of 2024, Livin' by Mandiri has introduced hundreds of features that are tailored to customer needs, ranging from saving to investing.

"Livin' by Mandiri not only offers a more sophisticated modern banking experience, but also acts as a loyal partner in meeting customers' various lifestyle needs. With the latest features that facilitate personalized financial access, we are committed to helping customers achieve their financial goals more quickly and efficiently," Darmawan said in his official statement, Thursday, August 8.

The Multi SoF feature is one of the latest innovations showing Livin' by Mandiri's commitment to providing flexibility for customers in paying various bills. With this feature, customers can choose three different sources of funds for bill payments using the Pay/VA feature, namely Savings, Credit Cards, and Paylater.

Customers can manage their own finances better and as needed. For example, customers can choose to pay bills using Credit Cards if the savings balance is insufficient, or use Livin' Paylater for ease of payment in the future. The presence of this option makes Livin' by Mandiri the first banking application in Indonesia to offer bill payment flexibility like this, "he explained.

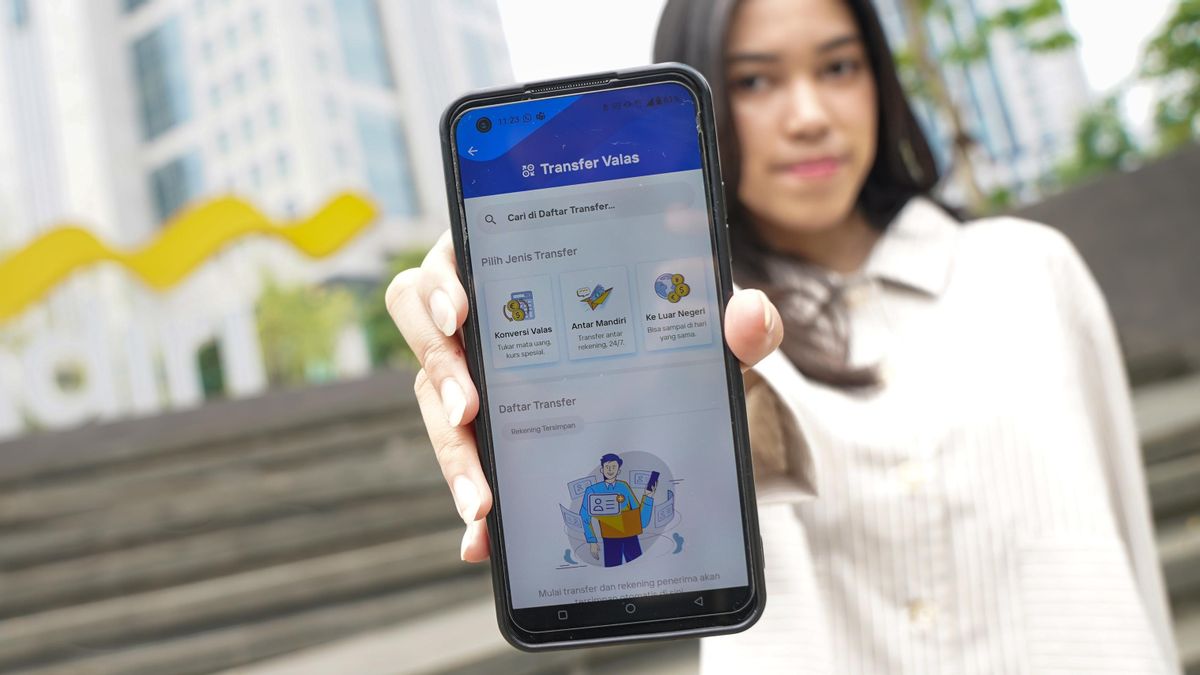

In addition, Livin' by Mandiri also introduced the Pasti Valuta Foreign Solutions service that allows customers to transact indefinitely at home and abroad. With this service, customers can open Multicurrency Savings in various foreign currencies, including USD, SGD, JPY, EUR, CHF, GBP, AUD, HKD, MYR, THB, SAR, CNY and other currencies that will be added according to customer needs in managing funds and transferring foreign exchange efficiently.

Customers who want to transfer money abroad and between Bank Mandiri can quickly take advantage of the Foreign Exchange feature in Livin' by Mandiri. Without the cost of converting the exchange rate and money will be received in full in real-time. This feature also supports sending money without restrictions on operating hours within 10 foreign currencies for foreign exchange transfers and 12 foreign currencies for transfers from fellow Mandiri," added Darmawan.

Since its launch in the first quarter of 2023, foreign exchange transactions through Livin' by Mandiri have continued to increase. Until the end of the second quarter of 2024, the volume of foreign exchange transaction sales in Livin' by Mandiri shot up with an extraordinary increase of 196.5 percent year on year (YoY) with an increasingly positive trend. Not only that, the daily average sales volume from foreign exchange transfer in the second quarter of 2024 reached IDR 8.3 billion, an increase of 11% from the daily average sales volume in the first quarter of 2024 which amounted to IDR 7.5 billion.

SEE ALSO:

The ease of transactions abroad is also further strengthened by the Tap to Pay feature. Customers can use Mandiri Debit Visa with funding sources from Multicurrency Savings to make payments by simply tapping from Android smartphones to payment machines. This feature can be used both for domestic and international payments, offering a fast, easy, and secure payment experience.

With these innovations, Bank Mandiri continues to be committed to providing a better banking experience for customers. The hope is that the innovations that have been presented will not only facilitate daily transactions, but also enrich customers' lifestyle, making Livin' by Mandiri a reliable beyond super app.

Sebagai tambahan informasi, hingga Juni 2024, pengguna aplikasi Livin' by Mandiri menembus angka 26 juta pengguna, naik 35 persen secara YoY. Dari jumlah tersebut, total nilai transaksi Livin' by Mandiri telah mencapai Rp1.883 triliun dengan volume transaksi 1,76 miliar transaksi.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)