JAKARTA - Economist and former Minister of Finance (Menkeu) in the 2014-2016 period, Bambang Brodjonegoro said, Iran's attack on Israel could pose a potential increase in Indonesia's inflation. The concern about this increase in inflation was mainly due to the increase in fuel oil (BBM) as a result of the escalation of conflicts in the Middle East.

"Currently we have a bit of inflation above the target, especially because food price inflation is volatile, especially rice prices. With this Iran-Israel (conflict) incident, of course, it depends on how far oil prices will soar," said Bambang at the 'The Fun Chat of the Impact of the Iran-Israeli Conflict on the Indonesian Economy' held by Eisenhower Fellowships Indonesia Alumni Chapter, Monday, April 15.

Bambang predicts that there will be pressure on Indonesia's inflation, which is slightly higher, this is influenced by three main factors both internally and externally.

According to Bambang, the first factor is that it comes from the high inflation of volatile food prices (volatile food) which is still the main factor in Indonesian inflation.

Furthermore, the second factor comes from inflation at the price of goods regulated by the government such as fuel oil (BBM) and liquefied petroleum gas (LPG).

Then the third factor of inflation originating from abroad or imported inflation is due to rising prices abroad, weakening the rupiah and disruption of global distribution.

"My estimate is that regarding inflation, there is a higher inflationary pressure," he said.

For information, the Central Statistics Agency (BPS) recorded the latest year on year (yoy) inflation rate in March 2024 of 3.05 percent or an increase in the Consumer Price Index (IHK) from 102.99 in March 2023 to 106.13 in March 2024.

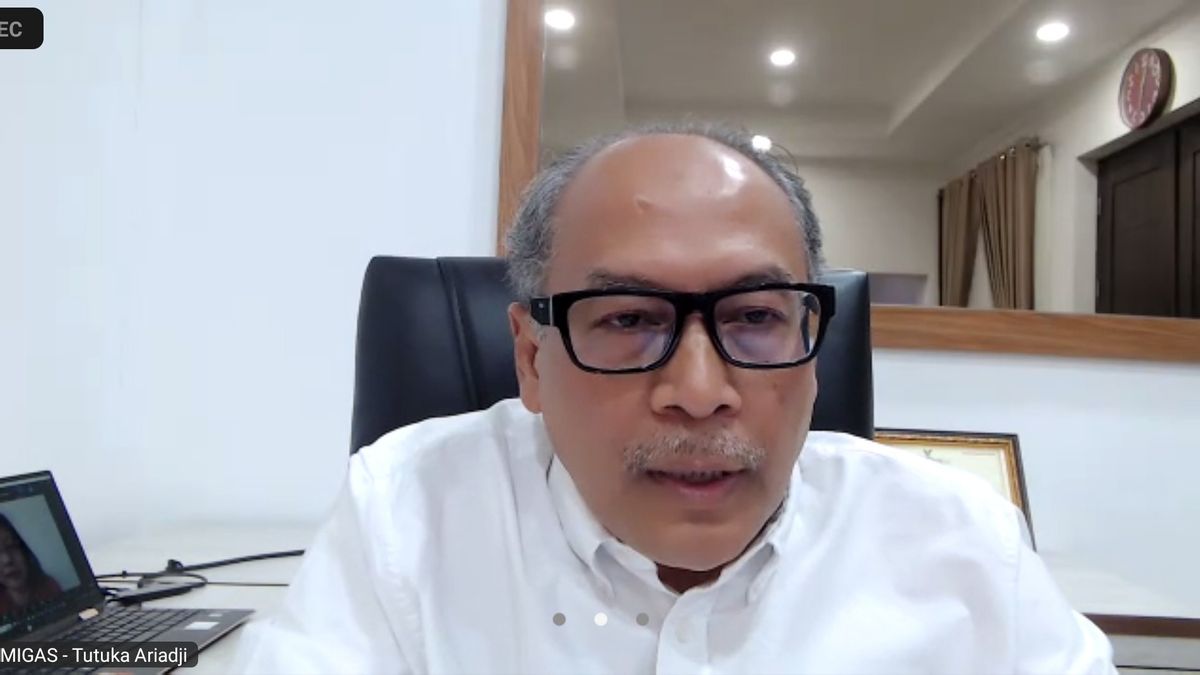

On the same occasion, the Director General of Oil and Gas (Migas) of the Ministry of Energy and Mineral Resources (ESDM) Tutuka Ariadji estimates that in the short term the conflict between Iran and Israel will make the price of Indonesian crude oil or the Indonesia Crude Price (ICP) also increase.

Tutuka said that in the short term following Iran's attack on Israel, the world crude price is estimated to have jumped to 100 US dollars per barrel. Meanwhile, in the assumption of the macroeconomics of the 2024 State Budget, the government has set an ICP of 82 US dollars per barrel.

"(The impact of Iran's attack on Israel) is likely to increase global oil prices to 100 US dollars per barrel," said Tutuka.

On the other hand, Tutuka said that from February to April, ICP tends to increase by around 5 US dollars per month. According to him, the increase in ICP will have an impact on soaring energy subsidies.

Even so, Tutuka said that his party was still reviewing whether the conflict would continue or not.

"Of course, this is a short-term impact, we need caution because longer predictions will be less accurate. We'll see the current response, we'll wait and see in the future," he said.

Tutuka said that at least in the short term there are several things that the government will pay attention to, namely the first comes from the reactions of producer and consumer investors in conducting assessments of future risks. For example, like the potential for an Israeli response that will affect the perception of the possibility of market escalation.

According to him, the second factor is that it comes from oil prices in the future which will contain geopolitical. And the third sentiment, it is estimated that members of the Organization of the Petroleum Exporting Countries (OPEC) or Organizations of Oil Exporting Countries in the world, will reduce the increase in oil prices in the future to be more balanced.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)